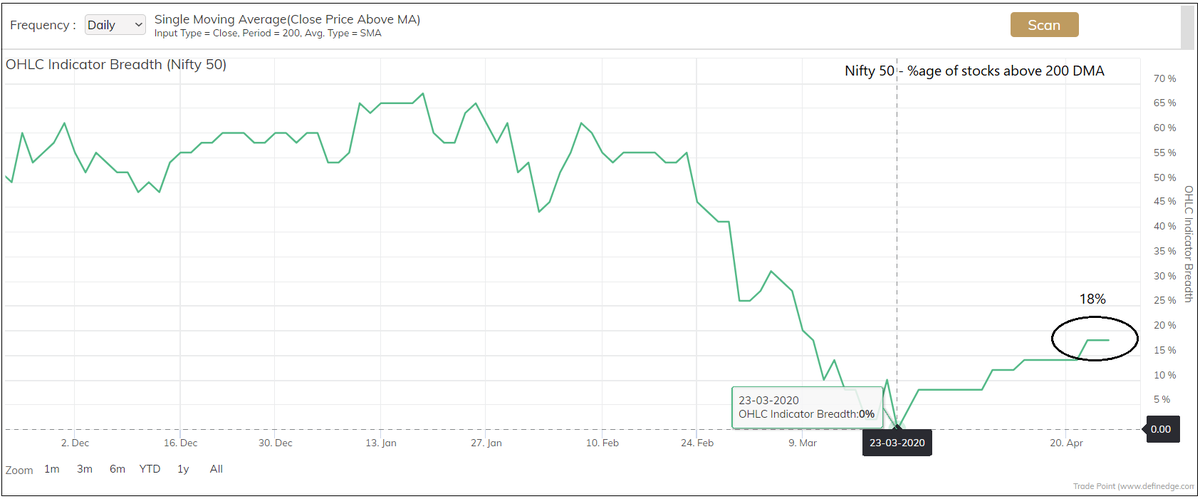

But Nifty 50 index consists of 50 stocks. Is this happening because of few heavyweight stocks?

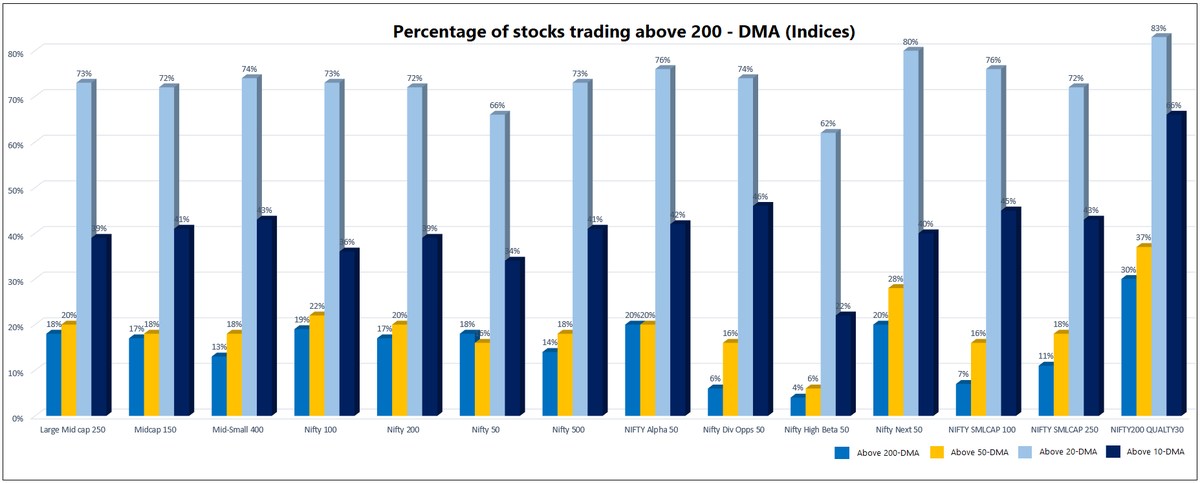

If 25 stocks from the Nifty 50 are trading above 200-DMA, then the reading would be 50%.

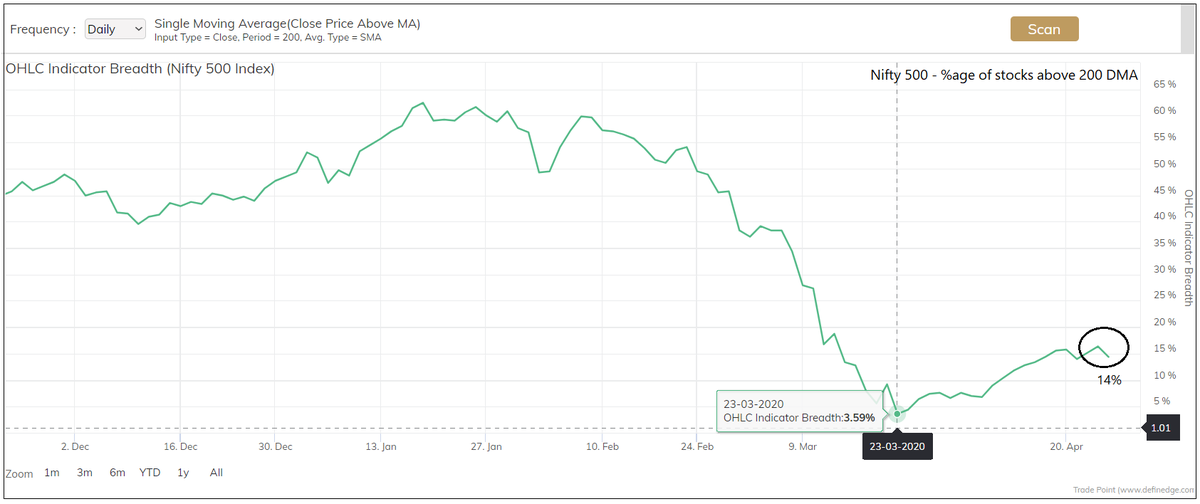

Let's look at a bigger universe - Nifty 500

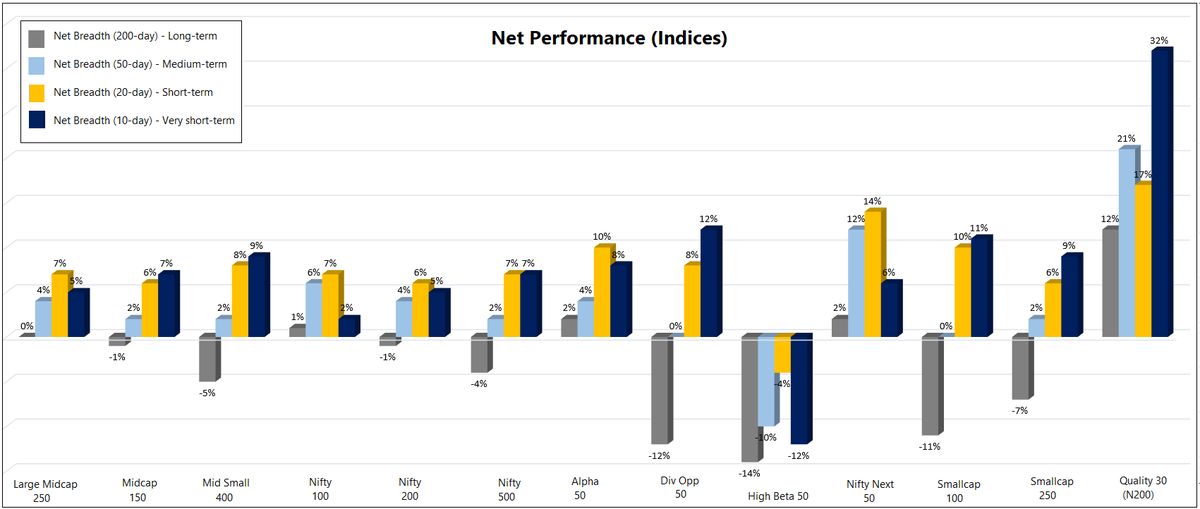

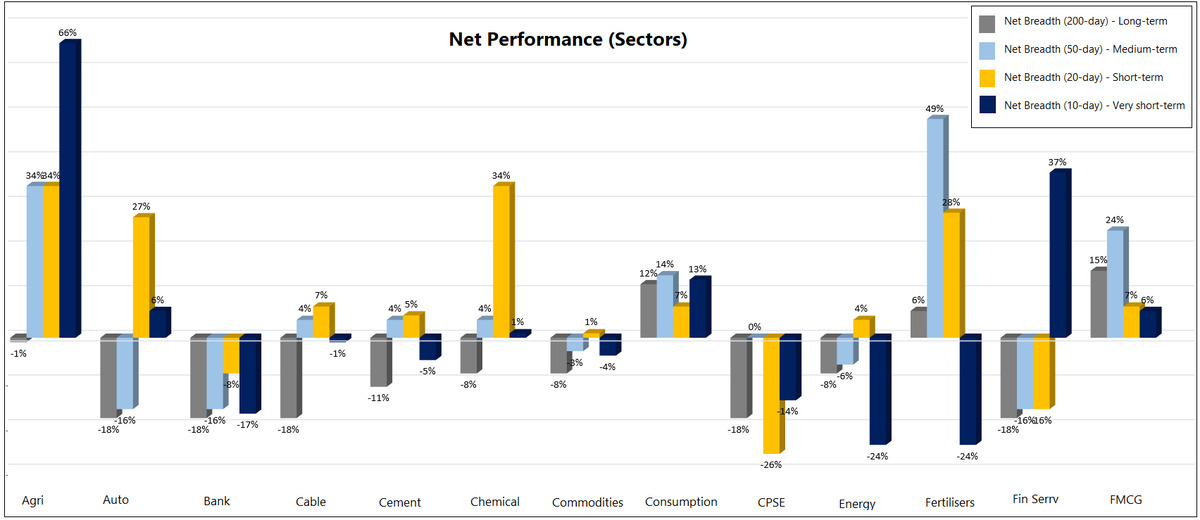

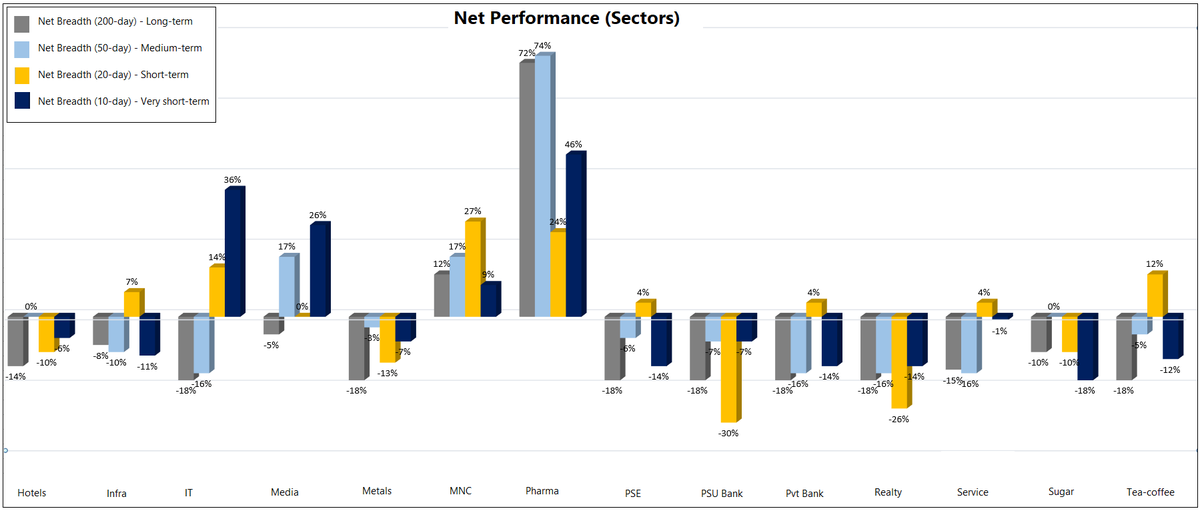

1 – Long-term trend is down across the stocks

2 – It could be around oversold levels

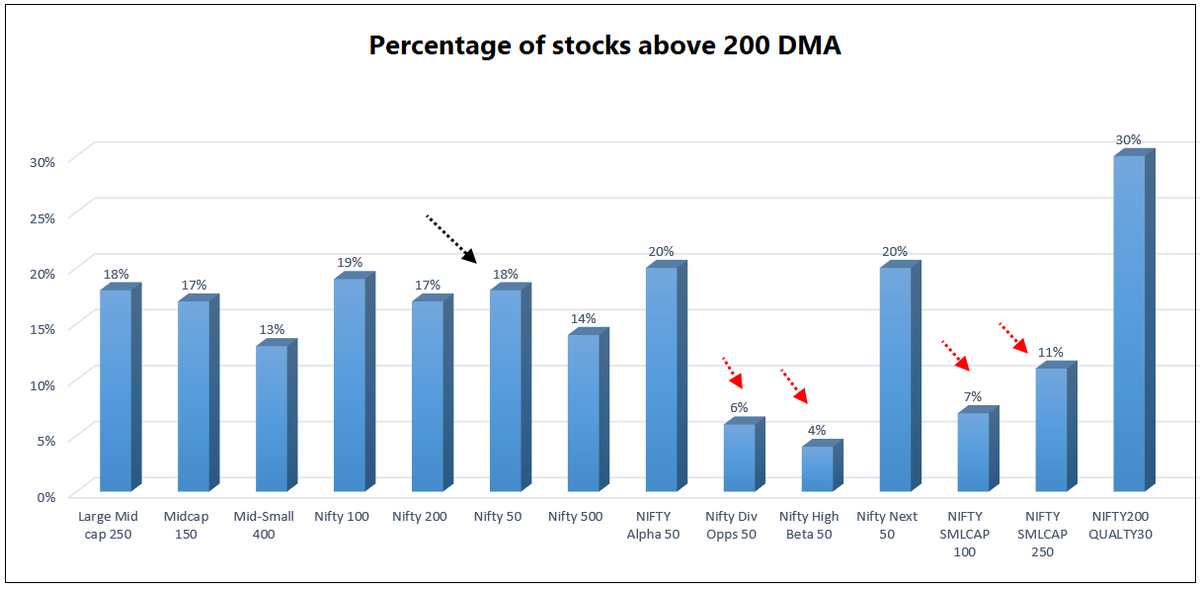

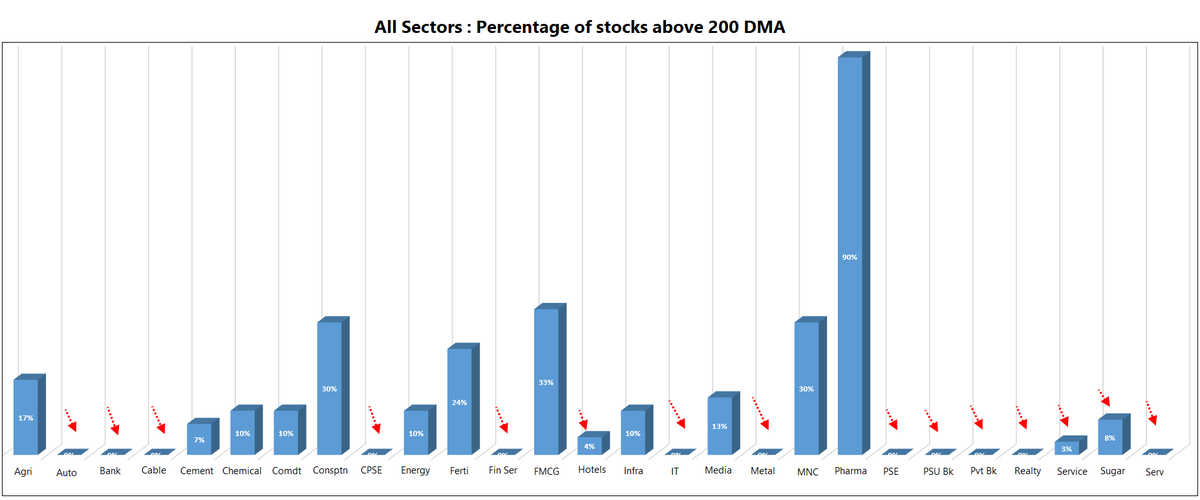

Let us dissect this this data further to gather more intelligence by looking at the picture across various indices and stocks.

For example, if 30% stocks are bullish in a sector & 20% are bullish in Nifty, the net breadth is 10%.

If reading is positive, it suggests outperformance and vice-versa.

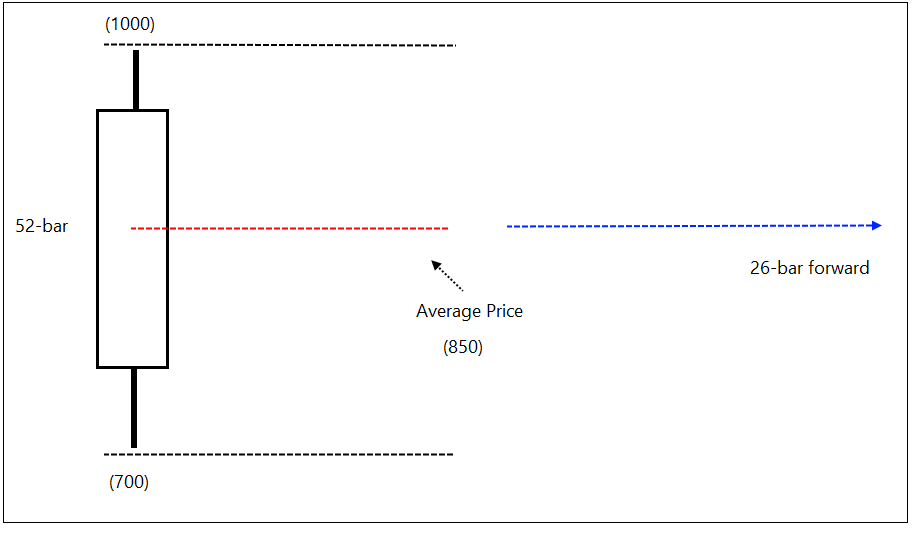

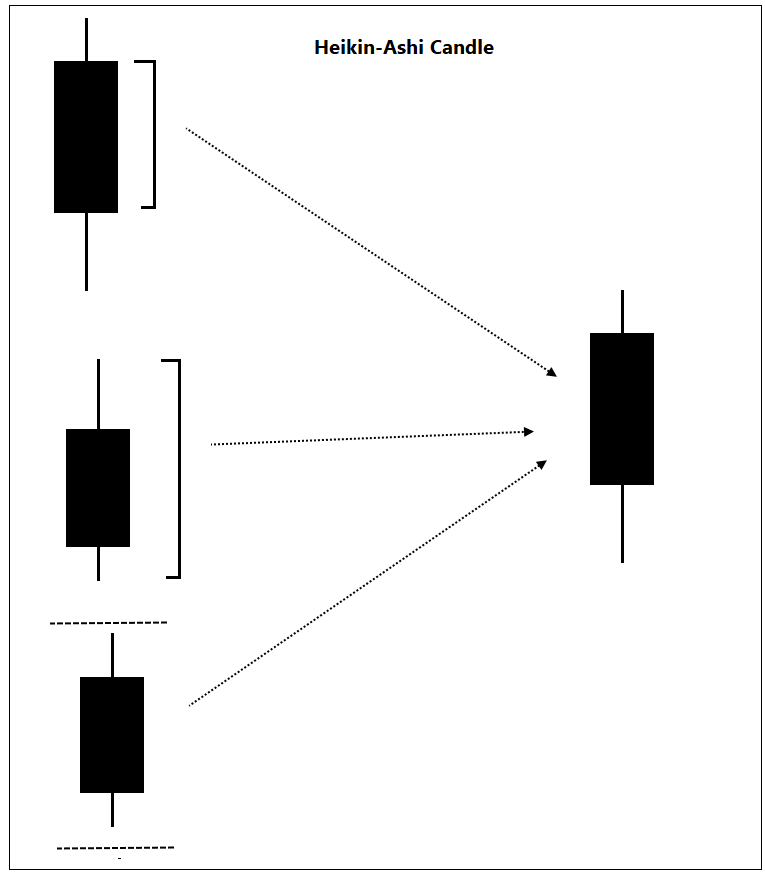

Similar study can be done using any other indicator. Moving average is popular indicator. Hence, I took that as an example to explain the concept.

End of Thread.