I'm going to thread it for you. It's 15 Tweets long after this!

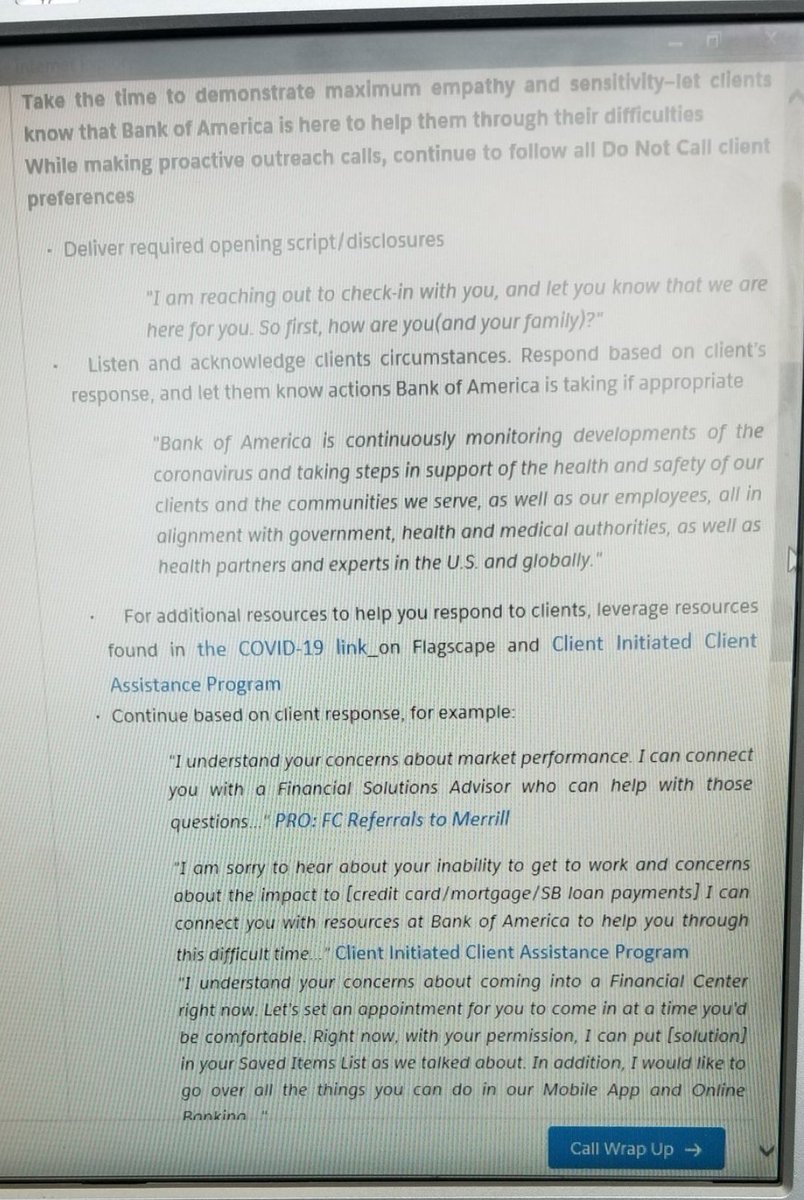

Thanks for reaching out and sorry to hear how much this coronavirus has impacted your business and life. As you may have seen, Bank of America has done a lot of things that have benefited our customers, employees, and communities during this pandemic.

We continue to address the needs of our clients, including

Consumer and Small Business deposit accounts: clients can request refunds including overdraft fees, non-sufficient

Consumer and Small Business credit cards: clients can request to defer payments, refunds on late fees.

Small business loans: clients can request to defer payments,

Auto loans: clients can request to defer payments, with payments added to the end of the loan.

Mortgages and home equity: clients can request to defer payments, with payments added to the end of the loan term for Bank of America-owned loans;

In all of these instances, there will be no negative credit bureau reporting for up-to-date clients.

We have also paused foreclosure

To request mortgage and credit card payment deferrals online, please visit our Client Assistance Page.

In addition, we’ve increased our grants to non-profits across the country by $100 million, specifically to address COVID

At the same time, we have kept our branches open to serve our clients while doing everything we can to keep

Our advanced on-line and mobile banking platform, which we’ve invested hundreds of millions of dollars in over the past 10 years, has allowed our customers to

In summary, I’m very proud of the lengths to which Bank of America has gone to offset some of the damage of this virus. I’m sorry that you have been so

Respectfully,

Ken

I never in my life have seen this. This is someone trying to act smarter than you and listing all the "noble" things Bank of America helped with BUT can't waive a $14 fee for you is insane.

Doing a podcast about this. Thanks again, @sradner

This is why I fight!

My God.