Data Driven Analysis: Mining #Bitcoin vs Buy & Hold BTC – Which is the Optimal Strategy to Capture the Long-Term Opportunity?

On Paper vs Real Results differ radically. We analyze 2 Mining Strategies vs Holding BTC:

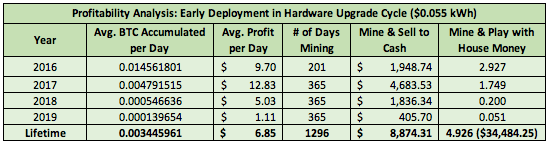

1. Buy & Hold Strategy: a miner buys Bitcoin and holds for the long-term

2. Mine & Sell to Cash: a miner buys a mining rig and sells all rewards daily to cash for the life cycle of the machine

3. Mine and Play with House Money: a miner buys a mining rig and

sells their operating expense to cash but holds the remainder in Bitcoin.

During Bitcoin’s 10 years of existence, lets analyze the opportunities to exit:

•Bitcoin was at $20,000 for only a few minutes

•Bitcoin closed above $17,000 only 7 days

•Bitcoin closed above $12,000 a total of 43 days over the past 10 years

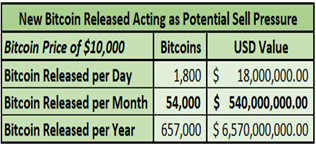

Mining BTC still generates cash flow/BTC even if BTC declines in price. Mining is actually the most optimal strategy in a sideways market as holding BTC yields $0 but with mining, you still earn daily rewards

Dollar Cost Averaging entails deploying a fixed dollar amount into an asset in consistent time intervals. The capital injections continue regardless of market conditions, which allows the following advantages:

1.Allows for the rare capitalization of Bear Market low prices

2.Avoid mistiming the market

3.Removes the emotion from capital deployment

4.Helps you focus long term

I will be going deeper into this analysis as well as providing updates on our outlook for Halving 2020 during .@BlockwareTeam Market Insights Webinar. Register through Eventbrite below & come with questions:

eventbrite.com/e/bitcoin-mark…

.@DenisRusinovich @bitentrepreneur @ArctosCap @JoshMetnick @RyanTheGentry @NicTrades @cburniske @scottmelker @krugermacro @nlw @AriDavidPaul @kyletorpey @ToneVays @stephanlivera @Xentagz @PrestonPysh