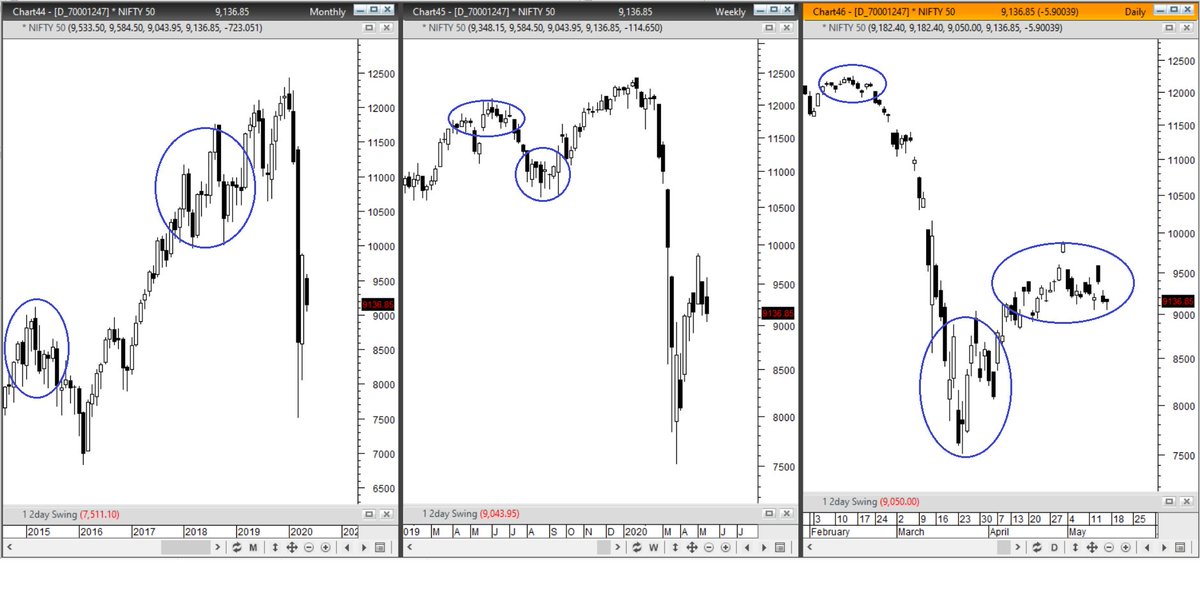

Today, I will try to make a complex looking chart into a clean & simple one (only useful for people who are PATTERN based trader/analyst)..1/n

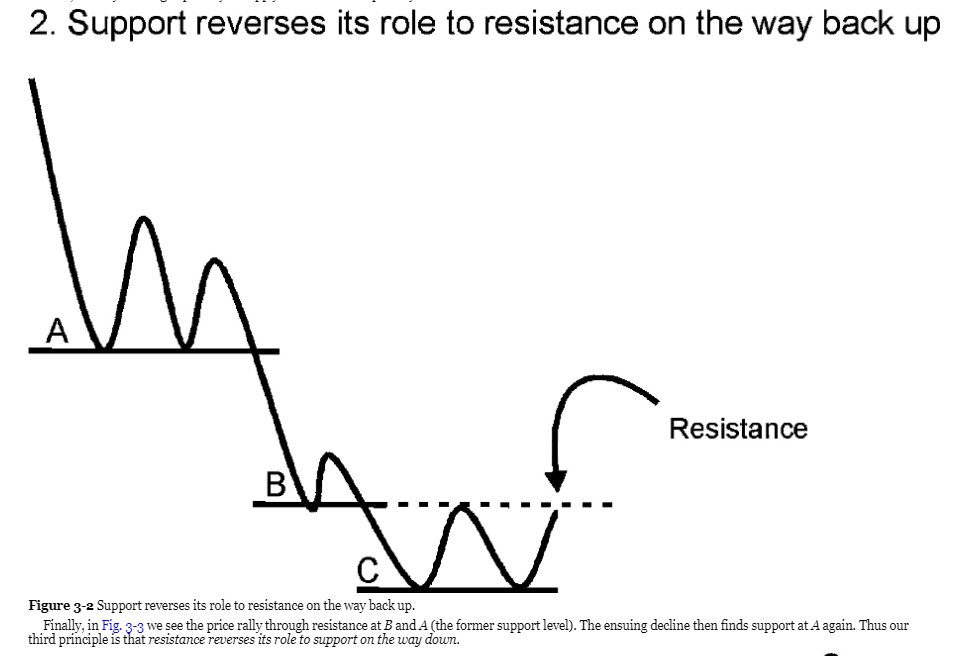

Further as disclaimer, the presented way will be more useful for people who have followed Martin Pring's book on chart patterns.. (images taken from Kindle version of the book)

There are 4 types of BARs.

Up Bar: Today's High > Previous day and Low > Prev Day,

Down Bar: Today's High < Previous day and Low < Prev Day,

Inside Bar: Today's High < Previous day and Low > Prev Day and

Outside Bar: Today's High > Previous day and Low < Prev Day..

Up / Down / Inside / OutSide...

Data Point selected:

-High when UP

-Low when Down

-Previous day's value when INSIDE

-High when previous day was High & Today is Outside

-Low when previous day was Low & Today is Outside

What a clean chart can show in having more clarity...

#HINDALCO Daily chart

* Third attempt of base formation breakout

* Speculative buyers very active here

* Short term RS line is near the roof

* Volume Profile suggests that the stock may clear resistance this time.

Logic: RS Line dropping at major resistance zone