The full report will be probably available sometime in the future here: shipfinance.dk/shipping-resea…

$STNG $ASC $DSSI $HAFNIA $INSW $EURN $TNK $FRO $DHT #tankers #oott #oil

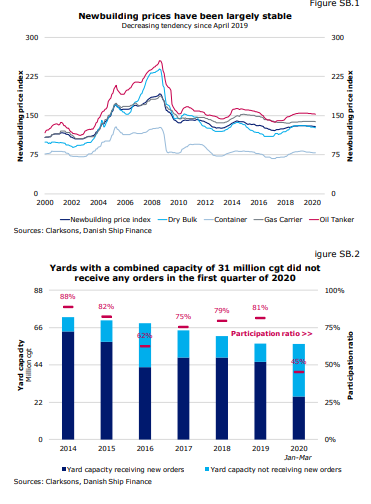

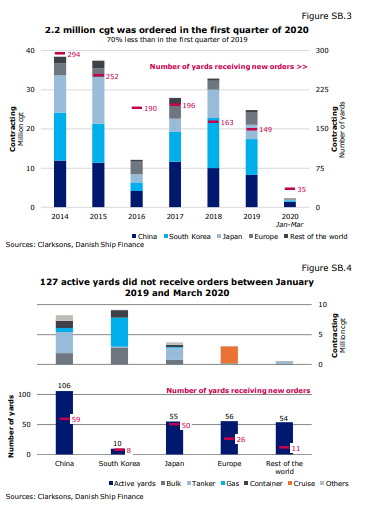

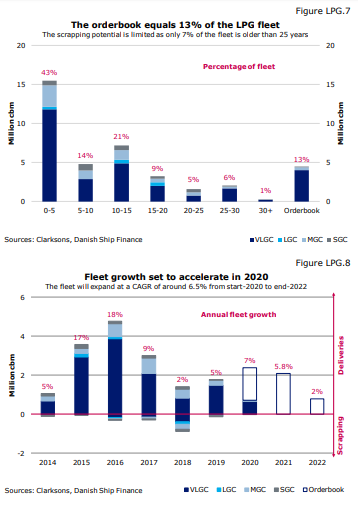

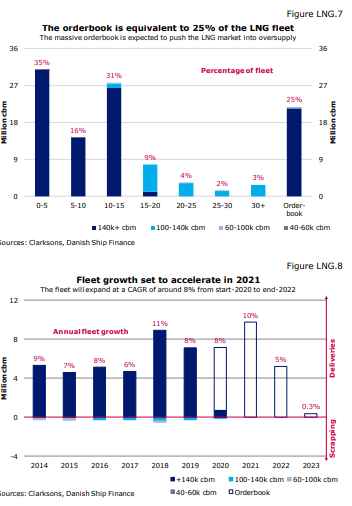

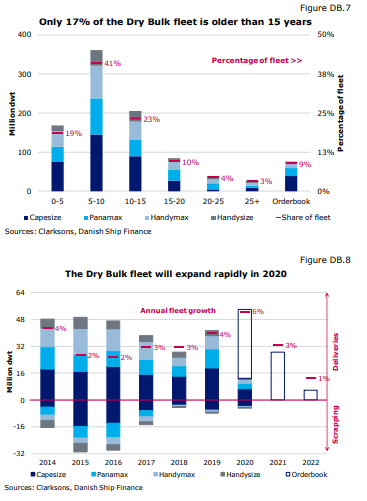

As long as finance is tight & regulatory uncertainty about the new types of ships persist, I think that we won't have rampant shipbuilding any time soon.

I haven't seen any reference to what Bugbee said to @calvinfroedge about the delayed drydockings. This will be a bullish surprise.