Economist. Interested in EMU, ECB, money, and macroeconomics. And more lately a bit of old school finance stuff and banking history.

How to get URL link on X (Twitter) App

Intuitiv scheint es klar: man sollte einem geostrategischen Konkurrenten keine Kontrolle über die eigene kritische Infrastruktur erlauben.

Intuitiv scheint es klar: man sollte einem geostrategischen Konkurrenten keine Kontrolle über die eigene kritische Infrastruktur erlauben.

https://twitter.com/RafaelMentges/status/15651218412152791052/ It is unclear whether crisis could have been avoided with a slightly more conciliatory Bundesbank and a small rate cut. But it would have definitely brought temporary relief to some European currencies that increasingly came under pressure to devalue against the Deutschmark.

The European Monetary System (EMS) was a fixed exchange rate regime that was supposed to stabilize exchange rates among EU (or EC) member states (MS).

The European Monetary System (EMS) was a fixed exchange rate regime that was supposed to stabilize exchange rates among EU (or EC) member states (MS).

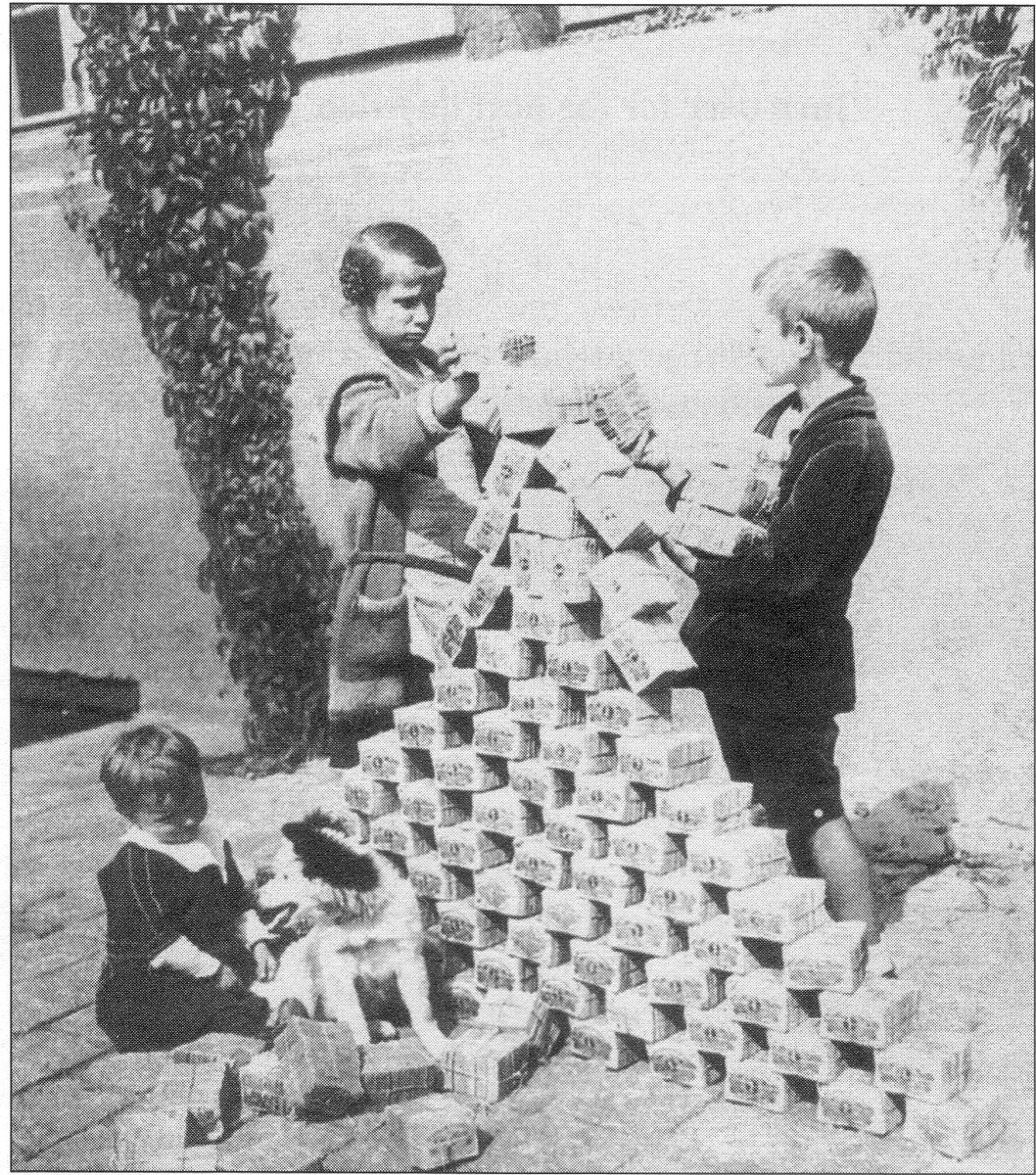

https://x.com/Markus_Soeder/status/1510946336274800641From econ textbooks we usually learn there is no generally accepted definition of a hyperinflation. But there is a rule-of-thumb: it says that we call inflation above 50% a hyperinflation.

2/ Will there be a crash of the Turkish lira tomorrow? Probably yes! But markets did not react to the appointment of Uysal in 2019 and rather slowly to his rate cuts. I am still pretty sure, the lira will depreciate strongly though.

2/ Will there be a crash of the Turkish lira tomorrow? Probably yes! But markets did not react to the appointment of Uysal in 2019 and rather slowly to his rate cuts. I am still pretty sure, the lira will depreciate strongly though. https://twitter.com/jeuasommenulle/status/1373669161923190787