Fiat Assured Destruction Event.

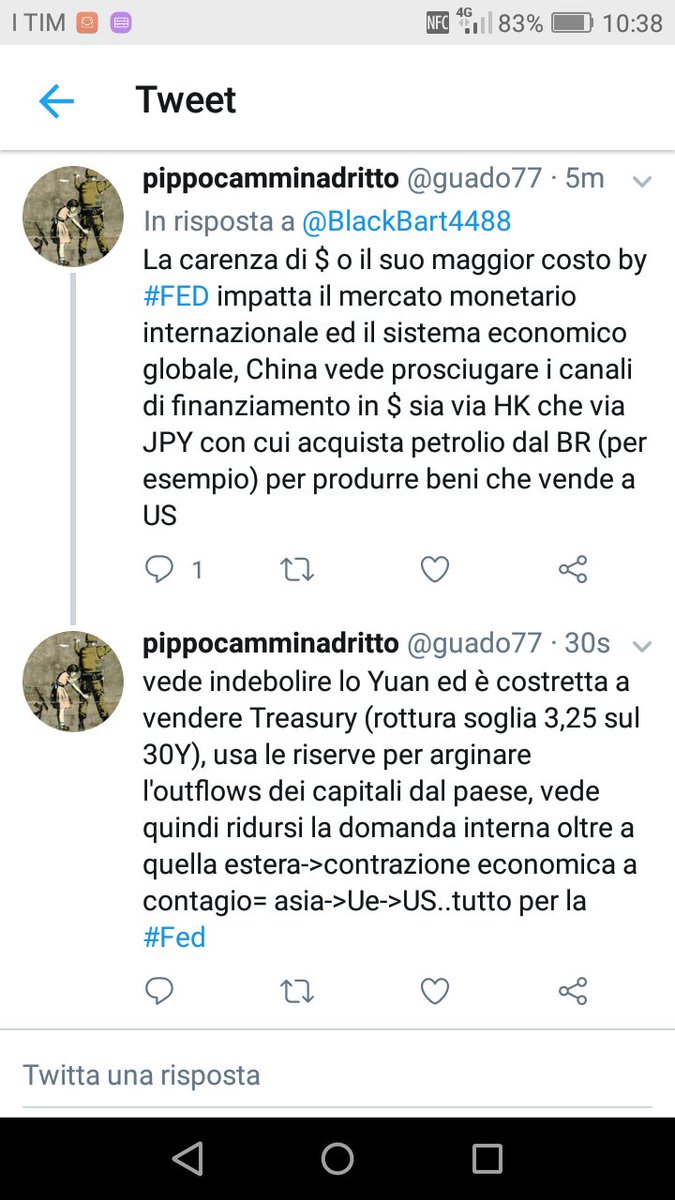

The Fed has launched an all out assault on the economy & will do “whatever it takes.” Oil, trade and currency wars have deepened the crisis. This (long) thread explores secondary effects of the Fed’s rescue mission.

Alter its charter, purchase stocks directly.

Institute negative interest rates.

Launch a USD digital coin.

Fund UBI/MMT efforts.

novoco.com/sites/default/…

#bitcoin