My Tweetstorm on how Malone invented the SaaS business model will appear in serial format over the weekend. It is intended to be an antidote against people who don't understand when the model works and when it doesn't. The antidote works against both promoters and detractors.

I remember the day in July of 1994 that this letter below was sent by Craig McCaw. Some people have framed it. I was sent six years after the business was founded announcing the very first accounting profit. Two months later McCaw Cellular was sold to AT&T for $11.5 billion:

3/ "You should earn your right to use a multiple by demonstrating your grasp its economic implications." Michael Mauboussin

"You should earn your right to use a SaaS business model by demonstrating your grasp its unit economic implications."

Tren Griffin riffing on Mauboussin

"You should earn your right to use a SaaS business model by demonstrating your grasp its unit economic implications."

Tren Griffin riffing on Mauboussin

4/ Malone earned a degree in electrical engineering from Yale in 1963. He also had a master’s in industrial management from NYU and a Ph.D. from Johns Hopkins in operations research. He'd worked for Bell Labs, McKinsey and a cable industry equipment supplier. It was fall of 1972.

5/ Craig McCaw started working in cable TV in 1969. The business was located in a small town south of Seattle. His father's death that year put him in charge of the system as CEO while he was still a student at Stanford. He had not yet graduated when Malone joined TCI in 1972.

6/ "Three things caught John Malone's attention: the highly predictable, utility like revenues; the favorable tax characteristics; and the fact that the [cable television] business was growing like a weed." William Thorndike in The Outsiders. amazon.com/Outsiders-Unco…

7/ Bill Gates said in a 1994 interview in Playboy magazine about Malone: “Malone is straightforward in terms of talking about technology and strategy. He and I are damn similar. He worked at Bell Labs and understands both business and technology."

8/ In a addition to McCaw and TCI there were thousands of other cable TV systems. What they had in common was a shortage of cash since the systems had up front capital costs, customer acquisition costs and the need to consolidate systems through M&A to generate more scale.

9/ For example of scale at the time, in 1969 the cable system run by Craig McCaw as CEO "employed ten people, served 4,200 customers and collected $8,000 a month in gross revenue." Craig said: "We tried to get the rates up and the cities wouldn't do it." amazon.com/Money-Thin-Air…

10/ While at Bell Labs Malone prepared a study for the AT&T board in which he recommended increasing its debt and reducing its share count. The AT&T board ignored his work. The stage was set for Malone and others to invent new models for a service business. To be continued...

11/ Malone: "Capital was so hard to come by in those days, for Jerrold and for the cable industry, that Jerrold was merely factoring taking paper from cable operators and factoring it to various financial discount houses with various partial guarantees." cablecenter.org/programs/the-h…

12/ Malone once said: "[TCI Founder Bob Magness] used to say: "We're so broke we've got to look up to see bottom. Lower than whale shit." Malone: "You'd go to these bank meetings and they'd say, "How are you going to pay us back." As the song says: "Money to tight to mention."

13/ "We decided to go on a cash flow metric much like real estate. Levered cash flow growth became the mantra. A number of our eastern competitors early on were still large industrial companies — Westinghouse, GE... — and they were on an earnings metric." bizjournals.com/denver/stories…

14/ “John Malone realized that maximizing earnings per share (EPS), the holy grail for most public companies at that time, was inconsistent with the pursuit of scale in the nascent cable TV industry.” The Outsiders, at page 90. Do you know anyone seeking a scale advantage today?

15/ "To Malone, higher net income meant higher taxes, and he believed that the best strategy for a cable company was to use all available tools to minimize reported earnings and taxes, and fund internal growth and acquisitions with pretax cash flow.” Page 90 of The Outsiders.

16/ “In lieu of EPS, John Malone emphasized cash flow to lenders and investors...Terms and concepts such as EBITDA (earnings before interest, taxes, depreciation, and amortization) were first introduced into the business lexicon by Malone." Page 91.

17/ Yes, interest taxes and depreciation are real expenses, but Malone generated the cash flow to pay them while still deferring taxes. A business must earn the right to use the term EBITDA (borrowing the phrase from Michael Mauboussin, who wrote this: bluemountaincapital.com/wp-content/upl…

18/ I don't recall Warren Buffett or Charlie Munger ever saying anything negative about the way Malone financed the cable business or otherwise . BRK is a significant shareholder in both Charter and Liberty Media. The most recent BRK 13-F is here: sec.gov/Archives/edgar…

19/ The story in this tweetstorm will continue soon over this weekend as the business model created by the cable industry is adapted by entrepreneurs like Craig McCaw for use in the emerging mobile phone industry as he sold his cable TV systems and doubled down on wireless.

20/ If you get impatient for this story about John Malone to continue in the form of new tweetstorm installments over the weekend and have not read Michael Mauboussin's "The Trouble with Earnings" paper, don't be damn fool. Read this paper: expectationsinvesting.com/pdf/earnings.p…

21/ This tweetstorm story picks up again in the 1970's when the protagonist (John Malone) is finding it hard to capitalize on opportunities since the banks were imposing harsh covenants on bank loans and broadcasters were using political power to regulate cable TV into oblivion.

22/ "At the time Wall Street evaluated companies on earnings per share. Period." The Outsiders. Malone knew that that as he scaled the business he would harvest supply and demand side economies. He needed metrics that showed that shareholder value was being created. Malone:

23/ How did Malone's focus on cash flow work out for TCI shareholders? How did a focus on accounting earnings rather than cash flow work out for big companies like Westinghouse, AT&T (the first one created in the sin off to do long distance that is now gone) and GE?

Malone:

Malone:

24/ The long distance business made certain ratios taught in business schools like internal rate of return (IRR), price earnings (P/E) and return on net assets (RONA) look good. Why would a business want to focus on cash flow instead of earnings? because: 25iq.com/2017/10/14/wha…

25/ Finally a few investors like insurance companies and newspapers started providing more capital. Yes newspapers, which actually flowed free cash then in huge buckets. Cable entrepreneurs like Malone and McCaw started the horizontal roll up of hundreds of cable TV systems.

26/ Even before graduating from Stanford, McCaw purchased other cable systems. For example, in 1971 Craig purchased the system serving Winlock, Lewis County, in Washington state for $50,000 (the terms: 29% down, with the balance over eight years at 8%). community.seattletimes.nwsource.com/archive/?date=…

27. A new but similar business opportunity was starting come into focus in the late 1970s. McCaw owned a $2,800 "bag phone" that wasn't hand held, but was a forerunner to a modern cellular phone. A user of this device would call an operator and ask to get in line to make a call.

27/ When this story continues it will reveal how many approaches to being a mobile operator were borrowed from cable TV businesses, in some cases by the same entrepreneurs. A fellow named Milken will appear and supply new sources of cash. Stay tuned. 25iq.com/2015/12/26/a-d…

28/ 1974: Bill Gates and Paul Allen see the issue of Electronics magazine about the Altair PC and Bell Labs tests the first cellular system.

1975: MSFT formed

1978: AMPs cellular system with 100 AT&T employees was tested in Chicago.

1979: FCC starts US cellular license process

1975: MSFT formed

1978: AMPs cellular system with 100 AT&T employees was tested in Chicago.

1979: FCC starts US cellular license process

29/ I describe how AT&T fumbled wireless opportunity in this post. 25iq.com/2017/10/14/wha… At the time of the AT&T break up negotiators were more interested in the Yellow Pages at that time than wireless. AT&T liked the accounting earnings generated by its long distance business.

30/ McCaw operated a paging system that could be built in a city for ~$500k but a cellular system was ~$5M. As was the case with cable TV, lenders to this new wireless business were scarce. New metrics were needed to indicate the long term value of an operating cellular system.

31/ Cable television had used POPS (covered population) as a valuation metric. John Stanton recently reminded me that when McCaw sold a stake in McCaw Cellular to Scripps Howard in 1983, MHz/POPs was invented as a valuation metric that indicated future cash generating capability.

32/ An electronics manufacturer held up a cellular phone with a price in thousands and a $69 citizens-band radio. He told the McCaw executive the difference between the two was a $25 chip. The executive realized a cell phone would eventually cost <$100. community.seattletimes.nwsource.com/archive/?date=…

33/ A study estimated a cellular system would break even if ~1% of POPs subscribed vs 40% for cable-TV. McCaw executives estimated the licenses for non-Bell applicants in the first 30 markets alone were worth $16B. Financiers who recognized this cash generating value were needed.

34/ In 1986, McCaw executives met with Michael Milken in Beverly Hills. Milken arrived, grabbed some popcorn from a bag on table and asked: "How much are you looking for?" The McCaw team said "225 million." Milken answered: "Then we'll have to show strength. We'll go for $275."

35/ In the next episode, people in the software industry start pushing teams toward going back to annuity pricing for a service rather than a perpetually licensed product. The first time people recall Bill Gates talking about annuity pricing was 1993. Could be it was earlier.

36/ An investor must estimate future cash flows and yet the future is mostly uncertain and occasionally impacted by previously unknown events. As Mauboussin writes: “Expected long-term cash flows, discounted by the cost of capital—not reported earnings—determine stock prices.”

37/ A recurring theme in this tweetstorm is entrepreneurs trying to raise financing creating metrics to indicate the ability of a business to generate cash in the future. EBITDA, POPs and MHz/POP are examples. I have also written often about CLV (e.g., 25iq.com/2017/07/15/ama… )

38/ Per subscriber is another metric: “Redskins owner Jack Kent Cooke on January 1, 1987 agreed to purchase McCaw's cable TV business for $780M in cash (433,000 subscribers in 42 markets). Cooke paid ~$1,800 per subscriber. McCaw was the nation's 20th-largest cable provider.”

39/ Metrics can go horribly wrong if the assumptions in a model are broken. The CLEC debacle in the late 1990s is one example. John Malone: “The fiber business is a good business—for one or two providers—but for thirty? All funded with a bunch of bonds?” 25iq.com/2014/11/02/a-d…

40/ The $14B acquisition of MFS by WorldCom kickstarted the CLEC explosion. What was a modest cream skimming business for MFS became a gold rush. Craig McCaw said to me often during this period: “You are always at the mercy of your stupidest competitors.” 25iq.com/2017/11/11/the…

41/ That "accounting earnings" can be a misleading/broken metric to measure the value of a growing business doesn't mean there aren’t other metrics that are also broken. There is no substitute for doing the detective work on assumptions and the math. abovethecrowd.com/2012/09/04/the…

42/ "To perform present value analysis, you must predict the future, yet the future is not reliably predictable.” “A perfect business in terms of the simplicity of valuation would be an annuity. Real businesses, even the best ones, are unfortunately not annuities.” Seth Klarman

43/ Some businesses are more "annuity like" than others. Businesses that have shown a consistent track record of earned returns on capital that substantially exceed the opportunity cost of capital for three to five years are favored by investors like Buffett and Munger.

44/ "Software contracts are better than first-lien debt. A business will not pay the interest payment on their first lien until after they pay their software subscription fee. We get paid our money first. They can’t run their business without our software.”google.com/amp/s/25iq.com…

45/ What John Malone, Craig McCaw and similar entrepreneurs did was pioneer the use of alternative metrics which indicated that the business has attributes of an annuity which allowed enough investors to ignore current accounting earnings and finance a growing SaaS business.

46/ Enough investors learned from what happened in cable television and cellular to understand that a business like Salesforce (CRM) was creating annuity value even though it was not generating accounting earnings. These investors financed the growth of CRM, AMZN and others.

47/ The hard part is predicting which businesses will end up like cable television and cellular and which businesses will be like the CLECs I identified in this thread. As Charlie Munger once said: "Investing's not supposed to be easy. Anyone who finds it easy is stupid."

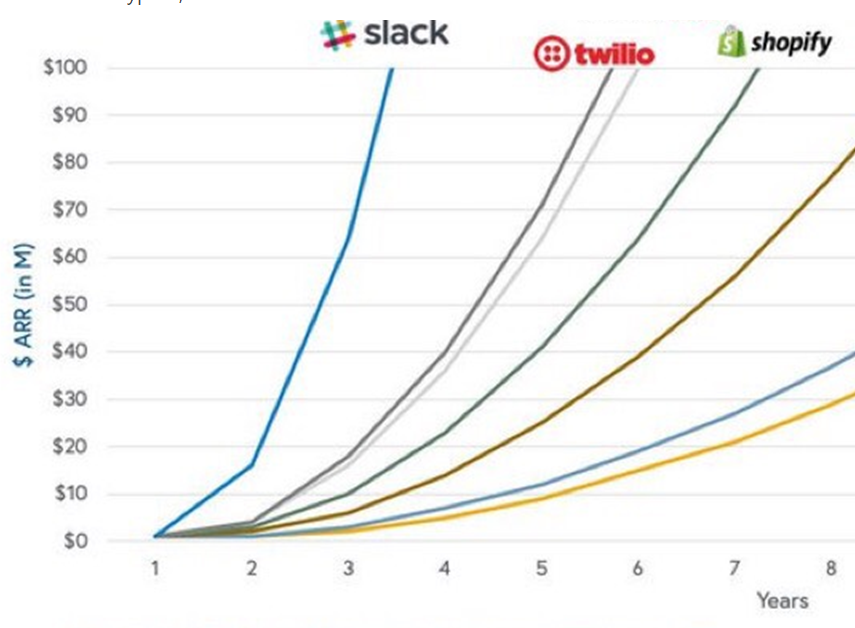

48/ 25iQuiz: What are the best available SaaS equivalents of the metrics created by Malone and McCaw in cable TV and cellular which predict the future ability of the SaaS business to generate cash for investors? ARR?

49/ "Retention is your best friend. Some of the best performing SaaS businesses we’ve seen in the past decade have higher than 100% net retention rate because they’ve built a metered business that sells more to a customer as its business scales." bvp.com/atlas/state-of…

50/ I received a thoughtful hand written note from Austin who lives in Austin thanking me for helping him learn via 25iQ and Twitter. I would tell my mother about his gesture but her Parkinson's symptoms are too debilitating. My mom is a strong advocate of hand written notes.

51/ Writing this tweetstorm as a series of episodes over a long weekend worked well for me. I expect it also made the story more discoverable. It was an experiment that I may repeat. Or not. Special thanks to my friends Craig MCcaw, Michael Larson, Michael Mauboussin and:

• • •

Missing some Tweet in this thread? You can try to

force a refresh