#SundayCharts #Uranium - Live from my toilet paper panic room edition🧻🧻🧻

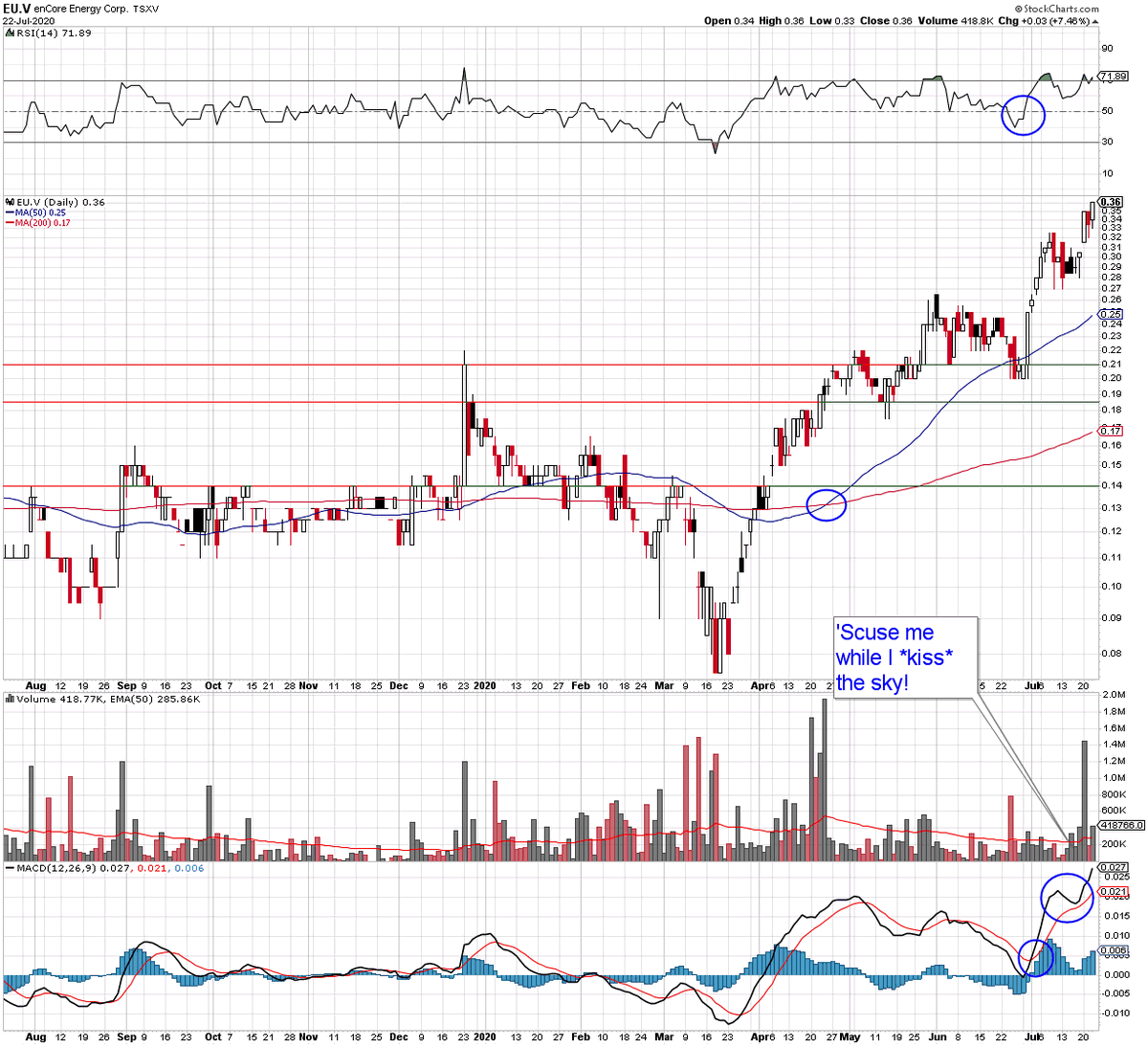

Just a word first. When markets have an extreme liquidity event technicals get distorted to the point where they have less meaning.

Just a word first. When markets have an extreme liquidity event technicals get distorted to the point where they have less meaning.

Still some value in viewing them relatively and looking at volume vs price percentage on moves. As the markets continue to convulse (and I think they will for at least a little bit longer.)

Start to look for ridiculous value and scale into purchases for long term holds.

Or panic like everyone else and throw your shares on the ask. Just remember someone is on the other side of that trade.

Or panic like everyone else and throw your shares on the ask. Just remember someone is on the other side of that trade.

• • •

Missing some Tweet in this thread? You can try to

force a refresh