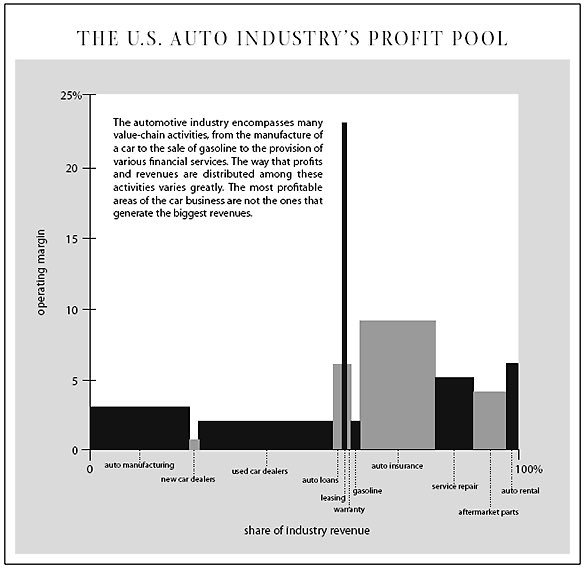

1/ This tweetstorm is about “wholesale transfer pricing power,” a term I learned from John Malone in the 1990s. WTPP determines who in a value chain gets the biggest share of the profit pool (e.g., do content owners, cable owners or vendors to cable firms have the best WTPP?).

2/ Wholesale transfer pricing = the bargaining power of A that supplies a unique product X to B which may enable A to take the profits of B by increasing the wholesale price of X.

A buyer can also have wholesale transfer pricing owner over vendors depending on relative BATNA.

A buyer can also have wholesale transfer pricing owner over vendors depending on relative BATNA.

3/ BATNA = acronym for Best Alternative to a Negotiated Agreement. What it measures is what we’ll do if the negotiator can do if don’t reach an agreement. It measures opportunity cost. The better the BATNA, the greater the power of the negotiator. My book 25iq.files.wordpress.com/2016/05/the_gl…

4/ “The single most important decision in evaluating a business is pricing power. If you’ve got power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session you’ve got a terrible business.” Warren Buffett

5/ John Malone “They key to future profitability and success in the cable business will be the ability to control programming costs through the leverage of size.” The scale economies produced by increasing cable company size allowed Malone to roll up a fragmented cable business.

6/ I had a ringside seat to watch Malone and Murdoch during the “the death star” era. Malone had a joint venture with Murdoch to use his satellite license. Their shared goal then was to reduce wholesale transfer pricing power of others in the profit pool. hbr.org/1998/05/how-to…

7/ Murdoch and Malone are two of the sharpest minds in business. Negotiating with them is the deep end of the profit pool where the biggest sharks feed. Watching them was like negotiation graduate school. Stephanie Keating writes in her book Cutthroat: High Stakes & Killer Moves:

8/ What share any one participant in a value chain gets depends on the supply and demand for what they provide which determines their negotiating leverage. When Snoop started out he had a terrible BATNA, so Suge Knight signed him to a long-term contract. 25iq.com/2018/02/17/bus…

8/ In a value chain analysis sources of value are traced to where they reside within the business or in the network of businesses delivering the product. Everyone (e.g., Chance the Rapper) is trying to extract the largest possible share of the profit pool. 25iq.com/2018/09/01/les…

9/ Rza of Wu-Tang Clan: "They offered us small amounts of money, like $200,000 for all eight members. ‘So I said, ‘Forget the money; let’s get a deal that gives all of us the power to get more deals.’" Rza had a BATNA to get a significant profit pool share.google.com/amp/s/25iq.com…

10/ "By 2011 we [Netflix] realized many of the firms we were buying from were eventually going to want to run their own streaming service. We had no reliable supply. We had to go vertical since it was not going to be in their interest to sell to us.” RH 25iq.com/2018/02/03/bus…

11/ "Netflix was relying on the Saudis for oil. It was pretty compelling. If Netflix didn't learn how to drill it's own oil wells, it was going to get cut off." Long-time Netflix board member Rich Barton in an interview this week with The Information. Wholesale Transfer Pricing!

11/ Streamers like Spotify must own 1st party content that doesn't expose them to wholesale transfer pricing power of content owners. Gross margin problems!

Content owners must avoid not having data on customers of streamers. 1st party!

Clash of Titans!25iq.com/2017/08/19/wha…

Content owners must avoid not having data on customers of streamers. 1st party!

Clash of Titans!25iq.com/2017/08/19/wha…

12/ 25iQuiz:

Was IBM's objective with its OS/2 operating system to regain its wholesale transfer pricing power (WTTP) over the PC by tying the software to proprietary IBM hardware?

Was IBM's lack of WTPP the reason why Compaq was able to be first to ship a 386 PC?

Was IBM's objective with its OS/2 operating system to regain its wholesale transfer pricing power (WTTP) over the PC by tying the software to proprietary IBM hardware?

Was IBM's lack of WTPP the reason why Compaq was able to be first to ship a 386 PC?

13/ 25iQuiz: Does a US mobile virtual network provider (MVNO) like Xfinity Mobile decrease the wholesale transfer pricing power (WTPP) of its suppliers by having the ability to buy wholesale wireless capacity from all four facilities-based mobile operators?rcrwireless.com/20191011/test-…

14/ 25iQuiz: Is the adoption by mobile operators of a virtualized RAN architecture which replaces proprietary equipment from suppliers like Nokia and Ericsson with general-purpose servers intended to reduce the wholesale transfer pricing power of suppliers?rcrwireless.com/20191008/netwo…

15/ 25iQuiz: How much of the profit pool has Drake been able to capture in releasing his music with Republic Records, Universal Motown, Cash Money, OVO Sound and Young Money Entertainment?

Does Drake's ability to change labels increase his Wholesale Transfer Pricing Power?

Does Drake's ability to change labels increase his Wholesale Transfer Pricing Power?

16/ The next 25iQ tweetstorm will be on "unit economics" which may include or be preceded by an explanation of how an earnings approach differs from a discounted cash flow approach in calculating shareholder value (e.g., earnings includes no charge for the cost of capital).

• • •

Missing some Tweet in this thread? You can try to

force a refresh