Thread on how to survive current in #stockmarketcrash 📈

👉Review the business of companies you are holding

👉Check whether your company will survive after few weeks of lockdown/slowdown in the country

👉Check post impact on the sector your company is into.

#SurviveToThrive

👉Review the business of companies you are holding

👉Check whether your company will survive after few weeks of lockdown/slowdown in the country

👉Check post impact on the sector your company is into.

#SurviveToThrive

#SurviveToThrive

👉 Check the domestic/International exposure of your company

👉Companies mostly into Domestic business will make a fast Comeback than companies having international exposure

👉 Companies with good cash on books will revive faster than companies with debt

👉 Check the domestic/International exposure of your company

👉Companies mostly into Domestic business will make a fast Comeback than companies having international exposure

👉 Companies with good cash on books will revive faster than companies with debt

#SurviveToThrive

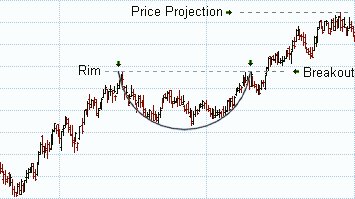

👉1st Sectors like FMCG, Chemicals & Pharma will Survive & Thrive with fastest pace after current slowdown

👉2nd Consumer discretionary will Revive & Thrive

👉3rd Service sectors like Airlines, Travel & Hotels will revive & thrive as per their business model

👉1st Sectors like FMCG, Chemicals & Pharma will Survive & Thrive with fastest pace after current slowdown

👉2nd Consumer discretionary will Revive & Thrive

👉3rd Service sectors like Airlines, Travel & Hotels will revive & thrive as per their business model

#SurviveToThrive

👉 Last we need to check business model of each company we are holding

👉 Sell companies which would struggle to survive or revive after this slowdown

👉 Buy/Average down companies which would would survive/revive/thrive after this slowdown

#StockMarketCrash

👉 Last we need to check business model of each company we are holding

👉 Sell companies which would struggle to survive or revive after this slowdown

👉 Buy/Average down companies which would would survive/revive/thrive after this slowdown

#StockMarketCrash

Hello Friends🤗

In Summary always remember & focus on 3 parameters to handle any market crash going fwd..

1. Survive

2. Revive

3. Thrive

Businesses which have strategy to survive can revive easily, Businessess which have strategy to revive can thrive easily😊

#SurviveToThrive

In Summary always remember & focus on 3 parameters to handle any market crash going fwd..

1. Survive

2. Revive

3. Thrive

Businesses which have strategy to survive can revive easily, Businessess which have strategy to revive can thrive easily😊

#SurviveToThrive

• • •

Missing some Tweet in this thread? You can try to

force a refresh