Why invest in emerging tech companies?

Technology is nothing new to us.

We have seen how technological inventions have changed the mankind over centuries.

3 biggest technological inventions by mankind..

Steam engine - 1700 it changed the way people travelled.

Technology is nothing new to us.

We have seen how technological inventions have changed the mankind over centuries.

3 biggest technological inventions by mankind..

Steam engine - 1700 it changed the way people travelled.

Electricity - 1879 - it changed the way we live and work

Internet - 1960 - it changed everything

What are the next big revolutions ??

There are many..

Artificial intelligence

Autonomus and electric cars

Cloud computing

Digitisation

They are changing the way we do everything

Internet - 1960 - it changed everything

What are the next big revolutions ??

There are many..

Artificial intelligence

Autonomus and electric cars

Cloud computing

Digitisation

They are changing the way we do everything

At the beginning of 1900 virtually no one had driven a car, made a phone call, used an electric light, heard recorded music, or seen a movie; no one had flown in an aircraft, listened to the radio,watched TV, used a computer, sent an e-mail, or used a smartphone.

Mankind has enjoyed a wave of transformative innovation dating from the Industrial Revolution, continuing through the Golden Age of Invention in the late 19th century, and extending into today’s information revolution.

These transformations have given rise to entire new industries: electricity and power generation, automobiles, aerospace, airlines, telecommunications, oil and gas, pharmaceuticals and biotechnology, computers, information technology, and media and entertainment.

Meanwhile, makers of horse-drawn carriages and wagons, canal boats, steam locomotives, candles, and matches have seen their industries decline.

There have been profound changes in what is produced, how it is made, and the way in which people live and work.

There have been profound changes in what is produced, how it is made, and the way in which people live and work.

This has changed the composition of industries listed and their market cap.

At the start of century marketcap was dominated by rail road companies which created huge wealth only to decline later accounting just 1%.

Huge wealth was created by banks, healthcare and others.

At the start of century marketcap was dominated by rail road companies which created huge wealth only to decline later accounting just 1%.

Huge wealth was created by banks, healthcare and others.

Industries which once seemed very important have become extinct today. For example telegraph which was considered as high-tech as smart phone of today has died today.

The largest company was candle and match maker at some time in 19th century.

The largest company was candle and match maker at some time in 19th century.

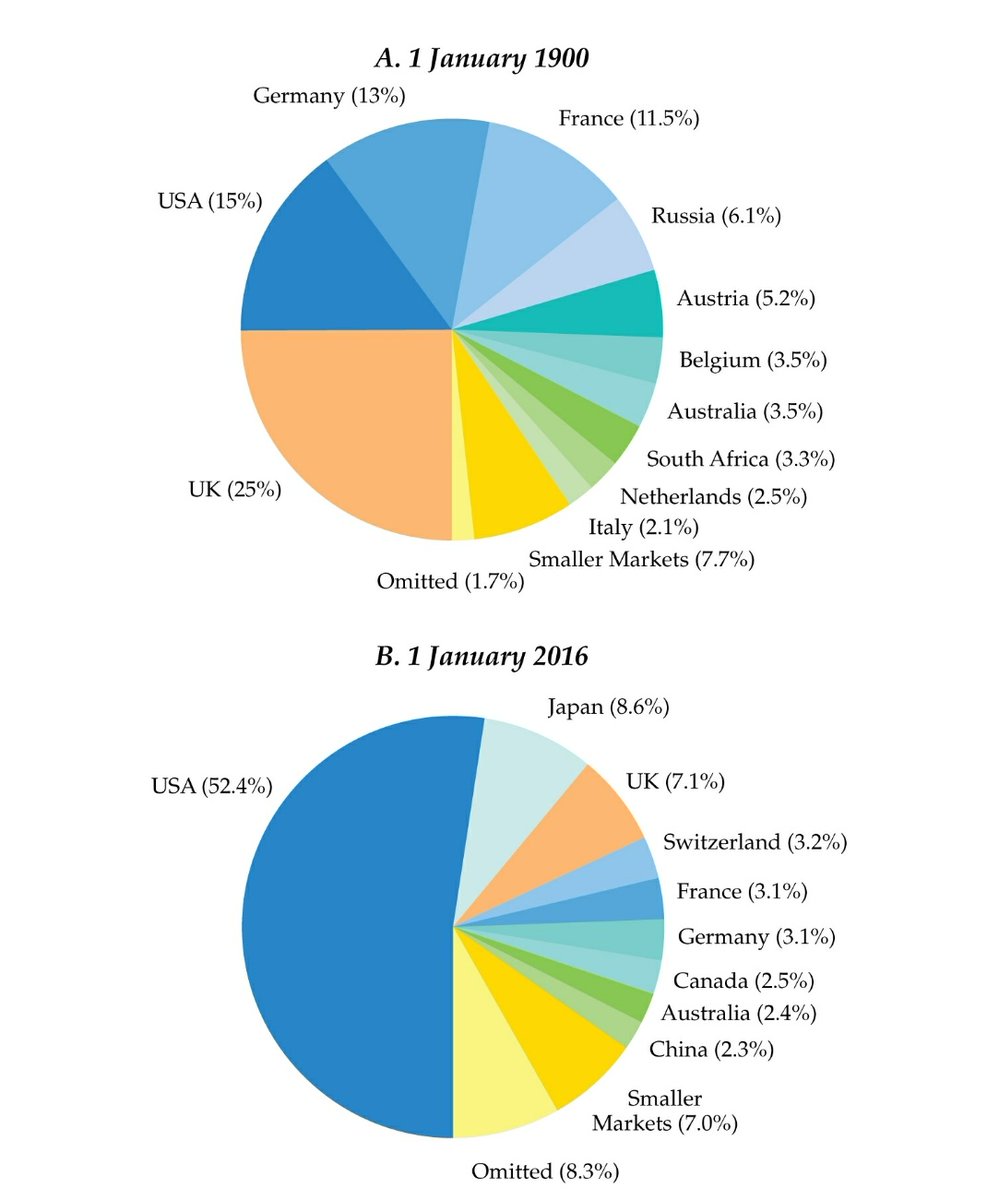

One important point to note is, during all these changes one market has been the heart of all these changes and has adapted well compared to any other country. The USA - It had 15% share in world market in 1900 increased to over 50% in 2016.

The reason for US to dominate the market cap share despite such changes in technology over last century is that it has been the center for all these technological advances.

Most companies which have dominated the world through newer technologies are from the US.

Most companies which have dominated the world through newer technologies are from the US.

The moot point is dominance of industries have changed every decade or two due to technological advances. Newer inventions and industries have created wealth and older ones have destroyed wealth.

Probably the most important thing in wealth creation journey.

Probably the most important thing in wealth creation journey.

One should have exposure to such companies which are driving technological changes. They can be the biggest wealth creators of future, signs of which are already visible.

Investing in @EdelweissAMC US Technology Equity FOF which invests in such companies can be a good start.

Investing in @EdelweissAMC US Technology Equity FOF which invests in such companies can be a good start.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh