Can you use Gilt funds for the short-term? Yes! Apart from you losing money, there's no other risk 1/n

PS: If I'm not going to say, investing is easy, picking a debt is easy or can be easy. 6/n

nakedbeta.com/musings-rants/… 15/n

In debt higher returns almost always = higher risk which is always = to higher defaults which always = you losing you bloody money! 22/n

freefincal.com/how-to-select-…

27/n

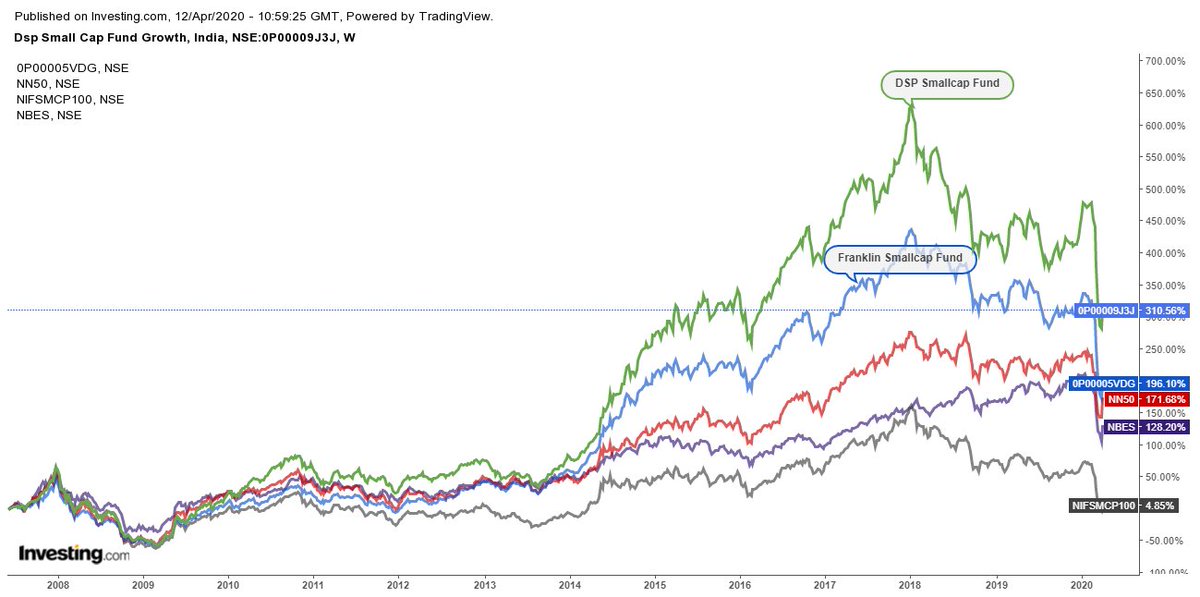

High AUM doesn't always mean safety. Franklin funds were some of the biggest in their categories. 28/n

primeinvestor.in/evaluating-deb…

1

valueresearchonline.com/stories/46714/…

32/n

Do read them and they're quite awesome. They've helped my thinking about debt funds.

valueresearchonline.com/stories/47010/…

Don't treat this as investment advice, PLEASEEEE 🙏I also BEG you not to take random investment advice on Twitter including this very thread. Learn, invest, make mistakes, learn, and repeat. 37/n

The end

I'm getting drunk and reading The Intelligent Investor now.