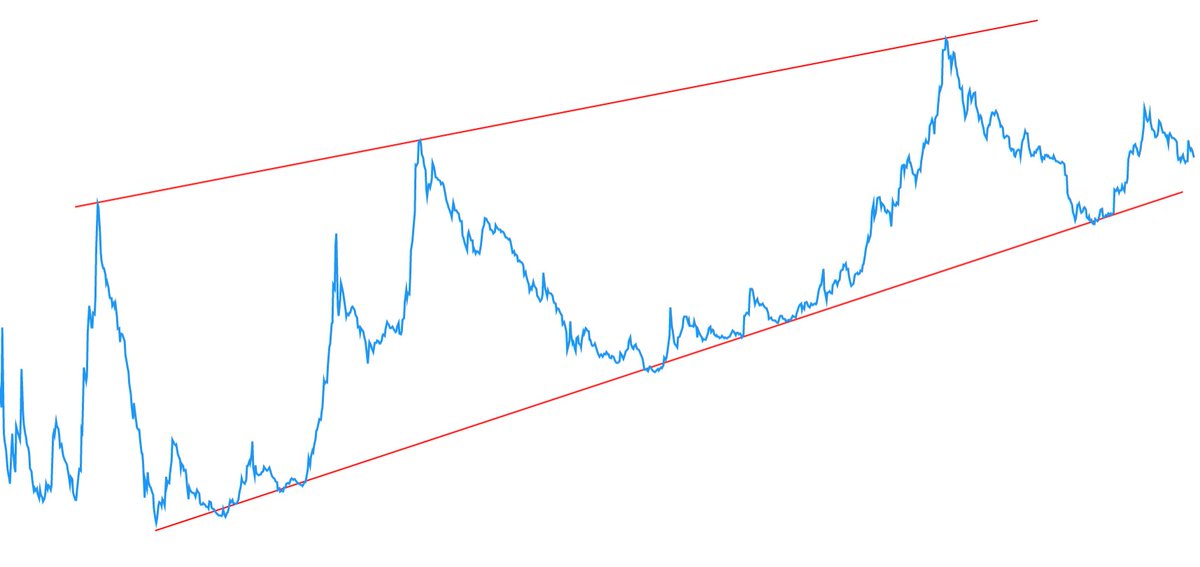

Last year Ray Dalio (most successful hedge fund manager alive) said we'd reached the end of a debt supercycle.

Supercycles last 50-100 years.

The last one ended in 1929.

amazon.com/Big-Debt-Crise…

What does Dalio think now?

forbes.com/sites/alexandr…

Did that just cross your mind?

Listen to how you sound.

But I’ve been wrong before. Maybe this is the new paradigm.

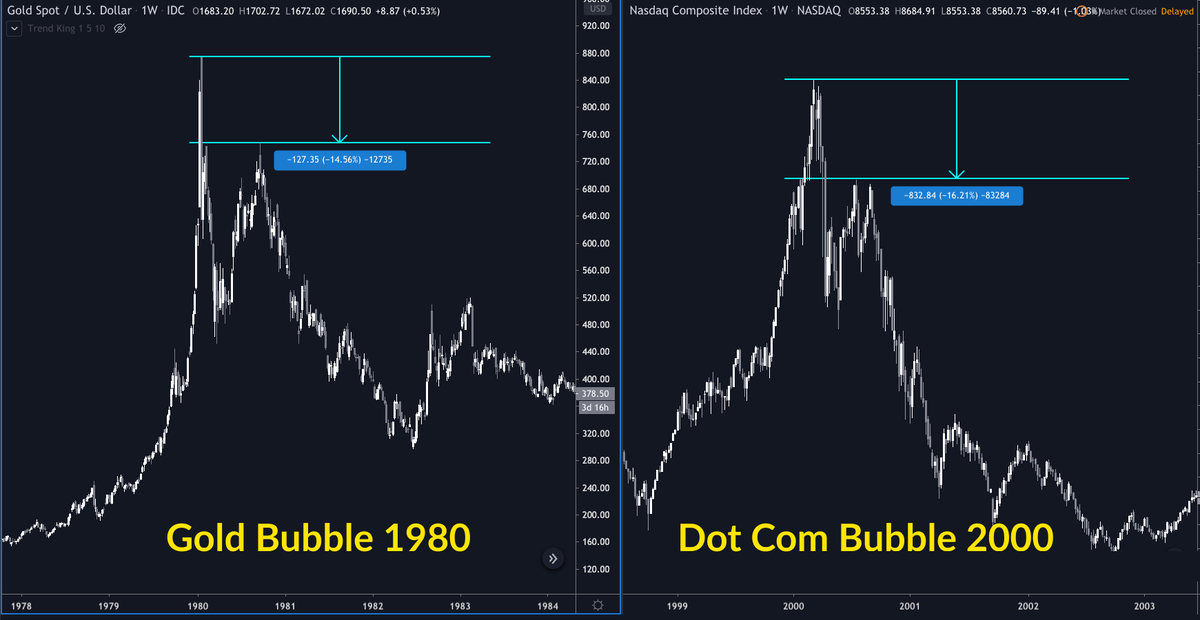

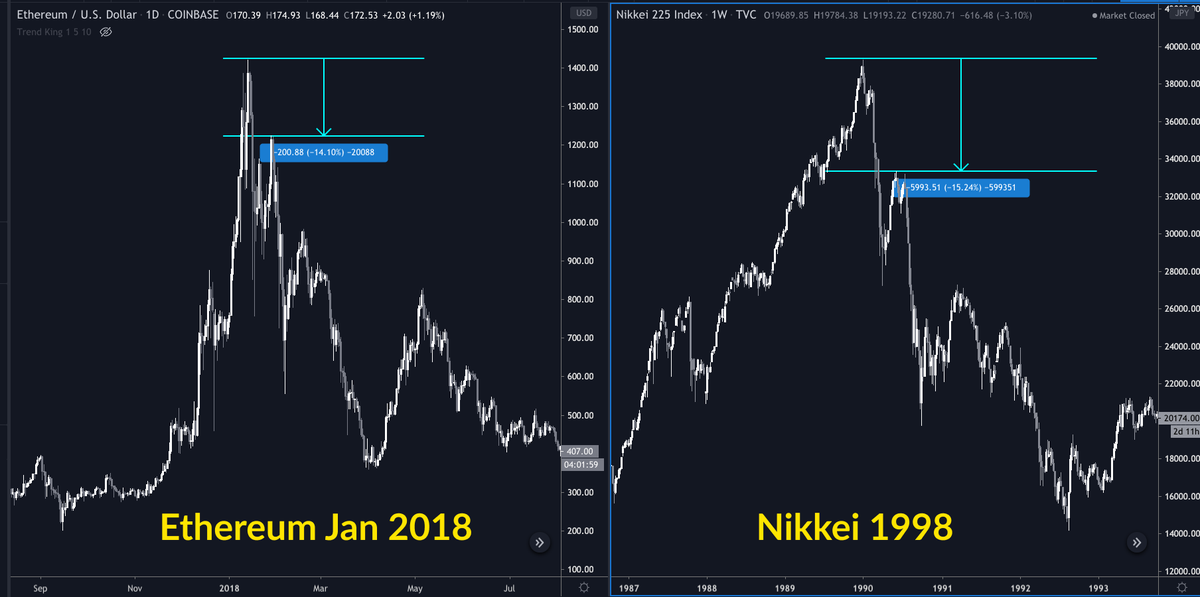

@SmartContracter breaks it all down.

It might not play out this way, this time -- QE might juice things.

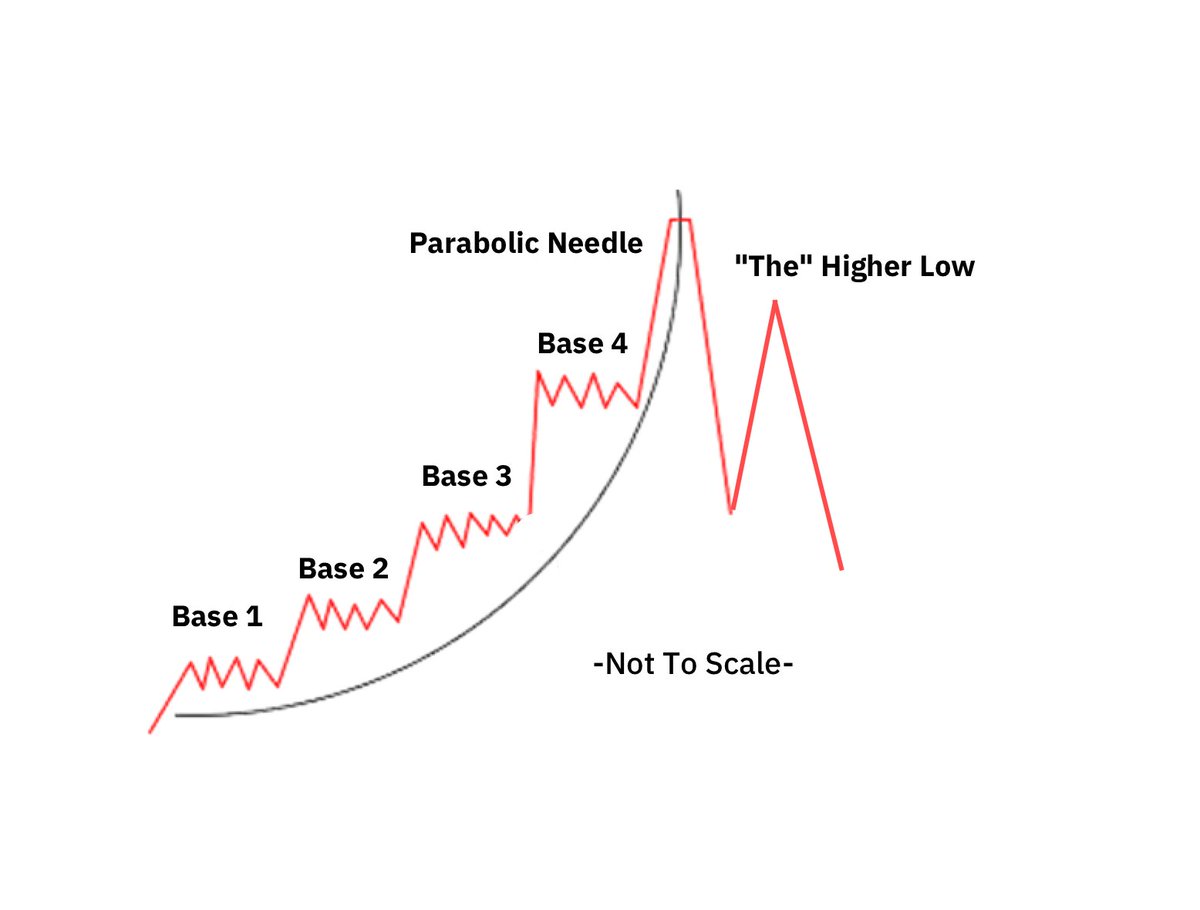

But when you’re exiting a parabola, it’s good to keep this sequence of events in mind.

Bitmex liquidation engine won’t make the same mistake twice.

But bitcoin could fill low orders.

I keep thinking about what my man @BTC_JackSparrow says, about liquidity game theory.

Most $BTC is already in strong hands.

Beyond a certain point...the more time passes, the tighter hands gonna grip.

That story always seems to end the same way.

h/t @BTC_JackSparrow

@glassnode reports there are now more $BTC whales than at any time since December 2017.

I cannot express how bullish that is.

Yield-seeking $ETH whales will lock up a lot of supply moving forward.

Though not a fixed-supply asset, $ETH may outperform $BTC in the next bull market.

Laws of physics seem to break each week.

📌 Don’t be all in

📌 Don’t be all out

📌 Amp down counterparty risk

📌 Market is always right

📌 Generational opportunities exist *if* you know where to look