hsbc.com/-/files/hsbc/i…

citigroup.com/citi/sustainab…

(two US ✅ on the same day, @realdonaldtrump will be annoyed!)

morganstanley.com/about-us-gover…

investec.com/content/dam/so…

straitstimes.com/asia/east-asia… by Walter Sim

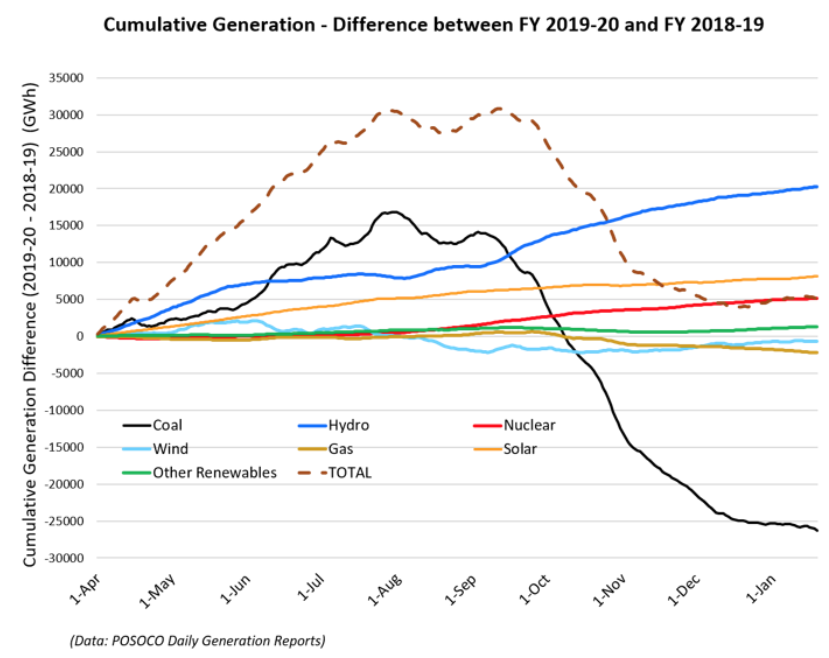

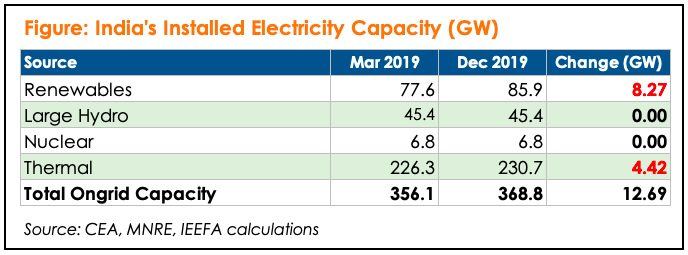

ieefa.org/finance-exitin…

#26 for 2020 year to date!

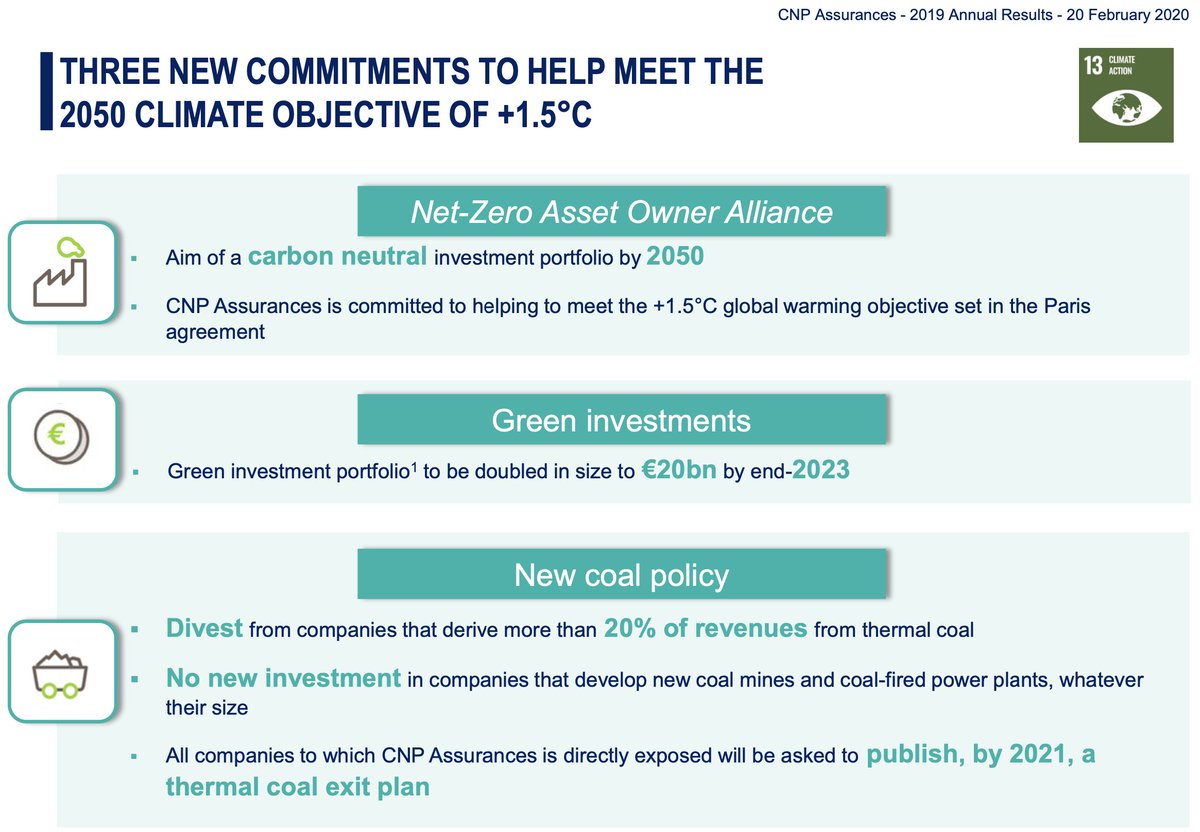

cnp.fr/en/the-cnp-ass…

Overnight Deka Investment announced their new #coal divestment program, using a >30% of sales for coal mining & >40% for coal power generators; “Coal is no energy source of the future.”

Link in German. nam12.safelinks.protection.outlook.com/?url=https%3A%…

Union Investment's first coal policy divests for >5% of sales for coal mining, reducing to zero by 2025. Union are evaluating a >25% of sales for coal power generators threshold, with an exit entirely by 2035, if they have a transition plan. 🇩🇪✅ nam12.safelinks.protection.outlook.com/?url=https%3A%…

US$13.50/MWh a 15% decline on the previous record low? 🇦🇪✅

pv-magazine.com/2020/04/28/abu… by Emiliano Bellini @pvmagazine