When I do financial coaching w/ friends & family

Step 1 is ALWAYS to get organized

Start by tracking your expenses

@mint

@PersonalCapital

@ynab

More:

👇👇👇👇👇👇👇👇👇👇

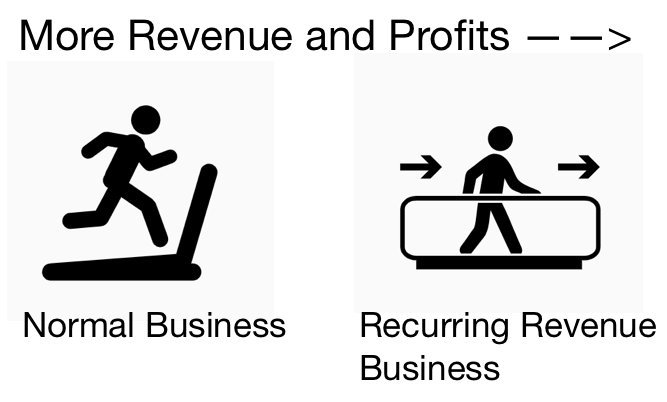

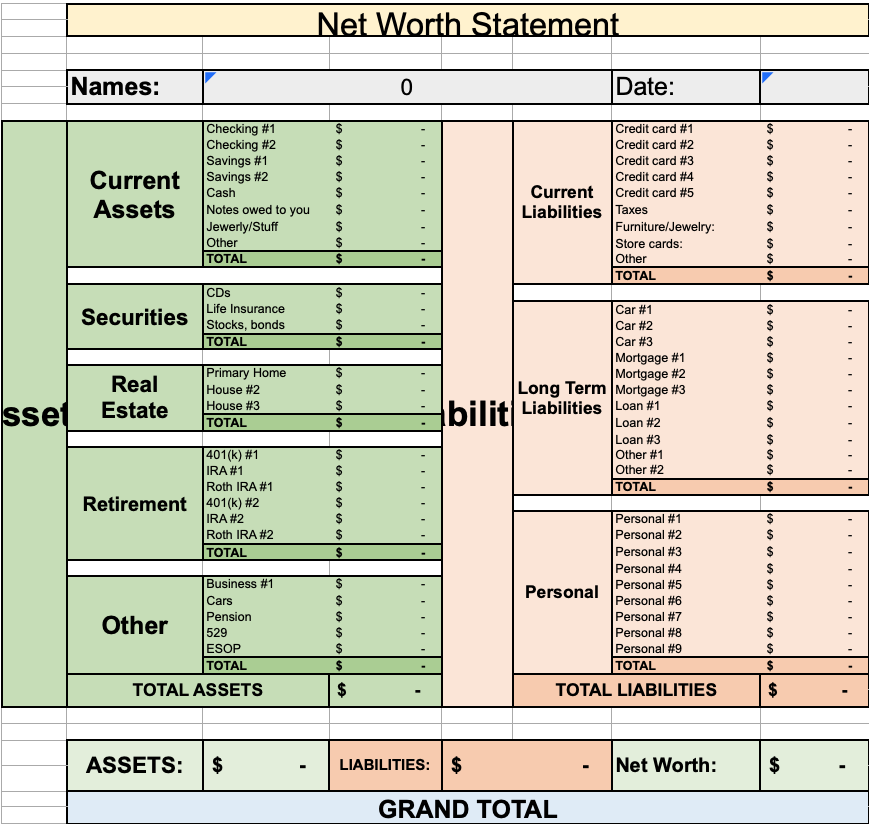

Create income / net worth statements

Here is the coaching template that I created and use with all of my clients

drive.google.com/open?id=18ee7t…

Optimize ALL expenses

Can you lower your cable / phone bill?

Can you spend less on food? (budgetbytes.com)

Do you have any recurring charges you no longer need?

Attack them all!

Starter emergency fund

How much? At least enough to cover insurance deductibles

Pay off ALL High-Interest Debt

Payday lenders

Credit cards

Loan sharks

401(k) up to the employer match

Full emergency fund

3+ months of expenses in cash

6+ months if you have 1 income and kids

Max Health Savings Account (HSA) contributions if you have a high deductible health plan

$1,400 deductible individual

$2,800/family

fool.com/retirement/com…

Max IRA contributions

Roth / traditional

$6,000 / $7,000 depending on age in 2020

Pay off ALL non-mortgage low-interest debt

Student loans

Cars

HELOC

Max out 401(k)

$19,500 / $26,000 depend on age 2020

529 contributions

33% to a regular brokerage account

33% to mortgage paydown

33% to irregular expense fund (car, roof, vacation)

Whatever you want

If you have kids, YOU NEED A WILL & OTHER ESTATE PLANNING DOCUMENTS

Pay to meet with a local lawyer

It's expensive but worth it

YOU NEED LIFE INSURANCE

20-year, fixed-rate, TERM insurance (not whole/universal) is a good start

I like $1 MM per adult

@Policygenius & @healthiqinsure are excellent resrouces

Health

Umbrella policy

Disability

Home/renters

Car

Business (if small business owner)

@creditkarma for tracking credit score

SSA.gov

Annualcreditreport.com

@upromise

missingmoney.com

travelmiles101.com

GET AN ENERGY AUDIT DONE

Many utilities offer this FOR FREE

And will even subside improvements

F.I.R.E.

@ChooseFi

@AffordAnything

Personal finance

@AnswersPodcast

Market

@MFIndustryFocus

@MarketFoolery

@MotleyFoolMoney

Hire a fee-only money coach

I like momandddadmoney.com

But there are lots of great choices

It's all of our responsibility to do these things on our own

And to spread the word so others have a roadmap to follow

Sadly, they don't teach this stuff in school (I'm working on changing that!)