🧵 on Bond laddering - A technique to reduce interest rate risk in your fixed income portfolio and create a predictable stream of income.

Do RT and share with more people to spread the awareness. This can be the future of fixed income investing in India.

1/n

Do RT and share with more people to spread the awareness. This can be the future of fixed income investing in India.

1/n

Investor seeking stable income from their portfolio usually prefer investing in bonds or bond funds.

One popular way in developed market to invest in bonds or Target maturity bond funds is by creating a ladder of bonds with various maturities.

2/n

One popular way in developed market to invest in bonds or Target maturity bond funds is by creating a ladder of bonds with various maturities.

2/n

Laddering means spreading your investments in different maturing bonds or target maturity bond funds.

Maturity of these bonds can range from 1 year to upto 10 years or even higher.

3/n

Maturity of these bonds can range from 1 year to upto 10 years or even higher.

3/n

How it works?

Say you have Rs. 10 lakhs to invest which you can spread across different maturing bonds as follows:

2023 Bond 4.3%: 2 lakhs

2025 Bond 5.1%: 2 lakhs

2027 Bond 6.3%: 2 lakhs

2029 Bond 6.6%: 2 lakhs

2031 Bond 6.8%: 2 lakhs

*Yields are assumed

4/n

Say you have Rs. 10 lakhs to invest which you can spread across different maturing bonds as follows:

2023 Bond 4.3%: 2 lakhs

2025 Bond 5.1%: 2 lakhs

2027 Bond 6.3%: 2 lakhs

2029 Bond 6.6%: 2 lakhs

2031 Bond 6.8%: 2 lakhs

*Yields are assumed

4/n

This ladder of bonds will earn you an average yield of 5.8% on your portfolio.

In year 2023, when 2023 Bond matures you can reinvest that money in 10 year maturing bond of 2033 at then prevailing yield. This can continue every time some portion of portfolio matures.

5/n

In year 2023, when 2023 Bond matures you can reinvest that money in 10 year maturing bond of 2033 at then prevailing yield. This can continue every time some portion of portfolio matures.

5/n

What are the benefits of laddering:

1. Bond ladder can help you create a predictable stream of income and can also manage some potential risks from changing interest rates.

6/n

1. Bond ladder can help you create a predictable stream of income and can also manage some potential risks from changing interest rates.

6/n

If the short-term bonds mature at a time when interest rates are rising, the principal can be re-invested in higher-yielding bonds.

7/n

7/n

On the other hand, when interest rates are falling, you will get a lower yield on the reinvestment. However, you still hold those long-term bonds that are earning you more favorable yield.

8/n

8/n

2. By staggering maturity dates, you won't be locked into any particular maturity for a long duration which may impact your portfolio if interest rates change.

3. Laddering also adds an element of liquidity to a bond portfolio.

9/n

3. Laddering also adds an element of liquidity to a bond portfolio.

9/n

Bonds usually are not very liquid. They can't be cashed in at any time without penalty (due to change in rates) specially long maturity bonds.

By buying bonds with different maturities there are some investments available to you always in shorter maturity to exit.

10/n

By buying bonds with different maturities there are some investments available to you always in shorter maturity to exit.

10/n

This potentially reduces any impact while exiting a portion of your portfolio even if interest rates are rising and you get predictable stream of cash flows/returns.

11/n

11/n

How to select maturity basket?

Distance between the ladder can range between 1 to 5 years to 1 to 10 years, or even longer than that.

The longer you spread, higher is the period between each maturity and cash flows that may come when bonds mature.

12/n

Distance between the ladder can range between 1 to 5 years to 1 to 10 years, or even longer than that.

The longer you spread, higher is the period between each maturity and cash flows that may come when bonds mature.

12/n

Spreading the ladder over longer period (1 to 10 yrs) may get your higher yield than spreading it over shorter period(1 to 5yrs) as longer maturing bonds usually trade at higher yield vs. shorter maturity.

Long ladder also has a lower reinvestment risk vs. a short ladder.

13/n

Long ladder also has a lower reinvestment risk vs. a short ladder.

13/n

One should be careful while selecting the ladder spread.

If your cashflow needs are in the short term, then go for 1 to 5 year bucket.

If you don't need cashflows immediately, then you can go for 3 to 10 year segment or even longer.

15/n

If your cashflow needs are in the short term, then go for 1 to 5 year bucket.

If you don't need cashflows immediately, then you can go for 3 to 10 year segment or even longer.

15/n

To sum up..

Bond laddering is a strategy to reduce risk or increase the opportunity of making money in rising interest rates.

In times of low interest rates, like now, this strategy can help you avoid locking entire money in a poor return for a long period.

16/n

Bond laddering is a strategy to reduce risk or increase the opportunity of making money in rising interest rates.

In times of low interest rates, like now, this strategy can help you avoid locking entire money in a poor return for a long period.

16/n

Who should use ladder approach?

-Investors who don't want to take too much risk in fixed income and want predictable returns from their portfolio.

-Investors who know their cash flow needs and are ready to locking some portion of investments for longer and till maturity.

17/n

-Investors who don't want to take too much risk in fixed income and want predictable returns from their portfolio.

-Investors who know their cash flow needs and are ready to locking some portion of investments for longer and till maturity.

17/n

How do you create ladder in India given bonds are not liquid?

This is most important issue. The good news is, there are Target Maturity Funds launched in India.

Thanks to @EdelweissMF Bharat Bond ETF program which kick started this in 2019.

18/n

This is most important issue. The good news is, there are Target Maturity Funds launched in India.

Thanks to @EdelweissMF Bharat Bond ETF program which kick started this in 2019.

18/n

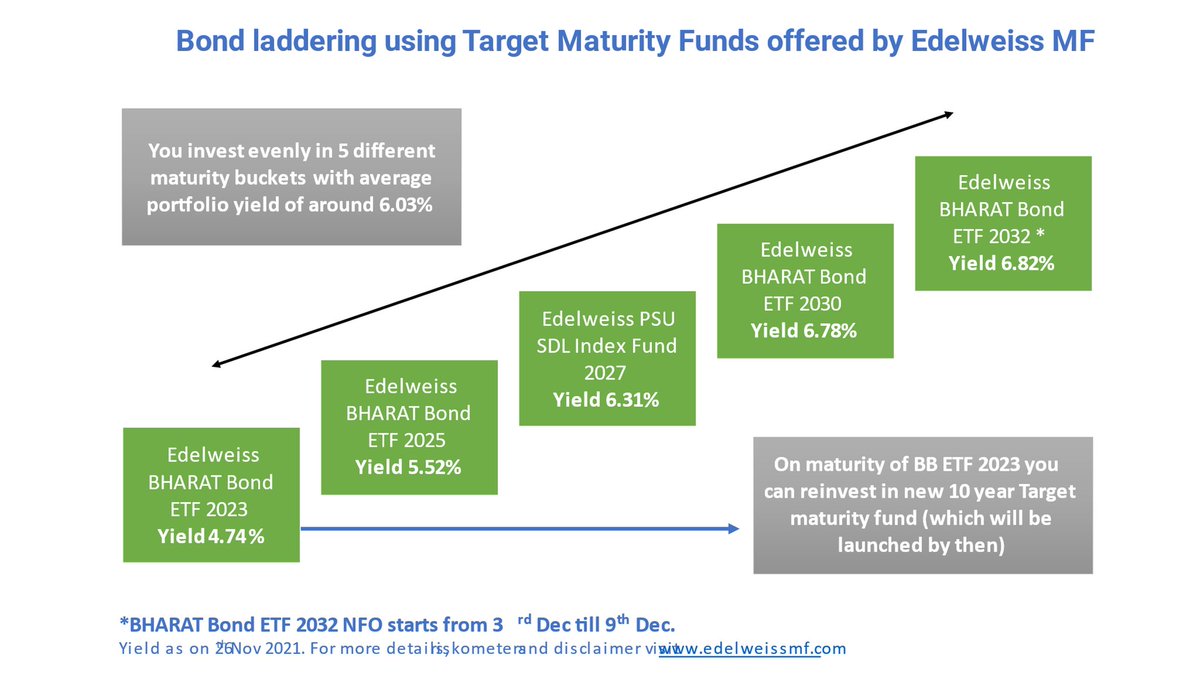

At @EdelweissMF you can create a complete ladder using various target maturity funds ranging from 2023 to 2032 maturity.

19/n

Details here..

edelweissmf.com/types-of-mutua…

19/n

Details here..

edelweissmf.com/types-of-mutua…

This approach will help you create a good fixed income portfolio which is ready to take any interest rate cycle head-on and you don't worry about tracking policies, macros, yields movements, etc..

Use ladder to climb and jump over the volatile bond markets 🙂

20/end

Use ladder to climb and jump over the volatile bond markets 🙂

20/end

• • •

Missing some Tweet in this thread? You can try to

force a refresh