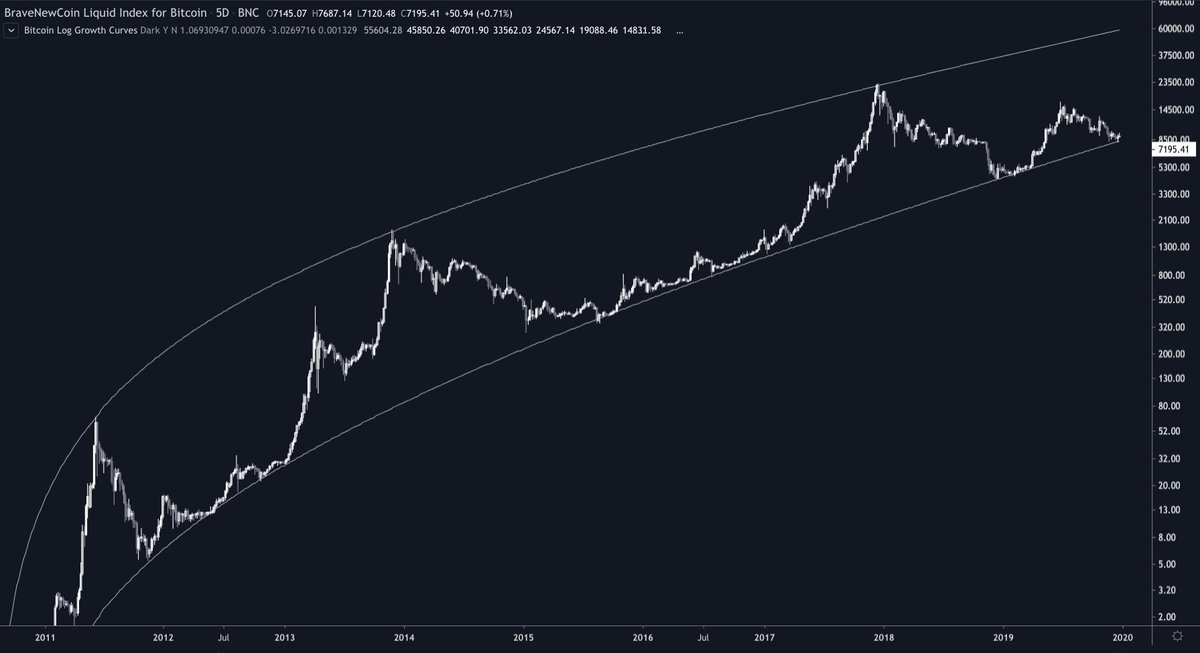

But what if you charted log price in log time? ('log-log')

Tradingview doesn’t offer that option — you need a specialized platform.

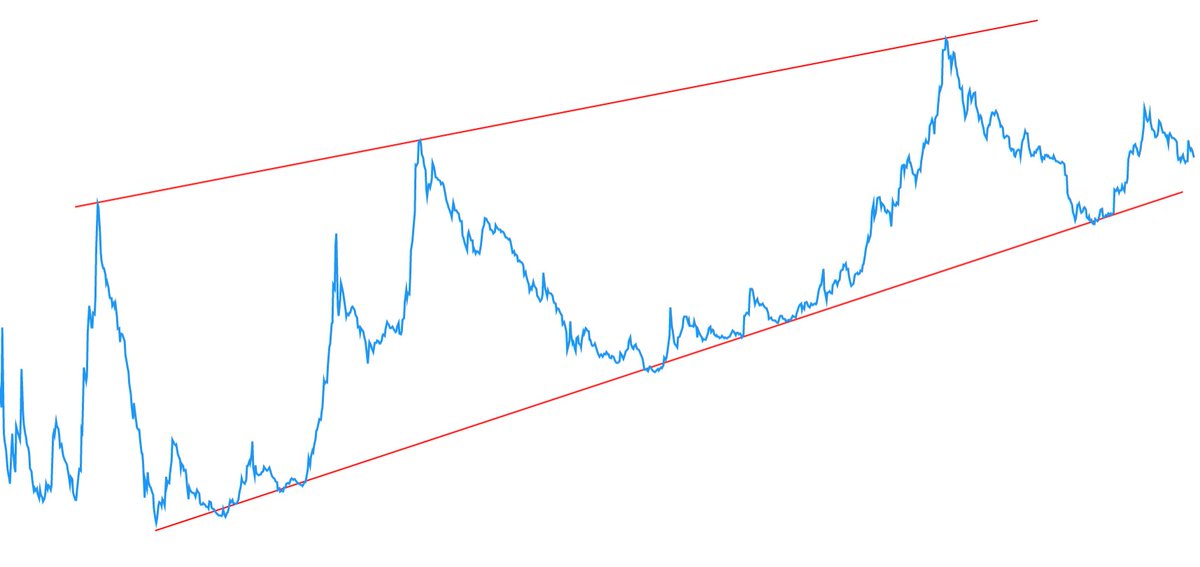

The trendlines directly overlap the top & bottom edges of BTC's adoption curve channel - they are one and the same.

*Don’t panic sell*

*Don’t try to sell & rebuy lower*

Price could linger underneath the channel for weeks, and it would still be a blip on the radar, big picture.

But the highest probability scenario is another bull market.

When will things start to take off?

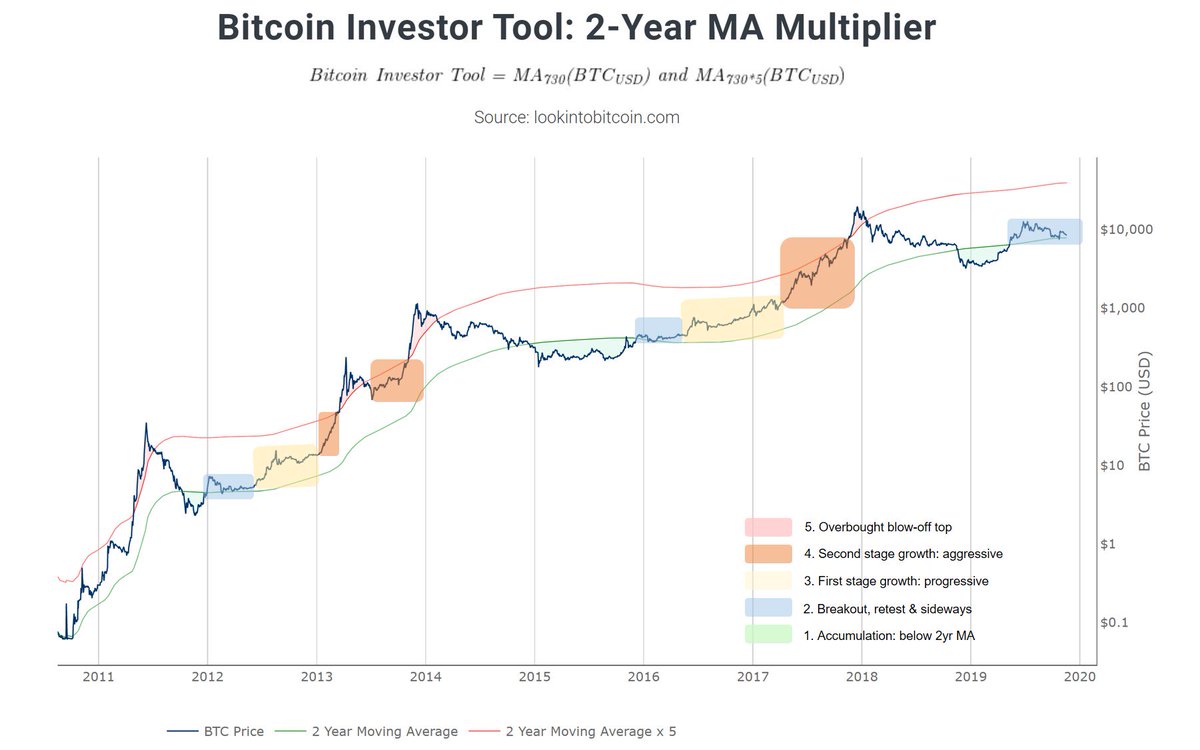

I expect we spend much of 2020 working our way through stage 3.

And I expect new ATHs by the end of 2020. 🚀

Don’t forget the log channel’s rising trajectory:

The longer $BTC takes to reach its next top, the higher we should expect it to be.

And wouldn’t you know it — key fib levels interact with historic price action in amazing ways.

Why? There's a whole other dimension to this indicator we haven’t explored.

Here’s one potentially very profitable way to use it:

There's one final way to use the log trendlines — and its *by far* the most important way.

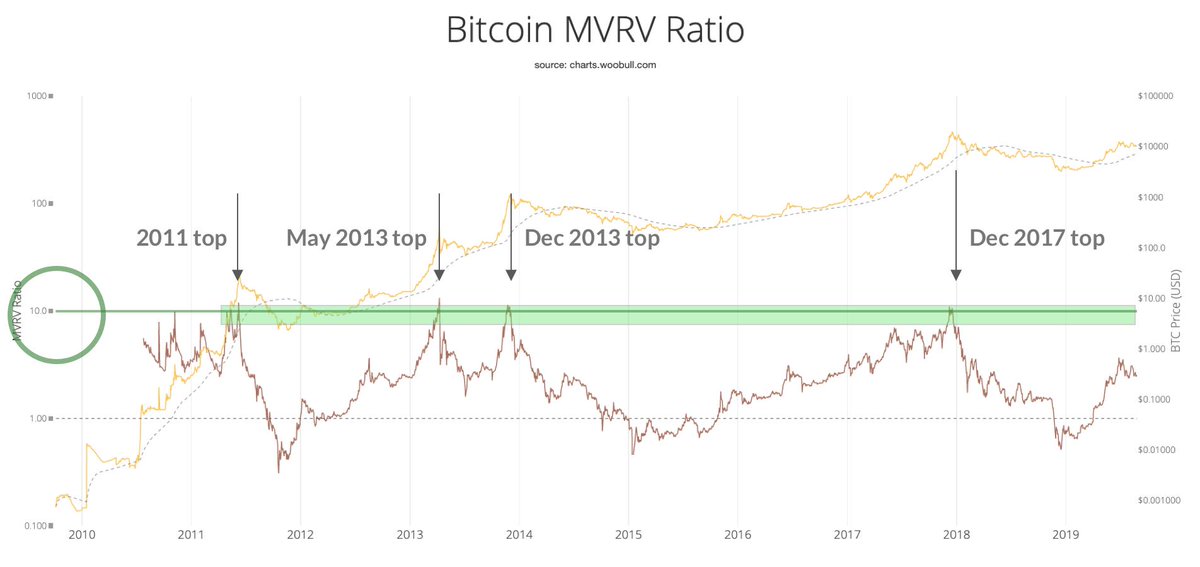

In log-log space, a flat trendline connects all tops.

To them - respect. You'll be rich.

And @quantadelic open-sourced it!

Badass! 👊

Give him a follow: @quantadelic

The oscillator: tradingview.com/v/aa2VwAcI/

The trendlines: tradingview.com/v/d0JTc61s/

And happy new year!

I failed to acknowledge the pioneering work of @hcburger1, upon which all of these ideas are built.

If you’re not already following @hcburger1, you should be.

And thanks to @intheloop for bringing this to my attention!