1/ @filbfilb called BTC’s bear market bottom 12 months in advance — before the bull market even finished!

His words on Dec 4, 2017: “I would lean towards 3k”.

His take on what comes next (and why) is fascinating.

tradingview.com/chart/BLX/1o5t…

He focused on one metric: estimated cost of mining production.

He layed it all out in March, 2018: est. cost of production's price range bottoms out at $3170.

9 months later, $BTC bottomed out at $3148.

tradingview.com/chart/BTCUSD/3…

Miners are natural sellers — they drive supply more than anyone else.

But their incentive to sell vanishes below the cost of production.

Institutions and smart money knew it, and were ready. Retail was mostly unaware.

Take it from Satoshi, in 2010: “the price of any commodity tends to gravitate toward the product cost."

But Bitmain & friends aren't fools, they know the block reward will halve in May.

That's priced into their bottom line by now.

Smart money knows it, again. Retail has no clue, again.

(Lots of longs in the right place, for the wrong reasons).

tradingview.com/chart/BTCUSD/O…

Big miners have incentive to drive $BTC price back to its production cost.

They’d love to dish out max pain one more time before the bull market steamrolls forward out of control.

Every bull market is preceded by a terminal shakeout.

It’s a spring — one last higher timeframe stop run before the parabolic advance gets started.

We never got one this time.

I think we’re in the process of getting it now, and I think it’s healthy for the bull longterm.

But I also think we need to revisit liquidity in last year’s Eternal Range before we can make a run at ATHs.

Their incentives align with Big Mining. For now.

IMO it could be a nice opportunity to hedge short. Or sell spot & rebuy lower.

(Be careful -- never go all out, or all in.)

A daily close above $10k invalidates this IMO.

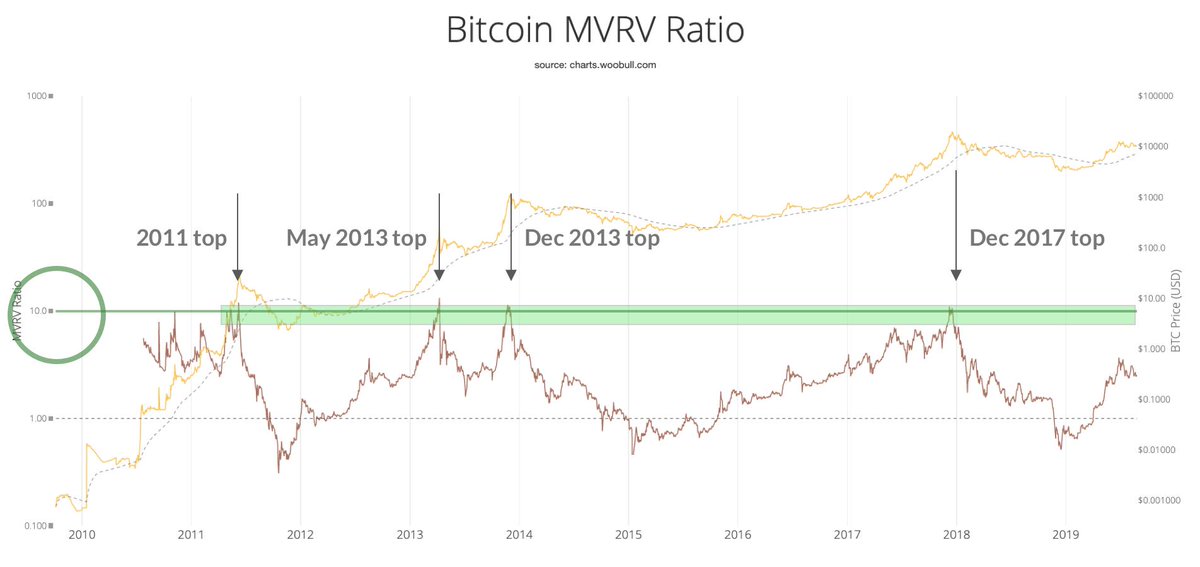

If all of it happens, it’s just another guidepost along our path through BTC’s market cycle.

Either way I’m super bullish.

And your patience will *so* be rewarded. 👊

@filbfilb's free newsletter: decentrader.com