@ArminHaas3 @JoeRini6 & I developed 4 scenarios. Out now in JOIE

Factors: Will @federalreserve swap lines hold in crisis? Will G-20 states cooperate or compete?

cambridge.org/core/journals/…

1/n

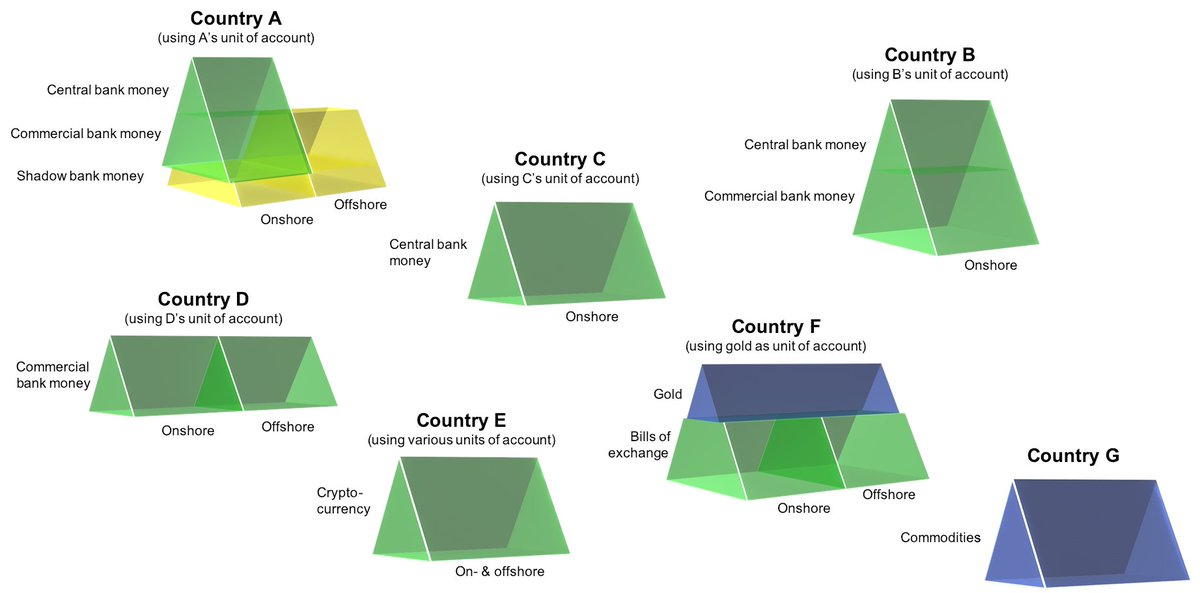

We have developed a visual conceptual framework to go beyond triple coincidence

@StefanAvdjiev @HyungSongShin

3/n

Non-US institutions are USD deficit agents & turned to the Fed for emergency offshore USD liquidity

The world is on lockdown, cataclysm is nigh. What next?

8/n

10/n

#Eurogroup

12/n

That’s a true non-system. Private int payment infrastructure gone, no new mechanism. Each country muddles through w/ own approach

15/n

@izakaminska

Destruction of wealth & economic capacity. Likely transition stage until new system is found

16/n

Research funded by @EUHorizon2020, @DAAD, @DFG. No conflict of interest.

@IASS_Potsdam @GDPC_BU @GDPC_BU @HarvardWCFIA @CITYPERC

17/END