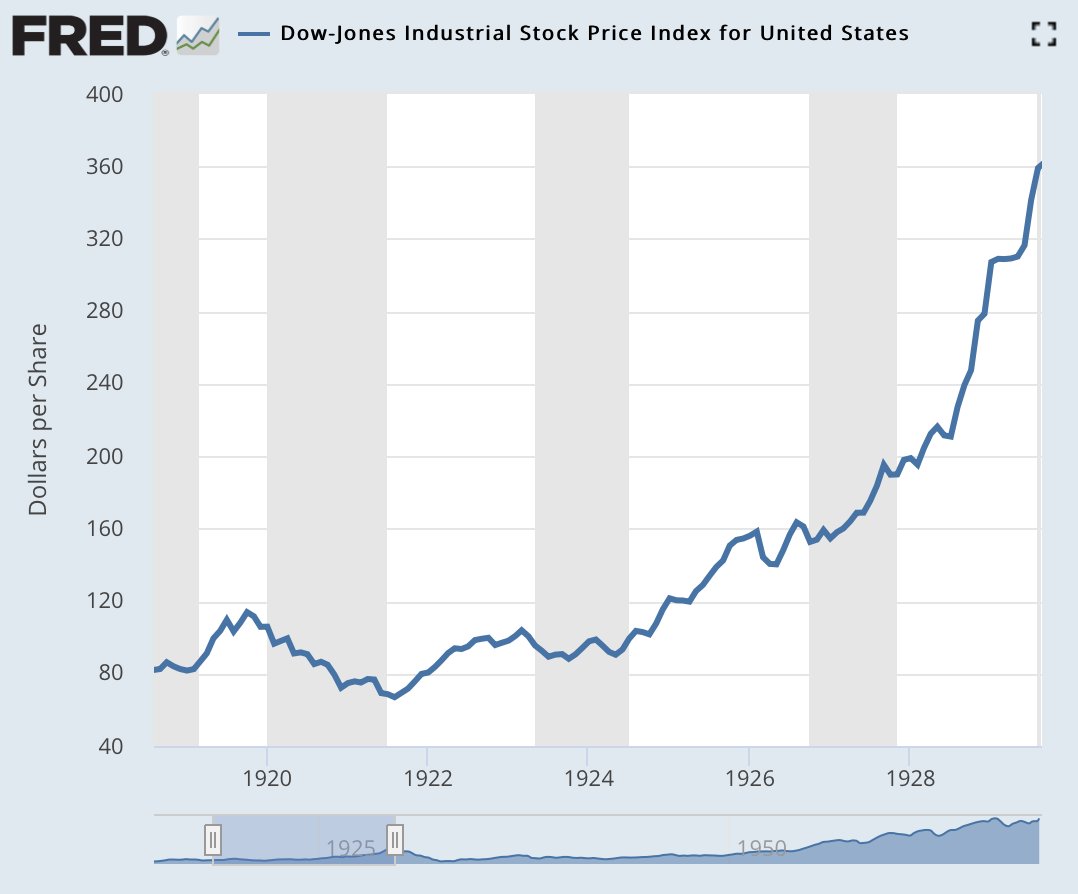

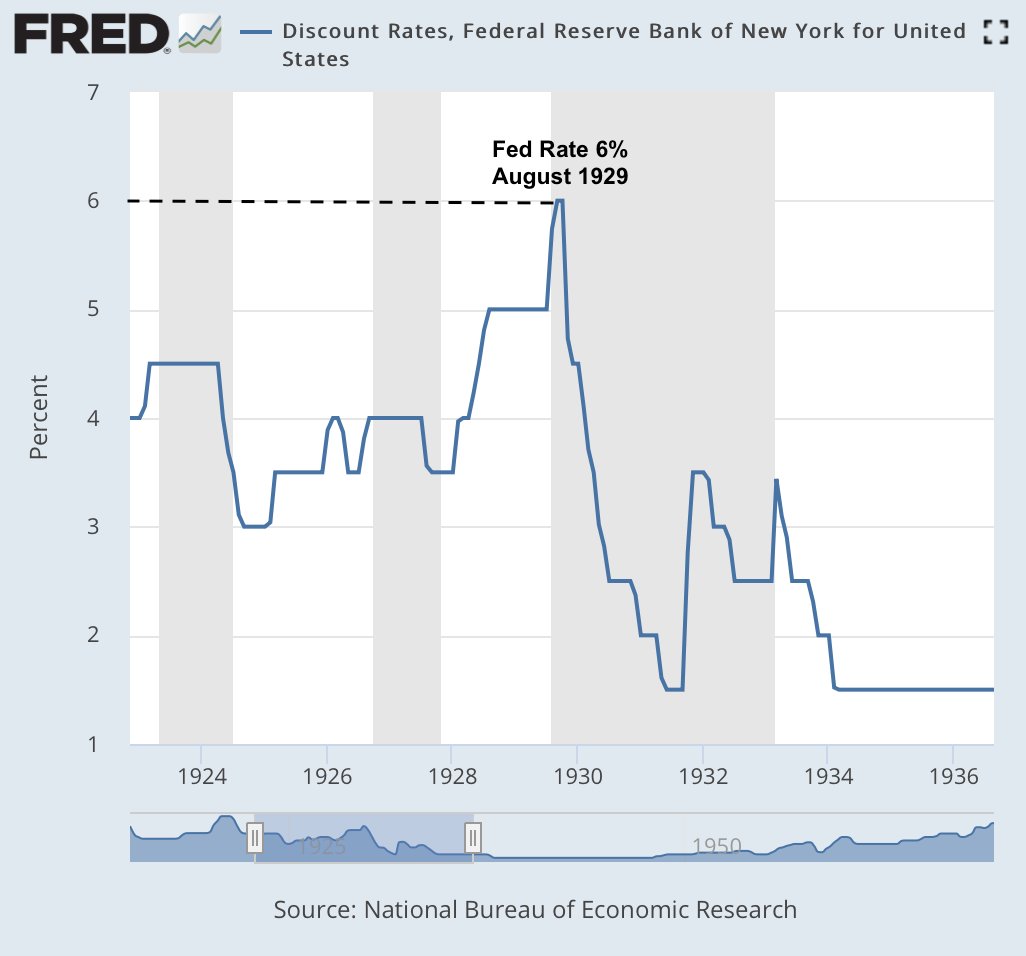

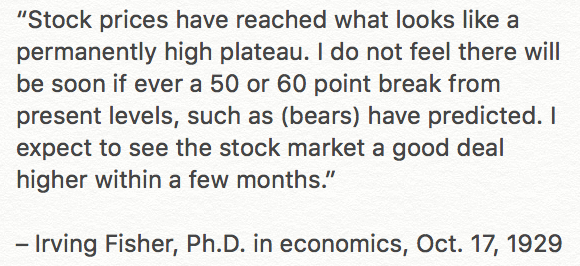

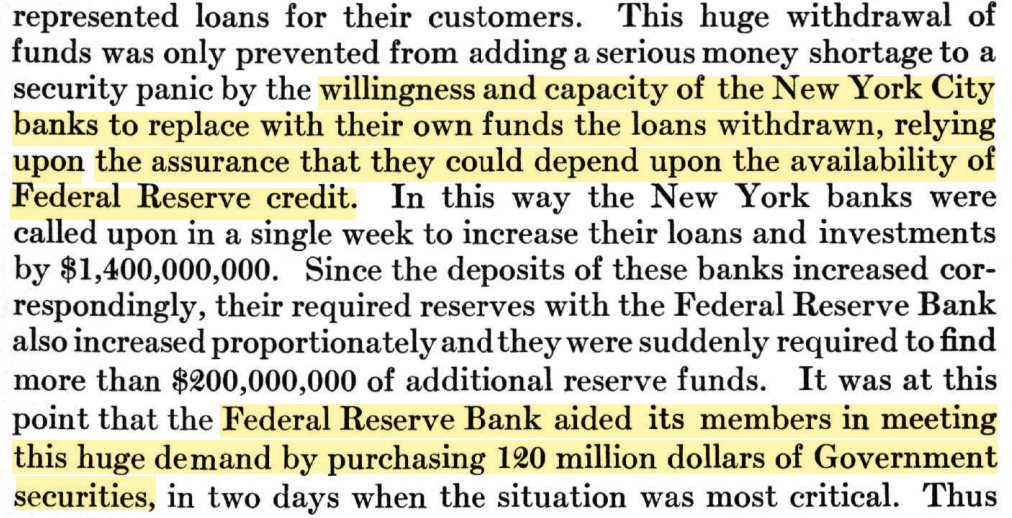

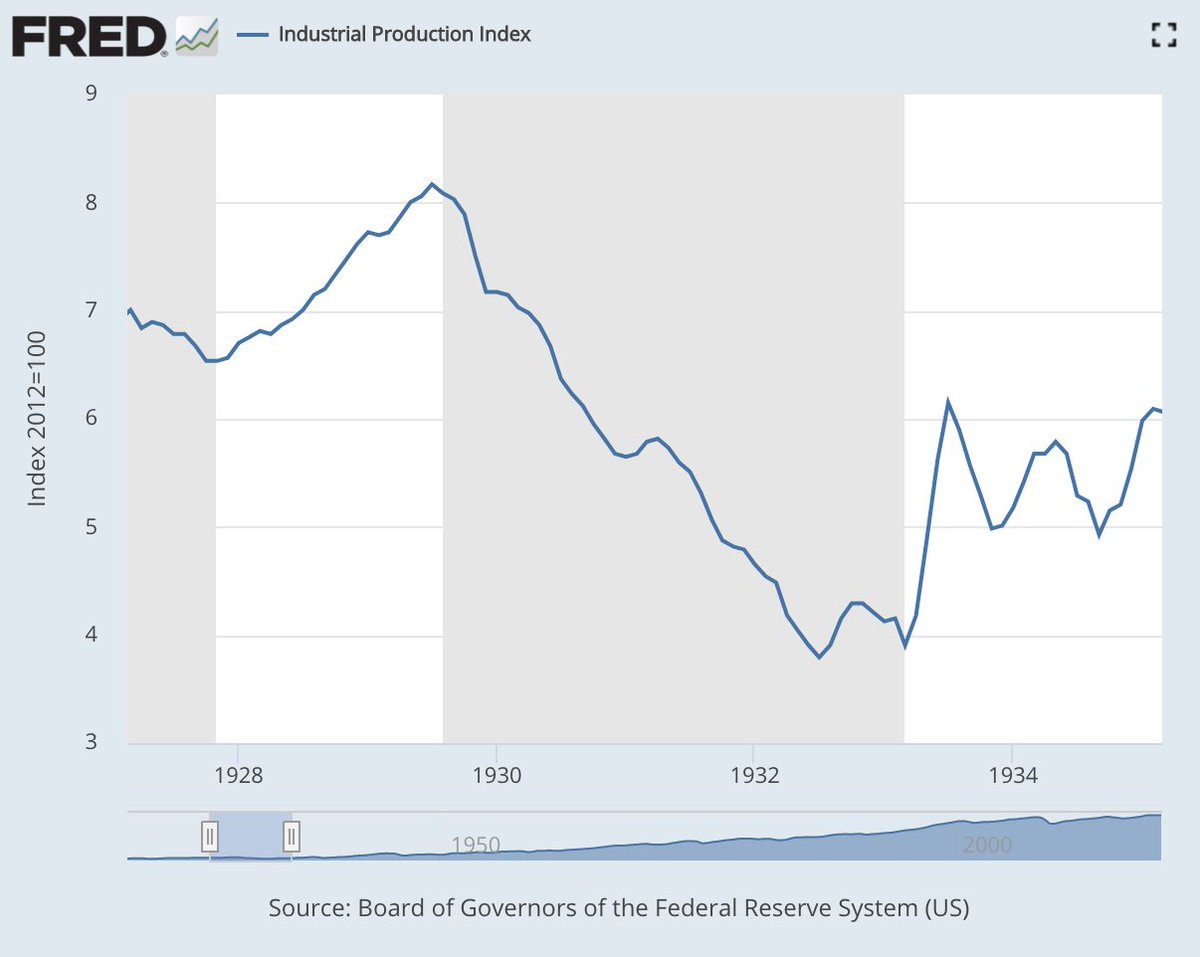

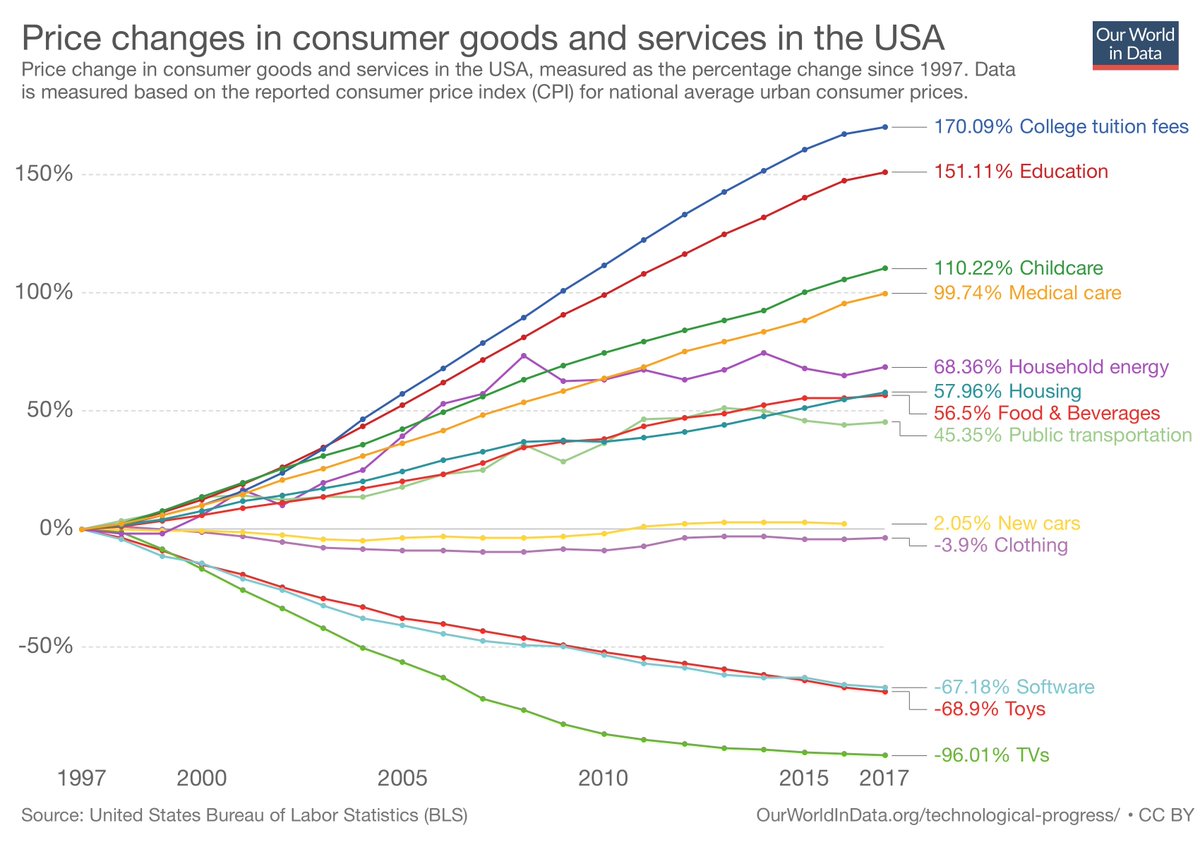

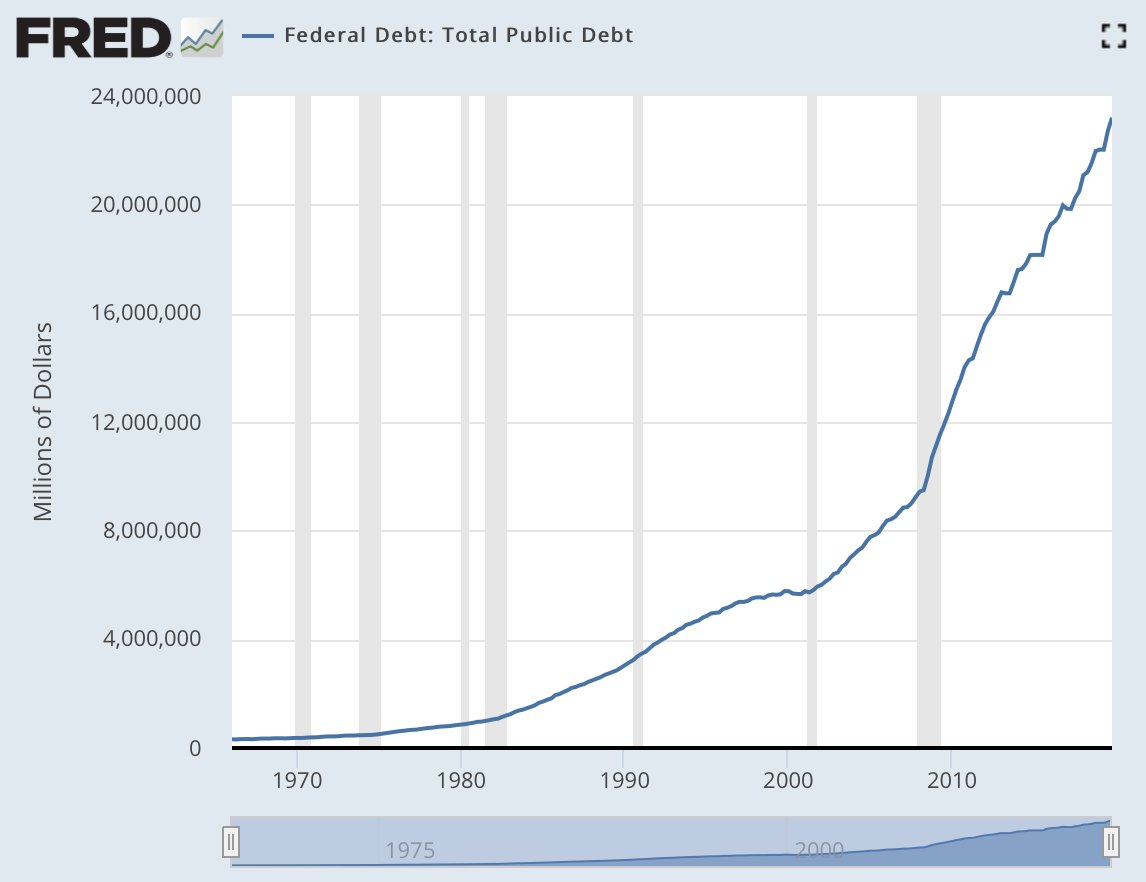

Over the last 11 years a debt fueled speculative economy with multiple asset bubbles has been primed for correction. Will this be remembered as the Great Crash of 2020? This cycle shares many characteristics with the 1920s and its 1929 crash. A mega thread ⤵️

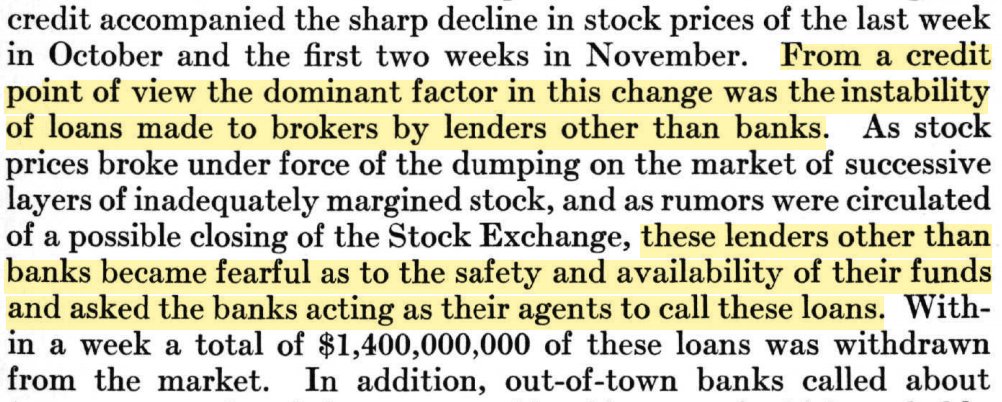

history.com/news/how-did-t…