dipp.gov.in/sites/default/…

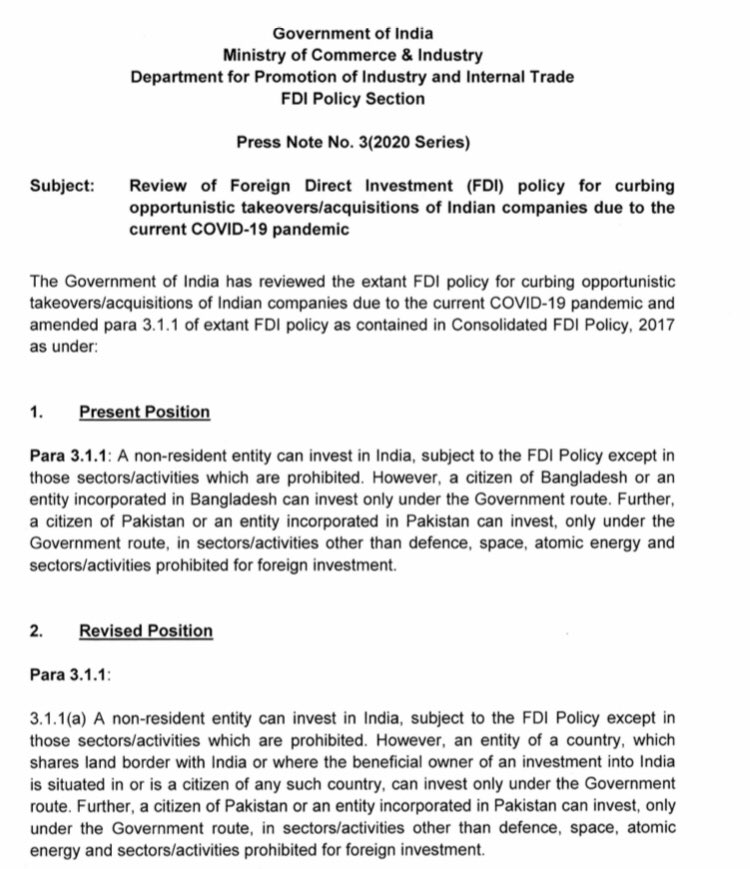

- "an entity of a country, which shares land border w/ India or where the beneficial owner of an investment into India is situated in or is a citizen of any such country"

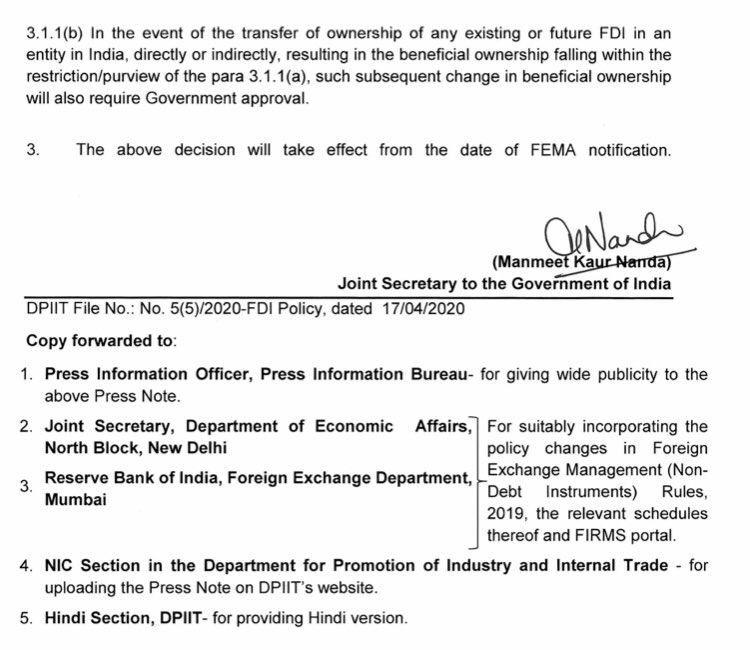

- applies if there's transfer of ownership too 2/

- timing, reports of such PRC-linked actions in COVID era

- specific to entities/indvs from states sharing "land border"

- limits for Pak already exist

- C is the Voldemort in India fopo--country that shall not be named. 3/

livemint.com/market/stock-m…

+ Chinese "State-owned entities...have approached consultants seeking plans for an orderly exit from India if the government imposes restrictions" 9/

economictimes.indiatimes.com/markets/stocks…

ft.com/content/e14f24…

- Chinese reax/retaliation (tho Indian cos. mkt access ltd there so 1-to-1 retal less likely)

- WTO implications

- broader unintended/unanticipated consequences

- its brought under revised investment screening sys 14/

- this is not a ban

- focus is natsec/econ sensitive sectors

- greenfield investments from PRC welcome

Also, will be worth watching if GoI makes adjustments post-feedback from PRC/Chinese cos./Indian stakeholders

- many loopholes a determined C investor can exploit

- C investment that shldnt be restricted but will be

- potential for retaliation

- concern re other countries

18/

- policy refers to "beneficial ownership" - both more interesting & cumbersome

- entities rather than citizenship of a country noted (HK implications)

- press note = policy decision. laws still to be amended 20/