*JAPAN'S ABE SAYS RULING PARTY BACKS $988 BILLION STIMULUS

Boom...

Boom...

Abe to Kuroda over breakfast:

"If debt to GDP of 250% didn't work, let us try 300.."

(2)

"If debt to GDP of 250% didn't work, let us try 300.."

(2)

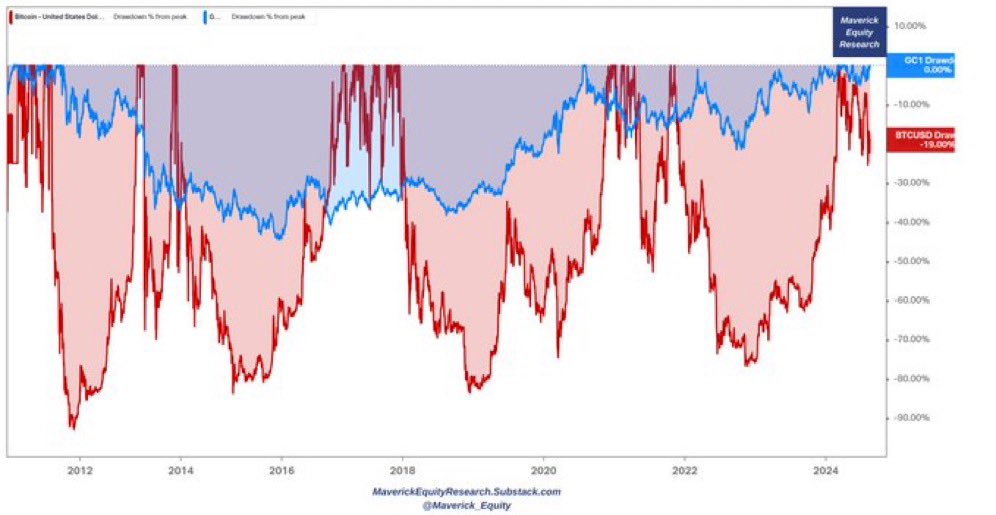

Since Q3 2018, gold has been kicking the S&P 500's ass, why? Larger central bank balance sheets.

#FOMC

#BOJ

#BOE

#ECB

#PBOC

(4)

#FOMC

#BOJ

#BOE

#ECB

#PBOC

(4)

Major bullish break in gold this morning. Join our institutional chat, reach out to us on Bloomberg, value add.

• • •

Missing some Tweet in this thread? You can try to

force a refresh