Still confused about why the repo market is freaking out, and whether you should care?

It’s about BUDGET DEFICITS.

Thread!

bloomberg.com/opinion/articl…

It’s about BUDGET DEFICITS.

Thread!

bloomberg.com/opinion/articl…

Budget deficits, while nothing new, obviously add up over time.

While the U.S. deficit soared after the crisis, it declined each year from 2011 through 2015. It widened again under President Donald Trump.

That’s TRIPLED the amount of U.S. Treasuries out there.

While the U.S. deficit soared after the crisis, it declined each year from 2011 through 2015. It widened again under President Donald Trump.

That’s TRIPLED the amount of U.S. Treasuries out there.

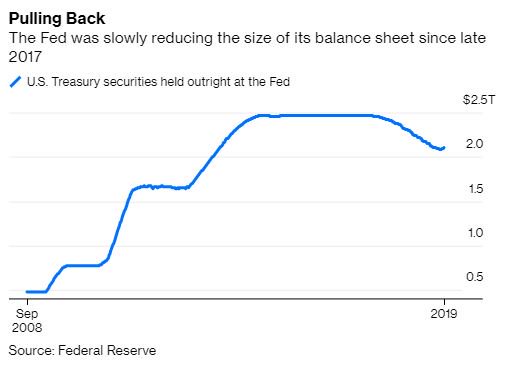

Running deficits is one thing when the Fed’s engaging in QE. But starting in late 2017, the central bank began trimming its balance sheet.

By the time the Fed ended its runoff in July, it had shed about $400 BILLION from its Treasury holdings.

By the time the Fed ended its runoff in July, it had shed about $400 BILLION from its Treasury holdings.

You might think: No problem! Foreign investors will pick up the slack!

Wrong.

China and Japan have not been buying bonds as fast as the U.S. has been selling. When compared to the size of the overall market, Japan’s Treasury holdings are at a 20+ year low.

Wrong.

China and Japan have not been buying bonds as fast as the U.S. has been selling. When compared to the size of the overall market, Japan’s Treasury holdings are at a 20+ year low.

So if it’s not the Fed, it’s not China and it’s not Japan, how is America financing its budget deficit? Where are all these Treasuries going?

Straight into the heart of the U.S. financial system.

Straight into the heart of the U.S. financial system.

Banks give money to the Treasury in exchange for its debt. That takes cash out of the system and replaces it with bonds (or, in the language of the repo market, “collateral”).

That drains reserves in a big way.

That drains reserves in a big way.

So that’s how we got where we are today in repo.

There are simply too many bonds sloshing around in the financial system and not enough cash on the other side of the trade.

That’s why the Fed is coming in to soak up those securities with its temporary repo operations.

There are simply too many bonds sloshing around in the financial system and not enough cash on the other side of the trade.

That’s why the Fed is coming in to soak up those securities with its temporary repo operations.

I write that “the Fed seems to have little choice but increase the size of its balance sheet in the face of trillion-dollar budget deficits.”

If that sounds like monetizing the debt, that’s because it pretty much is. 😬

If that sounds like monetizing the debt, that’s because it pretty much is. 😬

The alternative, of course, is for the U.S. government to find a way to close these budget deficits.

*pause for laughter*

*pause for laughter*

But seriously, we laugh because otherwise we’d cry.

The national debt is starting to become unwieldy for the inner workings of the U.S. financial system.

The End.

bloomberg.com/opinion/articl…

The national debt is starting to become unwieldy for the inner workings of the U.S. financial system.

The End.

bloomberg.com/opinion/articl…

• • •

Missing some Tweet in this thread? You can try to

force a refresh