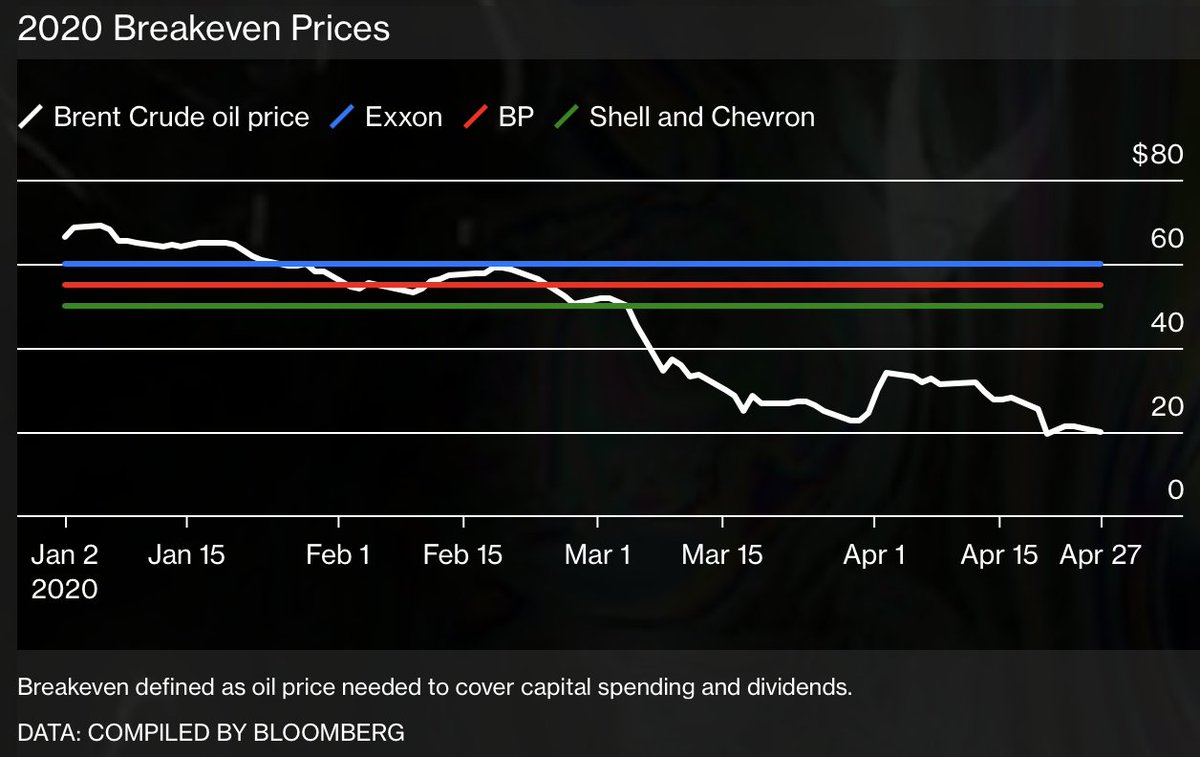

Negative oil prices. LNG <US$2/mmBtu.

Pivot or Die.

The boards have doubled down on expensive M&A when prices were double today, &/or catching the falling knife buying back their stock at double current prices. Caught asleep at the wheel.

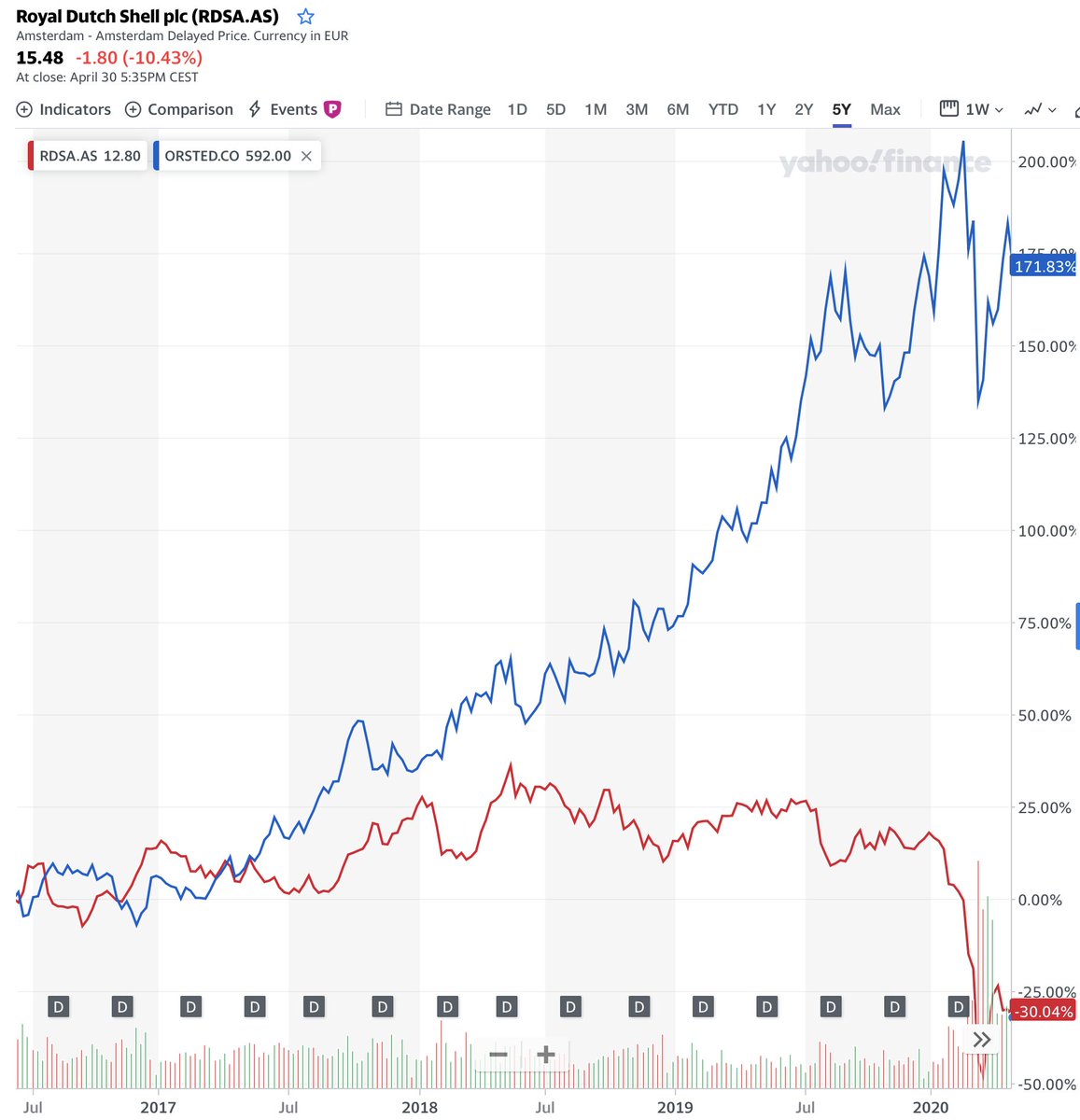

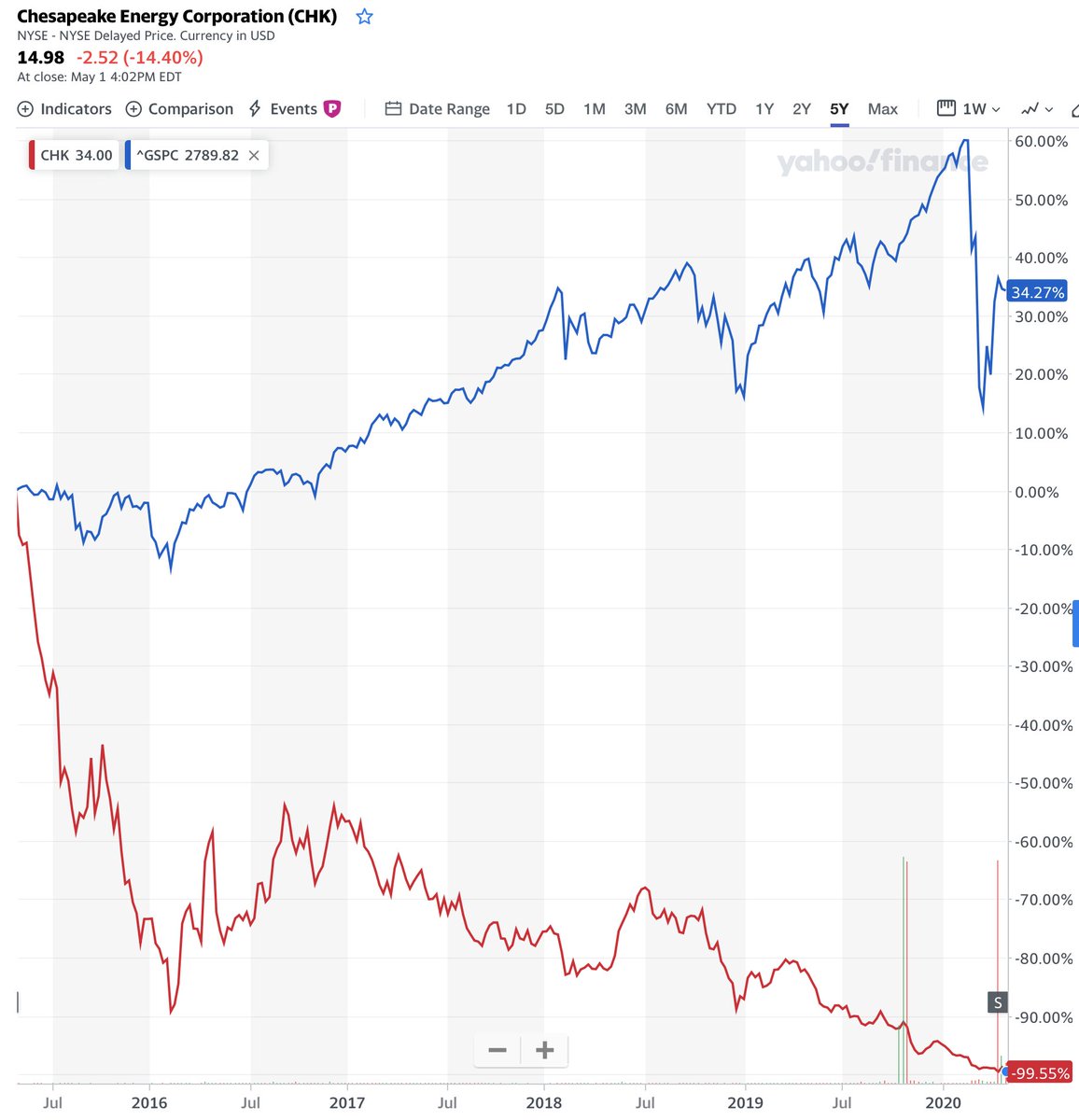

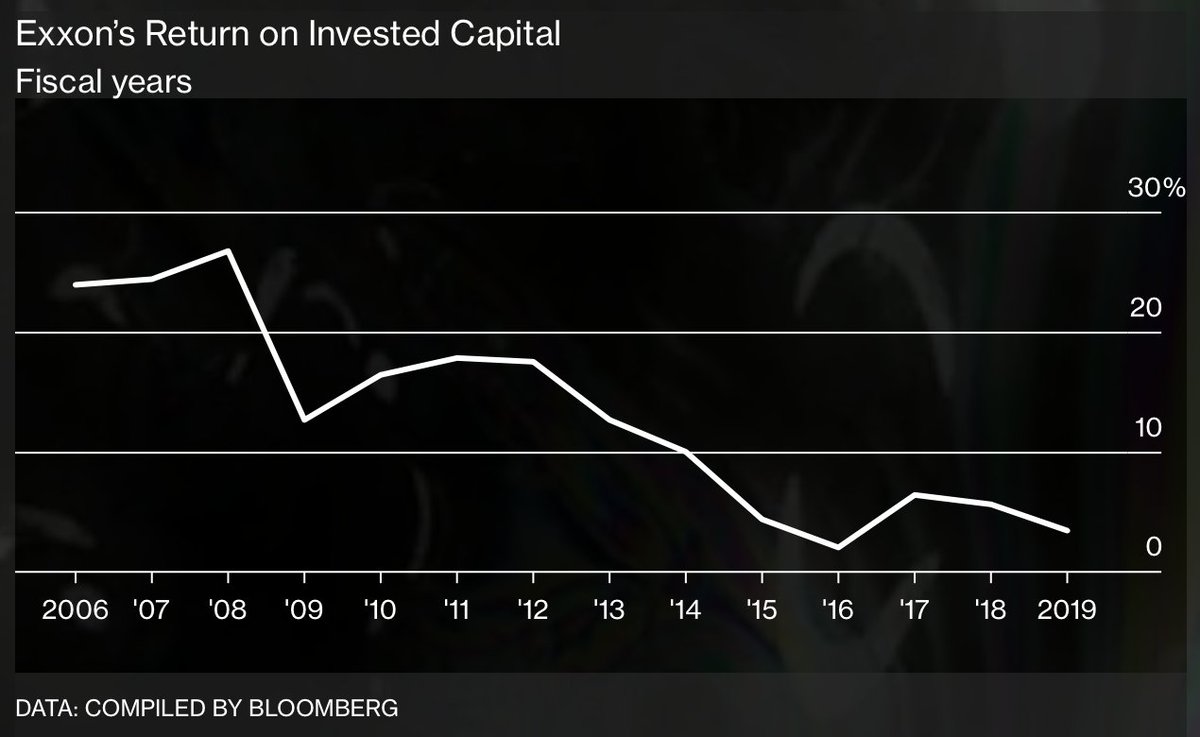

In a decade & the S&P500 rose 200% Exxon returned -10.8% to investors. The market evaluation of former CEO Rex Tillerson is clear, he failed. 2020 saw Exxon destroy 38% of shareholder wealth, Darren Woods is doing no better.

bloomberg.com/features/2020-…

By @AttractaMooney & @AnjliRaval @FT

theguardian.com/environment/20… by @adamlmorton

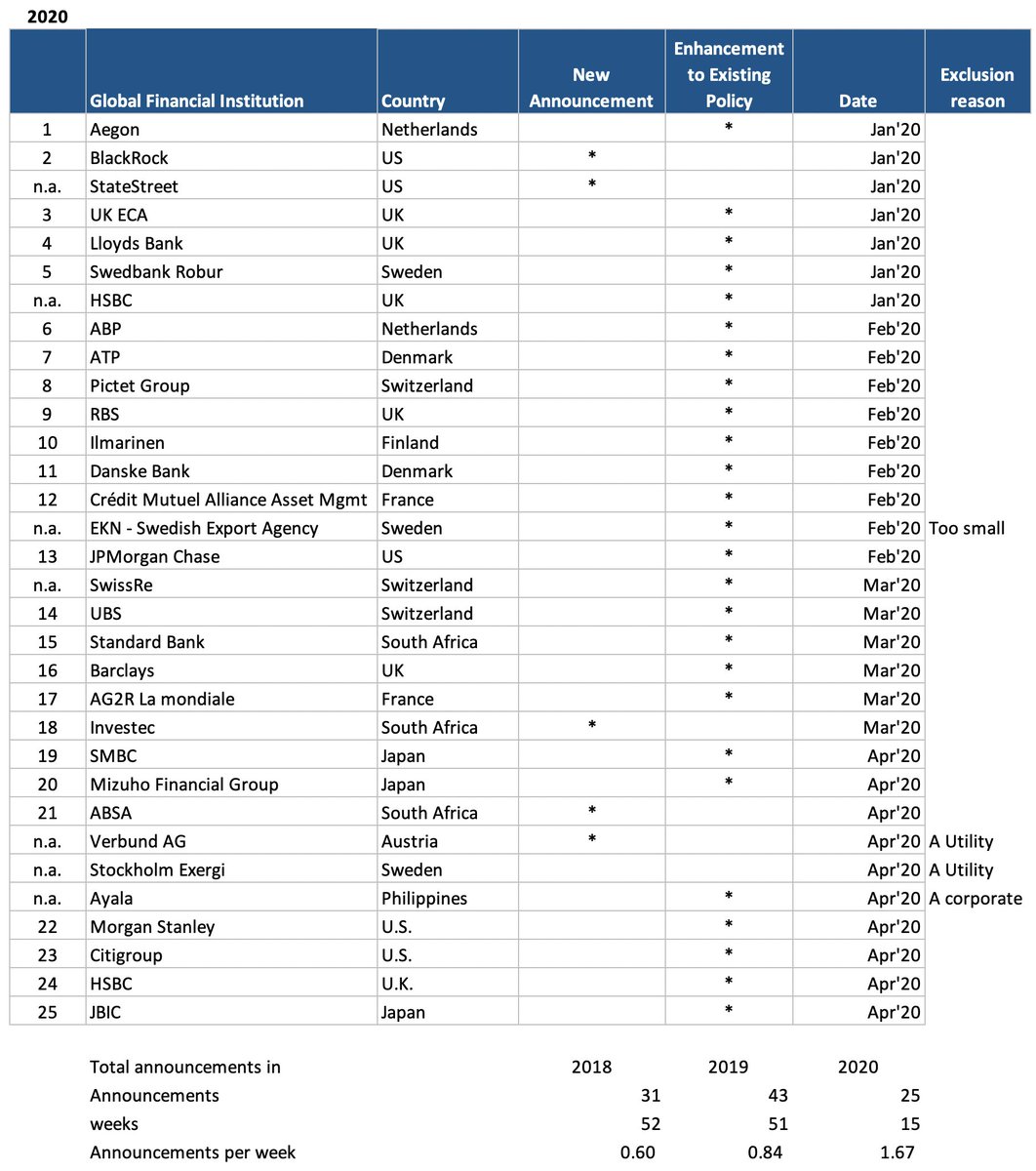

Woodmac has nicely pivoted their business into renewables, I wonder if their clients will follow? woodmac.com/news/editorial…