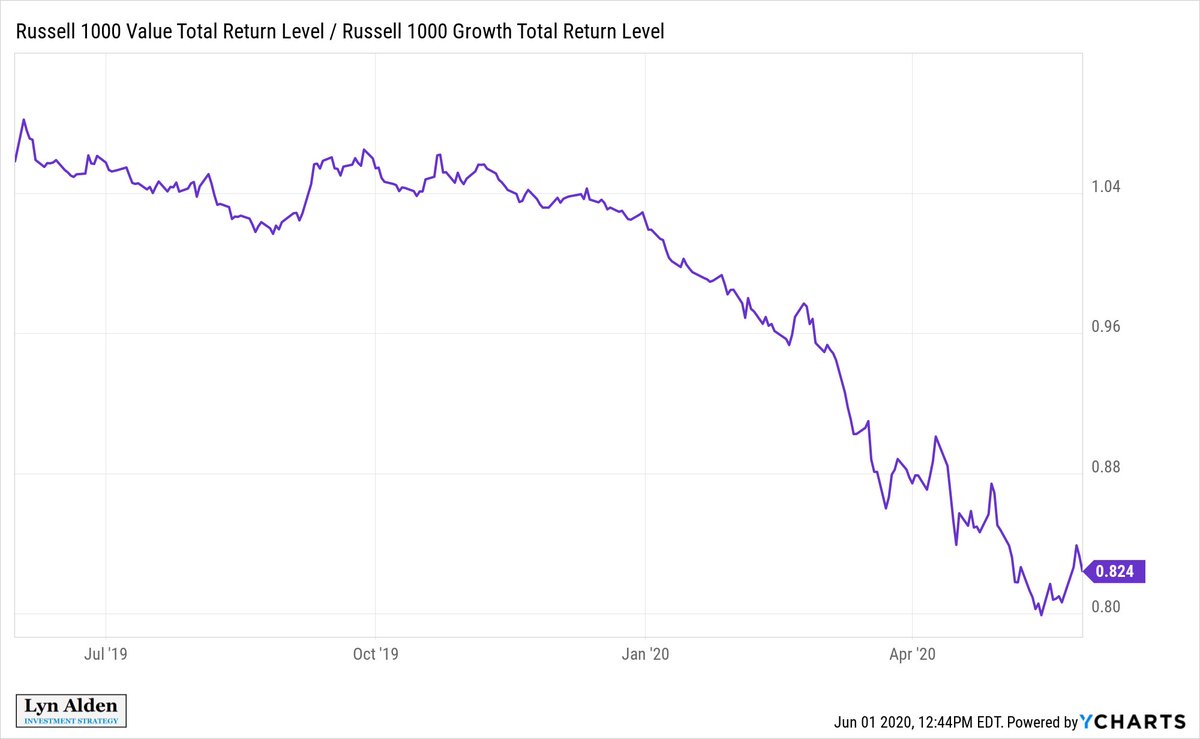

A bit pivot occurred in September, and it is still being interpreted in various ways. A short thread.

More here:

lynalden.com/currency-war/

I discussed that in this thread:

There may be corrections against the trend, but the overall trend is likely bearish for the dollar until the variables get re-arranged again.