I believe a possible solution involves using the EFSM, backed by the EU budget to purchase the junior tranche of a "coronabond". I explain the impasse and solution in this THREAD /1

1. Should ESM support be tied to immediate economic reforms or should lending conditions be laxer?

2. Should the ESM be available on an individual application, or should it be easily available to all? /3

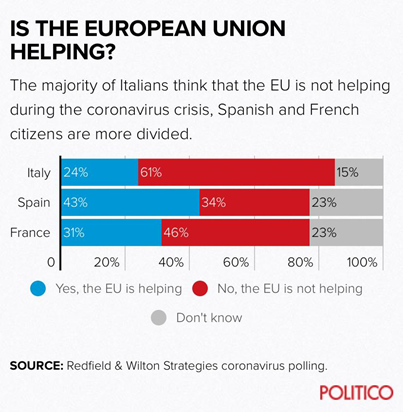

This would be politically explosive for Italy and unacceptable /4

and Lagarde’s testimony two weeks ago (huge repercussion there). /5

reuters.com/article/us-ecb…

politico.eu/article/how-to… ) /11