Many traders follow different types of moving average crossover #TradingStrategy but the main problem with such MA/EMA cross over system is whipsaws. How one could reduce such false breakouts and also gain from large trend ?

The answer is move to larger time frame.

Buy rules: Go long when 10 EMA is greater than 50 EMA

Sell rules: Exit when 10 EMA is lesser than 50 EMA

Time frame: Weekly

Buy rules: Go long when 10 EMA is greater than 50 EMA

Sell rules: Exit when 10 EMA is lesser than 50 EMA

Time frame: Weekly

Many of us must have invested in stocks like Yes Bank, #DHFL, #Graphite, #HEG etc. All these stocks were once a fundamentally strong stocks but due to sudden shift all these stocks tanked. Following this strategy rules would have helped you to exit at the right time.

Stock went from 90 Rs. levels to Rs.1000 levels but many investors were stuck in this stock as it tanked to Rs.200 levels now, however following this strategy would helped you to exit at the right time, as it gave exit signal when stock was at Rs.700.

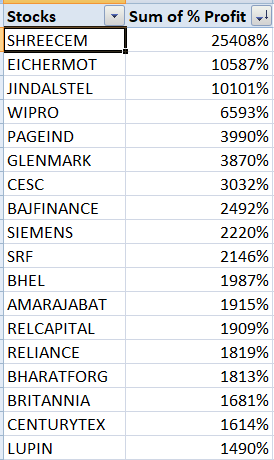

And this EMA cross over system helps you in identifying multi-bagger stocks as well, we tested this strategy with huge historical data sets. These are some of the stock list that returned multi fold returns

You can download the historical results of all #NSE stocks from this link, bit.ly/ema1050 it has been tested from 1994 to 2019. Blog post here squareoff.in/single-post/A-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh