bundesverfassungsgericht.de/SharedDocs/Ter…

eur-lex.europa.eu/LexUriServ/Lex…

eur-lex.europa.eu/LexUriServ/Lex…

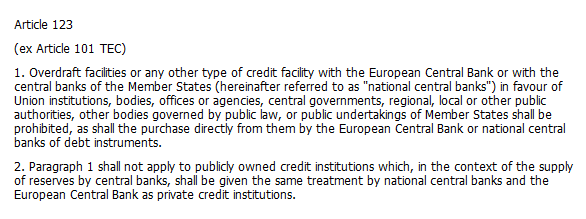

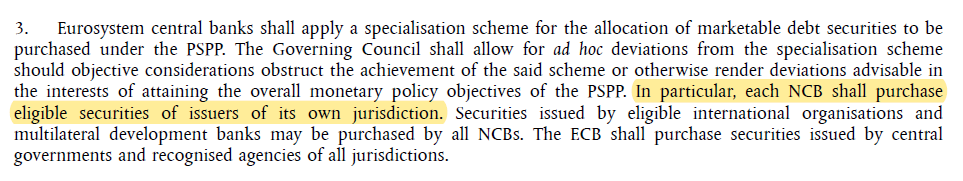

The ECB’s competence is monetary policy which is to be distinguished from economic policy according to Arts. 119, 127 et seq. TFEU. The claimants argue PSPP is of an economic policy nature and is not monetary policy anymore.

bundesverfassungsgericht.de/SharedDocs/Pre…

curia.europa.eu/juris/document…

ecb.europa.eu/ecb/legal/pdf/…

See this thread by @GrundSebastian:

While the court does not have jurisdiction over the ECB, it can make participation of the Bundesbank depending on the ECB’s willingness to comply with its demands.

The other judges can be split between hawks (who might see PSSP as rather illegal) and doves (who are still sceptical but would let the PSPP run its course).

Furthermore, some people have pointed out, that Tuesday is the last day of President Vosskuhle at the court.