The future of Europe is at stake, and Germany does not really know if it cares enough about it. This is pretty simple: the EU will not surive if Germany does not want it to.

"Any type of credit facility with the European Central Bank […]in favour of […]central governments, regional, local or other public authorities[…]shall be prohibited."Rules out e.g. what Bank of England is doing (lending to Treasury)

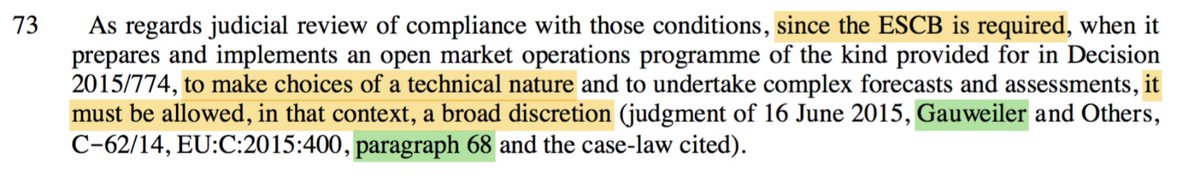

- Not to buy more than 33% of any issuance

- Buy their sovereign bonds following its own capital contribution key

Will they be able to sustain market access without seeing large increases in interest rates or, worse, self fulfilling spirals of loss of confidence?

Funding becomes very expensive

Investors worry about redenomination/currency risk ("will they exit Euro?")

Sell bonds/price drops—Interest rate goes up

Increasing break up risk etc

- Increase hugely PEPP and PSP to make sure that can buy enough Italian debt while keeping close to capital key

- Italy acceps new Pandemic line of ESM and its debt is then elegible for OMT