#Technicals #Candlestick

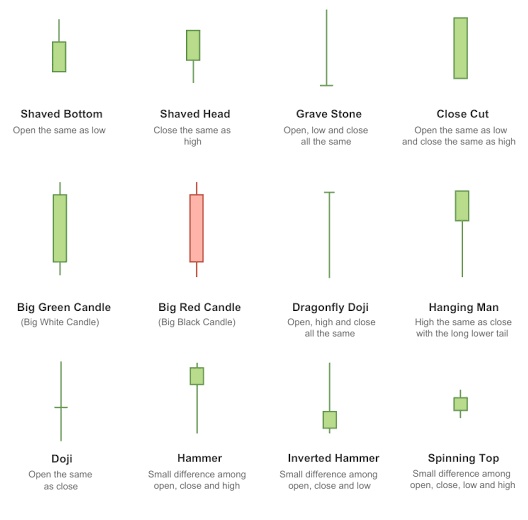

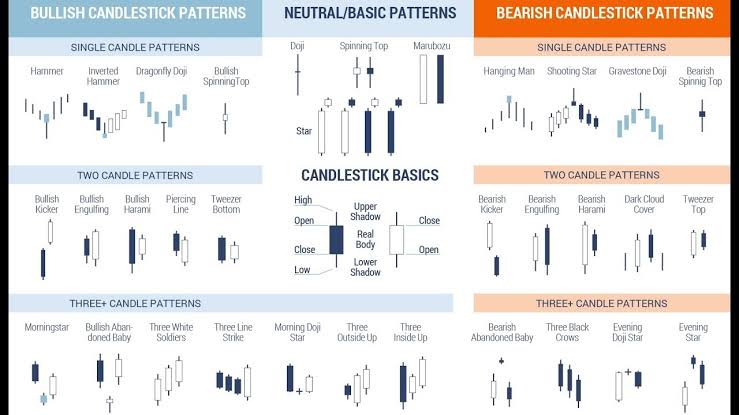

1. First & foremost thing is to know how many types of candles are formed by any security ( Doji, Bar)

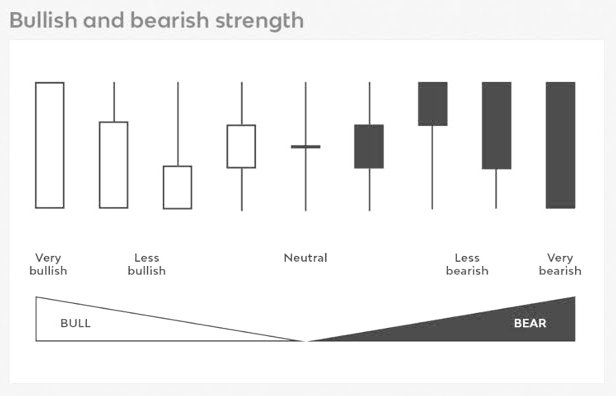

2. Second thing is to know description of that candle ( Bullish/Bearish

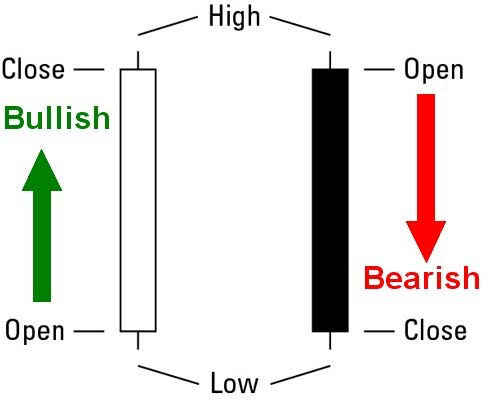

3. Third thing is to know break down of that candle

#Technicals #Candlestick

👉 Any candle formed by security has 4 components ( Open—Close, Low-Highl)

👉A candle is formed once the fight b/w 2 emotions (Buy-Sell) is got over in a certain time frame

👉Green signals bullish & Red signals bearish momentum

#Technicals #Candlestick 📊

👉Just learn the candles name like you print the image in mind😇

👉 Once you identify the candle break it down further to get detailed info about the move

👉 Like breaking an hourly candle into four 15m candles to know the momentum

#Technicals #Candlestick 📈

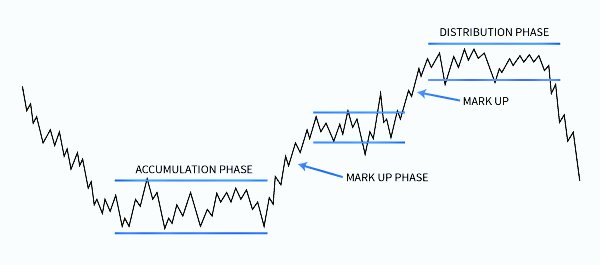

💡Once you know the candle names next step is to know different kind of patterns formed by these candles

💡There are 3 types patterns formed by candles as shown in the picture

💡Patterns can be seen on any time frame chart (D,W)

#Technicals #Candlestick 📊

💡To learn & excel in candlestick the most important thing is do is practice

💡We need to develop a habit of analysing candlestick patterns on 20—30 charts daily📈📉

💡With that practice we get better day by day, week by week 💪

#Technicals #Candlestick 📊

Pattern tells us the same direction on chart in any time frame..

💡For intra day use 5,15 minutes

💡For positional use 1hr, 2 hrs

💡For short term use daily

💡For medium term use weekly

💡For long term use monthly & quarterly