How to get URL link on X (Twitter) App

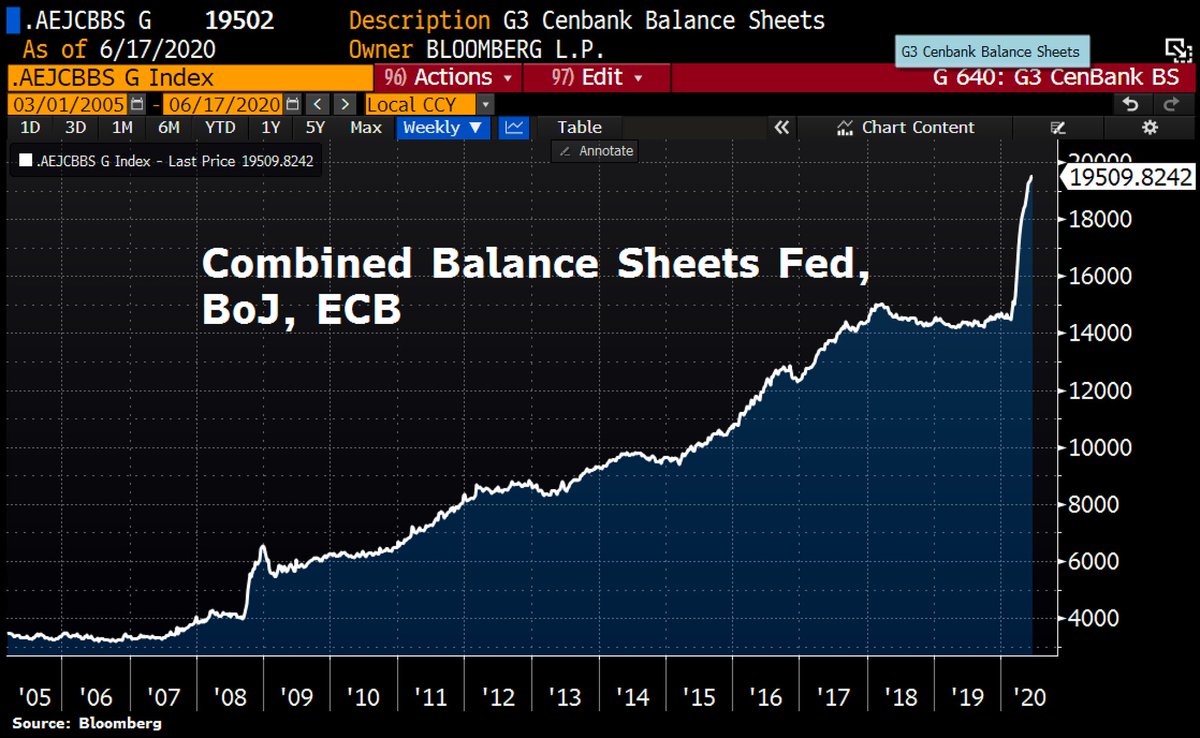

The deficit myth is a dose of not so “Modern” Monetary Theory yet the path has already been prescribed and socialist debt policies will decimate the economy.

The deficit myth is a dose of not so “Modern” Monetary Theory yet the path has already been prescribed and socialist debt policies will decimate the economy.https://twitter.com/obiwankenobit/status/1122887800523595778?s=21

https://twitter.com/CitizenBitcoin/status/12788193984558776331/Much of what we discussed can be found here in the original tweet thread.

https://twitter.com/ObiWanKenoBit/status/1270766046597672961?s=20

https://twitter.com/ObiWanKenoBit/status/1143522955357388801?s=20

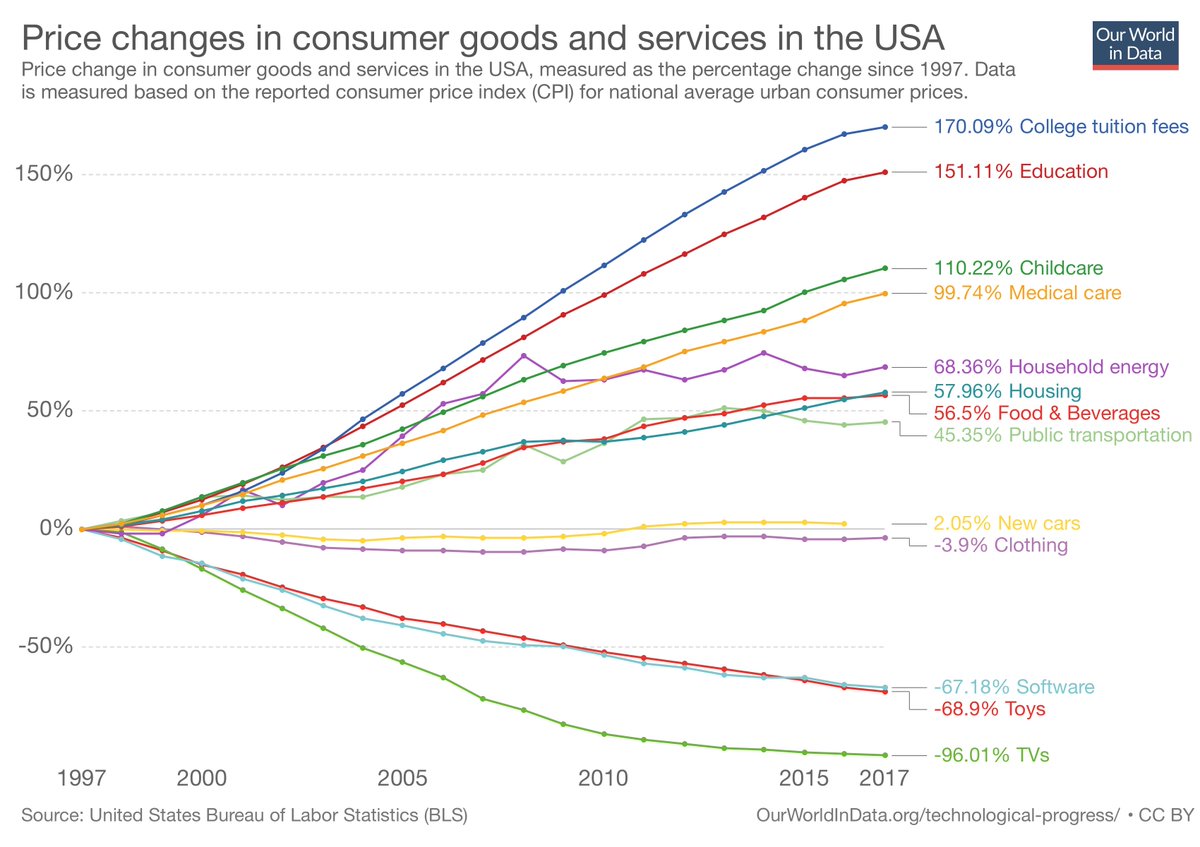

2/Savers don’t increase spending to consume. They invest and thereby kickstart an economic recovery much faster than a populace that has nothing saved at all!

2/Savers don’t increase spending to consume. They invest and thereby kickstart an economic recovery much faster than a populace that has nothing saved at all!

https://twitter.com/ObiWanKenoBit/status/11919726861651394572/Bitcoin elicits a strange concoction of voluntary painful decisions and actions. The simplest is HODLing through stomach churning drops, grinding bear markets and an endless stream of FUD.