- Financial duress related to Covid-19?

- Protecting jobs if you take PPP?

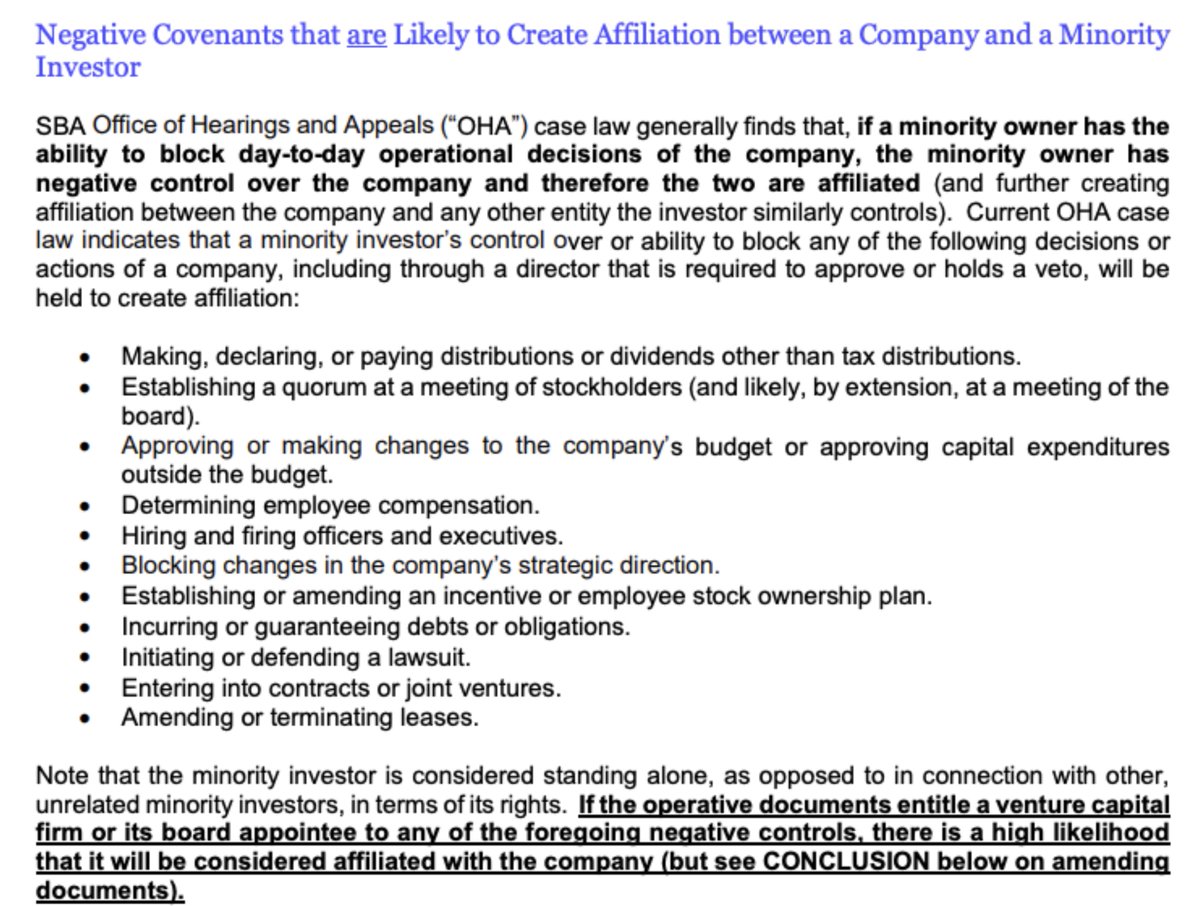

- Don't violate the Affiliate Rule?

- Can you obtain board approval?

- Do you have access to other sources of capital (other than the PPP) that are not significantly detrimental to your business?

cooley.com/news/insight/2…