1) No moat/shrinking moat

Q to ask: What prevents competitors from stealing customers?

"Nothing" = not good

Ex:

No moat: Most marijuana stocks/retailers

Shrinking moat: $UA / $WU / $GRUB

>10% sales/accounts recievable w/ 1 or more customers = risk

Search 10k for word "concentration"

Ex:

$AMT 51% of rev from 4 cust

$OLED 80% of rev from 3 cust

$SWKS 51% of rev from 1 cust ($AAPL)

Active / possible / none

Ex:

Active:

electrifiation/autonomous - $GM $F $TM

download vid gmz: $GME

Possible:

crypto $MA $V

Success depends on something outside of management control going right = too hard.

Ex:

Interest rates: banks $JPM $C

Oil prices: $XOM $CVX

Strong economy: Most industrials $AA

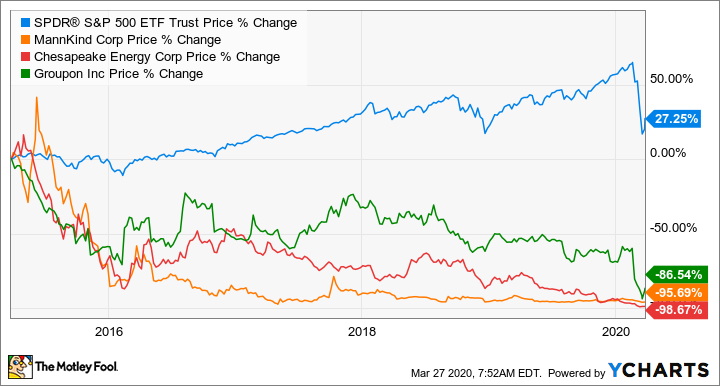

#winnerswin

#loserslose

I pull up 5-yr chart vs $SPY & since IPO date

Good = market beater

Bad = big loser

Ex:

$MNKD / $CHK / $GRPN

Business is hard enough as is. Why bother with 50 / 50 shots?

Ex:

Key patent being challenged in court

FDA approval for a single drug: most small-cap pharma/biotech

Acquisitions are hard. Numbers show most don't work out.

If growth thesis = constant acquisitions, I pass.

Ex:

$MIDD

$TDG

$HAIN

Some companies are WAY too comfortable w/ debt.

Super ugly balance sheet = pass.

Ex:

$TCS

$SBH

$HZN

Others I can't (moat under attack/industry disruption).

Business is hard.

Investing is hard.

Don't make it even harder by assuming unnecessary risks.