So far £1.1bn has been lent; 6,016 loans.

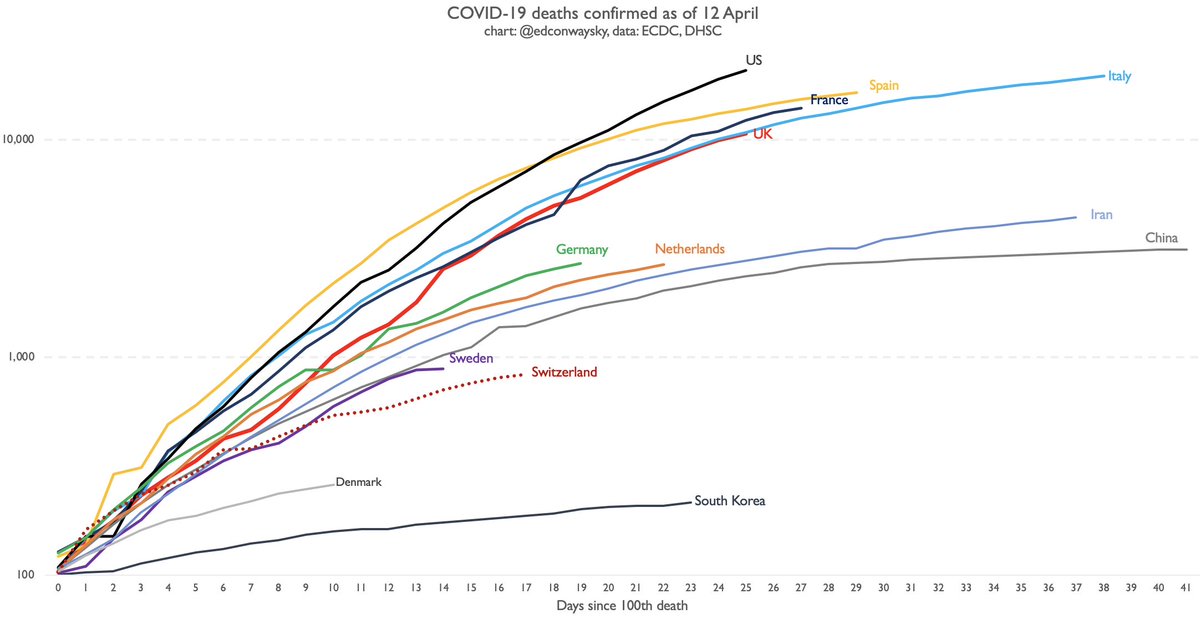

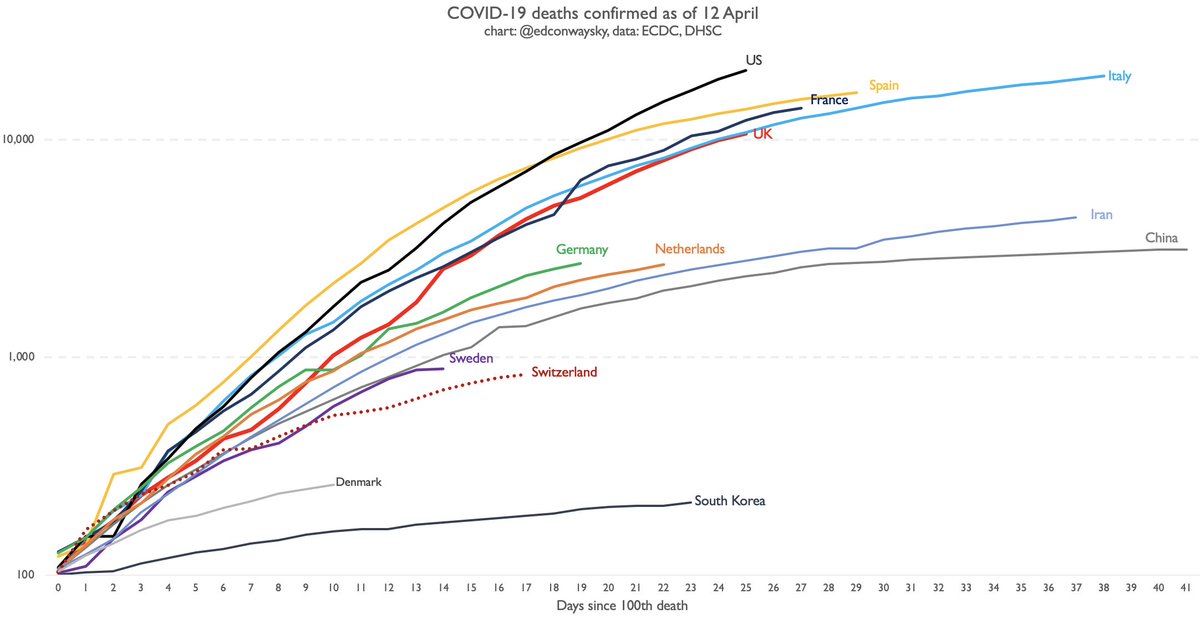

In Germany about seven times that has already been lent to small biz

In Switz there have been 100k loans

I was shocked - after all the EC had just loosened those rules. But he insisted that was the small print

Millions face unemployment.

Small businesses are going under.

Who in their right mind starts quibbling over the small print at a time like this (esp when the small print isn't really quite as prohibitive as you make out)??

Bankers reach for the small print so they don't have to take risk on loans.

Treasury reaches for the small print so they don't have to take fiscal risks.

Feels a lot like early stages of 2008 when people moaned abt "moral hazard"

This is one of the first tests of our policymaking & leadership as a newly independent nation.

Yet our officials still moan abt EU small print (even when it doesn't really apply).

We are following, not leading, when it comes to the economic rescue