Investor & Trader | Trading Coach & Mentor | Coaching For Success |

Educational Posts On #MutualFunds | #Investing | #Psychology | SEBI Unregistered |

37 subscribers

How to get URL link on X (Twitter) App

MCX >85% market share in commodity trading.

MCX >85% market share in commodity trading.

Textile Theme🧵 🇮🇳

Textile Theme🧵 🇮🇳

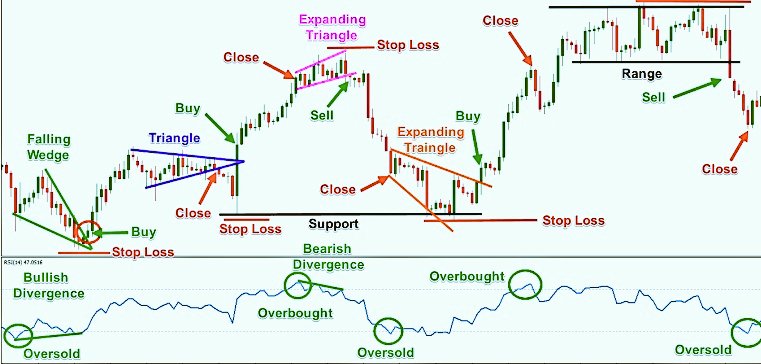

Risk Management Simplified📔

Risk Management Simplified📔

Price Patterns Simplified📒

Price Patterns Simplified📒

Rural India Theme 🇮🇳

Rural India Theme 🇮🇳

🇮🇳 Agriculture theme🌾

🇮🇳 Agriculture theme🌾

Agrochemicals🧪🌱

Agrochemicals🧪🌱

Agriculture theme🌾

Agriculture theme🌾

Agriculture theme 🌾

Agriculture theme 🌾

But he secretly requested Lord Shiva not to agree to these Farmers & when Farmers reached Lord Shiva he repeated the same thing that he will play Damru after 12 years.

But he secretly requested Lord Shiva not to agree to these Farmers & when Farmers reached Lord Shiva he repeated the same thing that he will play Damru after 12 years.

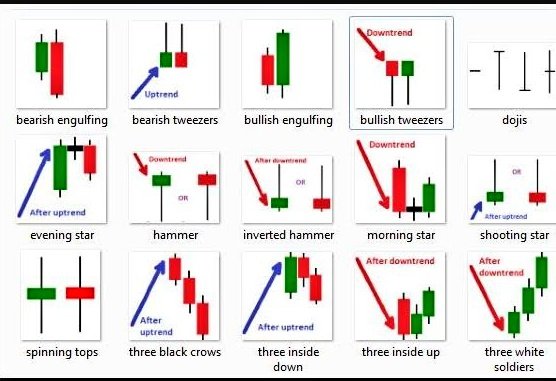

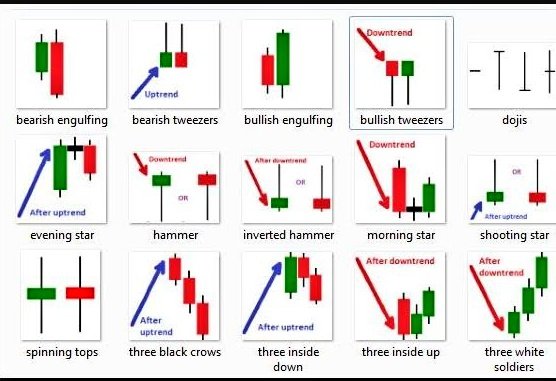

Price Patterns Simplified📒

Price Patterns Simplified📒

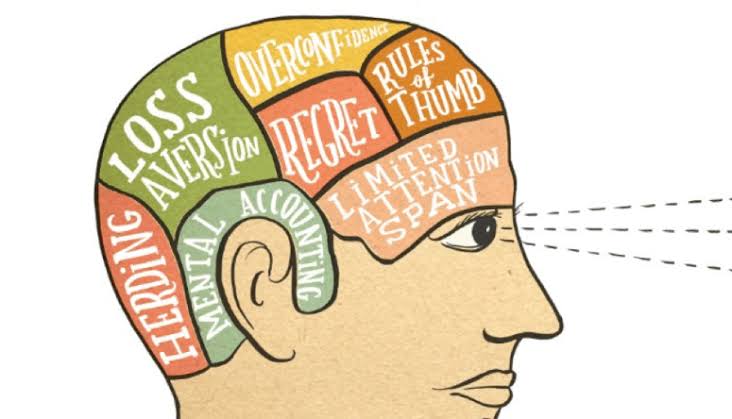

Behavioral Finance Simplified📒

Behavioral Finance Simplified📒

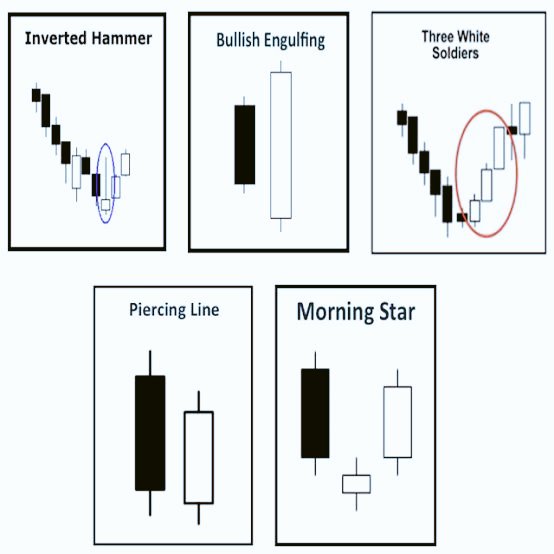

Reversal Patterns Simplified📒

Reversal Patterns Simplified📒

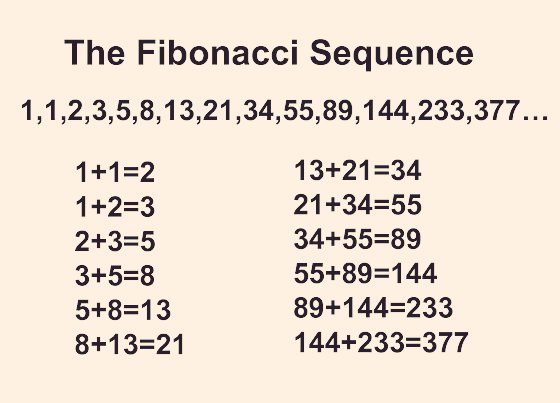

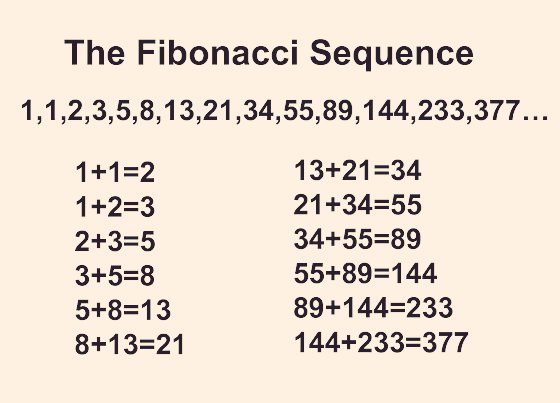

Fibonacci Simplified📒

Fibonacci Simplified📒

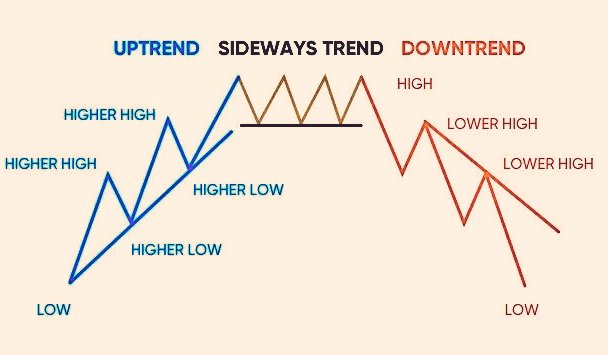

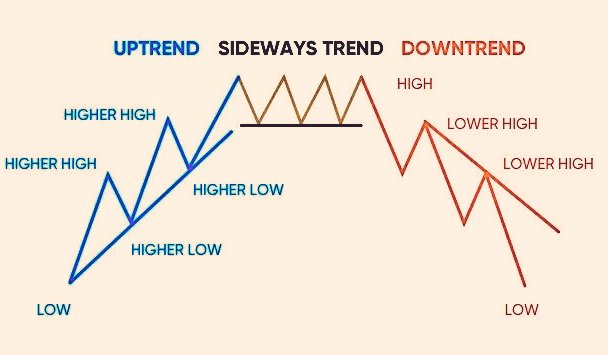

Trend Line Simplified📒

Trend Line Simplified📒

Ichimoku System Simplified📒

Ichimoku System Simplified📒

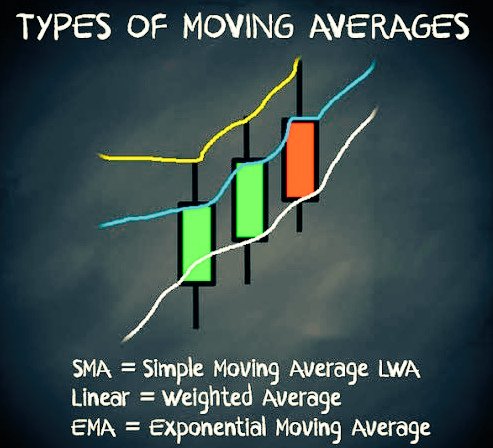

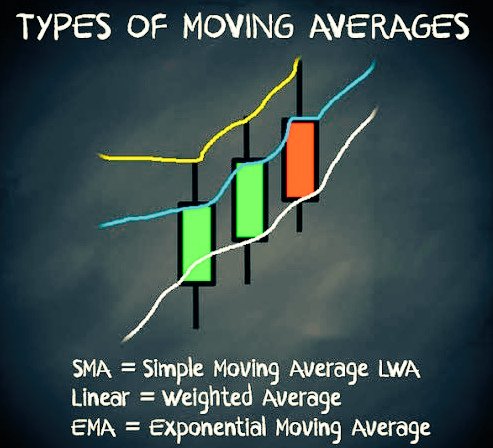

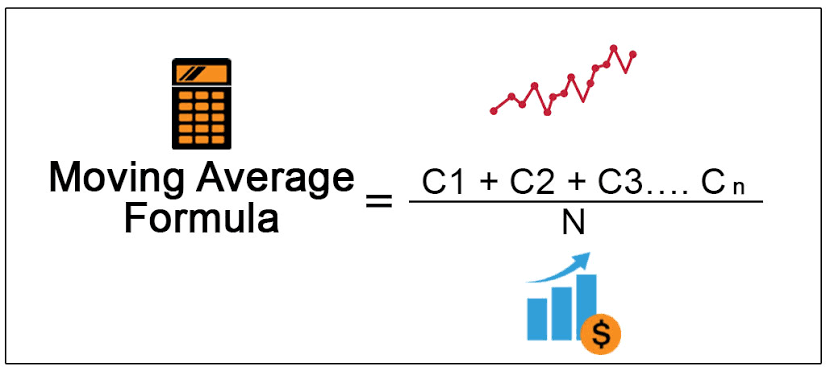

Moving Averages Simplified📒

Moving Averages Simplified📒

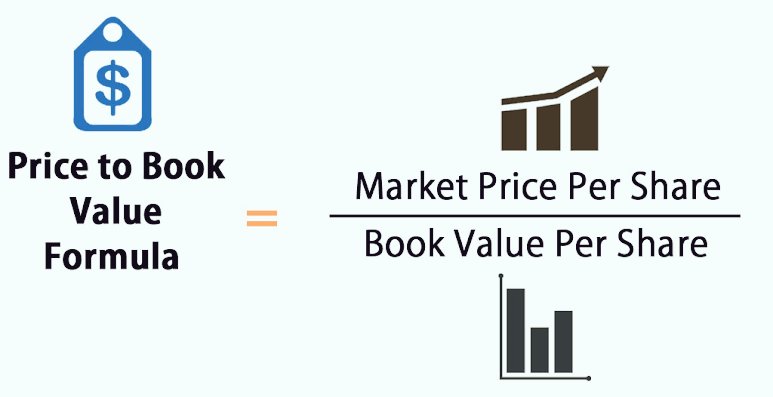

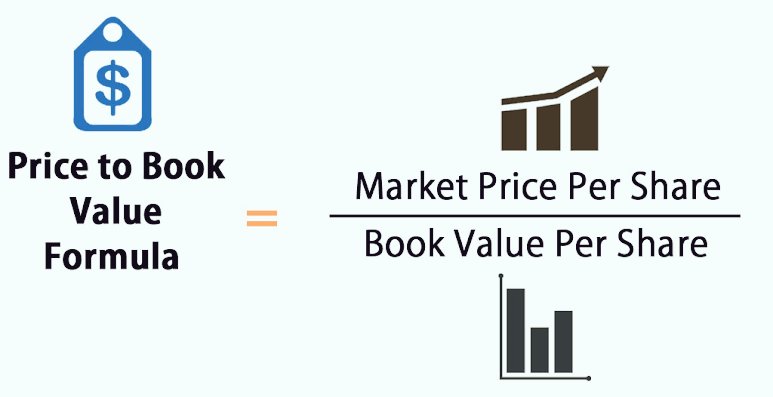

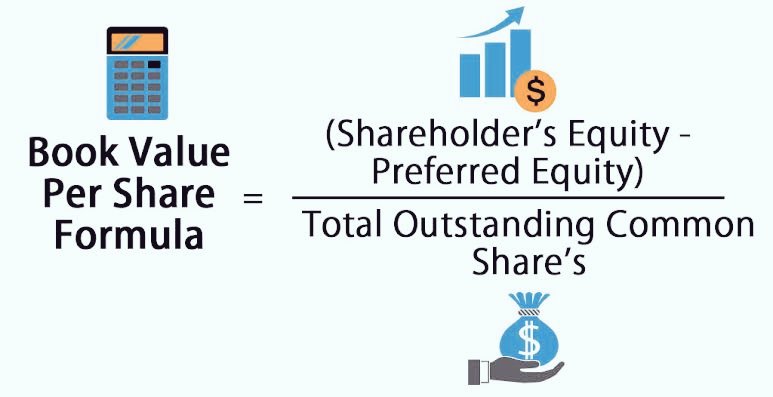

BV & PBR Simplified📒

BV & PBR Simplified📒

RSI Simplified📒

RSI Simplified📒

PE Ratio Simplified📒

PE Ratio Simplified📒