loss aversion refers to people's preferences to avoid losing compared to gaining the equivalent amount. “losses loom larger than gains”

economicshelp.org/blog/glossary/…

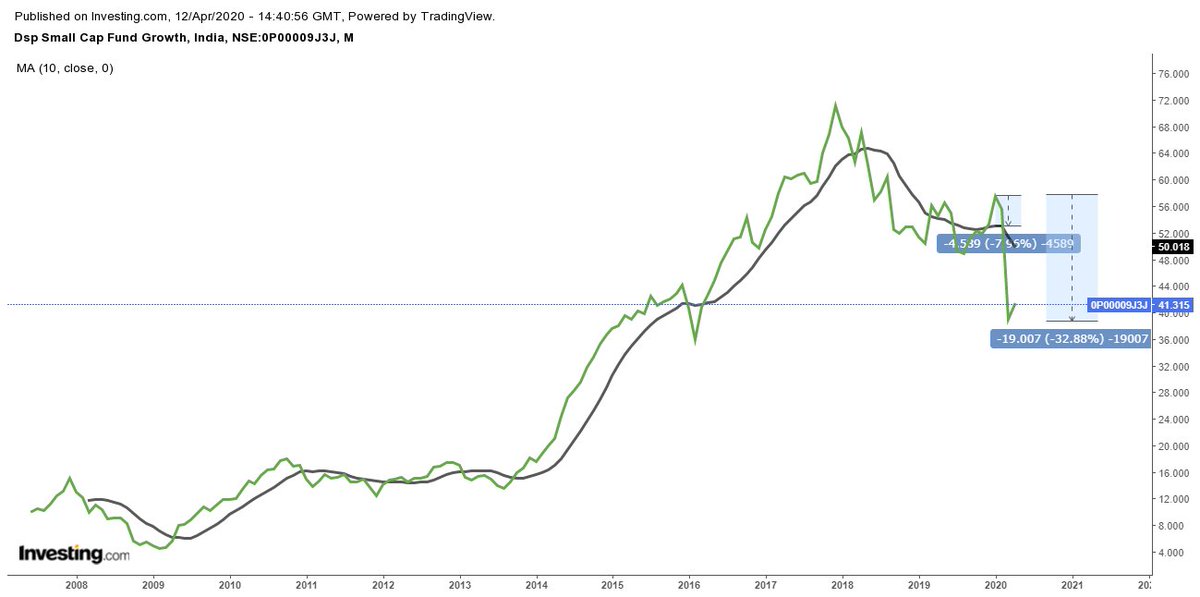

For example, @anishteli recommended a 10-month average, which would've protected investors from those sharp falls.

freefincal.com/why-a-sip-in-s…

indexheads.substack.com/p/is-my-beta-s…

aqr.com/-/media/AQR/Do…

qedcap.com/blog/dalal-str…

subramoney.com/2020/04/mutual…