How to get URL link on X (Twitter) App

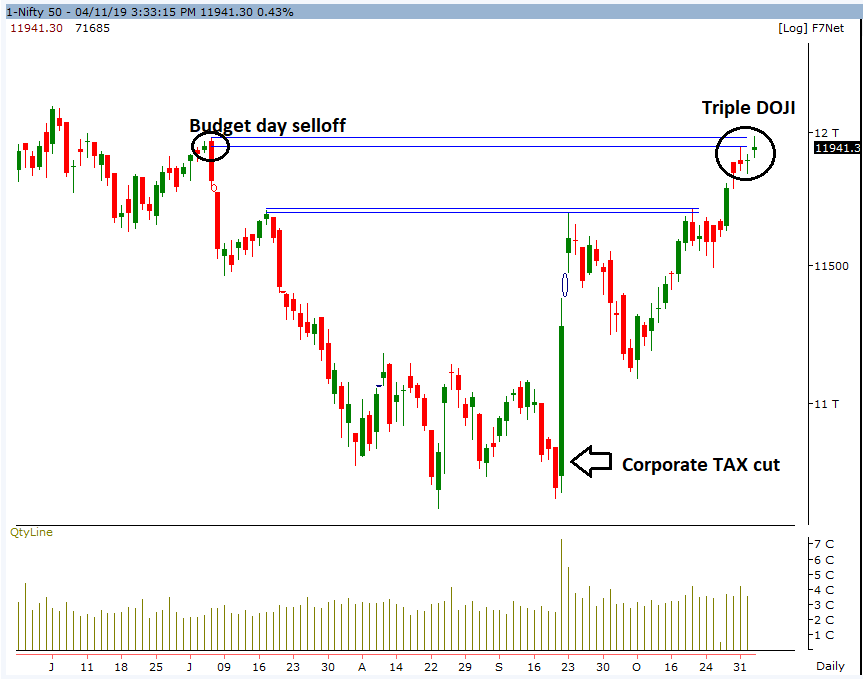

https://twitter.com/sumitverma29/status/1272998123896369152/photo/1Update on #Nifty chart

https://twitter.com/sumitverma29/status/1261869400283582464?s=20

https://twitter.com/sumitverma29/status/1264052994212917248?s=20

Updated ..

Updated ..

Today's Follow through Volume on the Upside in #BHEL speaks a lot about DIRECTION now...

Today's Follow through Volume on the Upside in #BHEL speaks a lot about DIRECTION now...

#NIFTY 500 Index chart - Index's reaction at Psychological round number has been similar (5000 vs 10000)... question is will history be repeated.. a Blow-off rally post 10000 from here? (I feel its possible as Market breadth is improving & #Dollar Index at 4 month low)

#NIFTY 500 Index chart - Index's reaction at Psychological round number has been similar (5000 vs 10000)... question is will history be repeated.. a Blow-off rally post 10000 from here? (I feel its possible as Market breadth is improving & #Dollar Index at 4 month low)

View is intact.. maintain SL 12042..

View is intact.. maintain SL 12042..

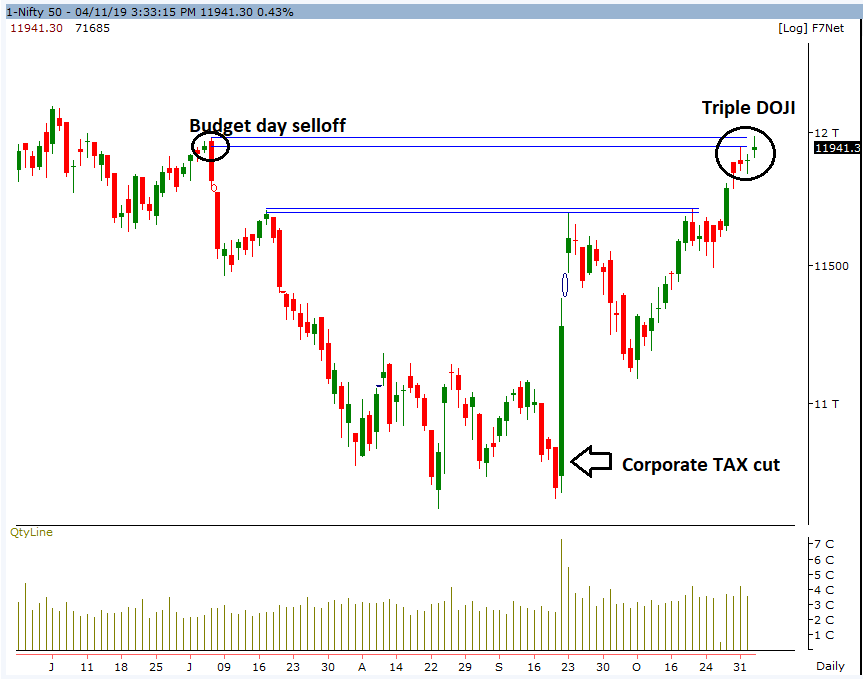

good start to #BANKNIFTY today.. similar setups like earlier occasion.. should be fast and furious from hereon...

good start to #BANKNIFTY today.. similar setups like earlier occasion.. should be fast and furious from hereon...

#FTSEMIB struggling to cross 38.2% retracement also. Timewise after 16 day's of decline and pullback of 4-8 days; if it fails to cross 50% retracement mark then can trigger fresh round of sell off. #ITALY

#FTSEMIB struggling to cross 38.2% retracement also. Timewise after 16 day's of decline and pullback of 4-8 days; if it fails to cross 50% retracement mark then can trigger fresh round of sell off. #ITALY

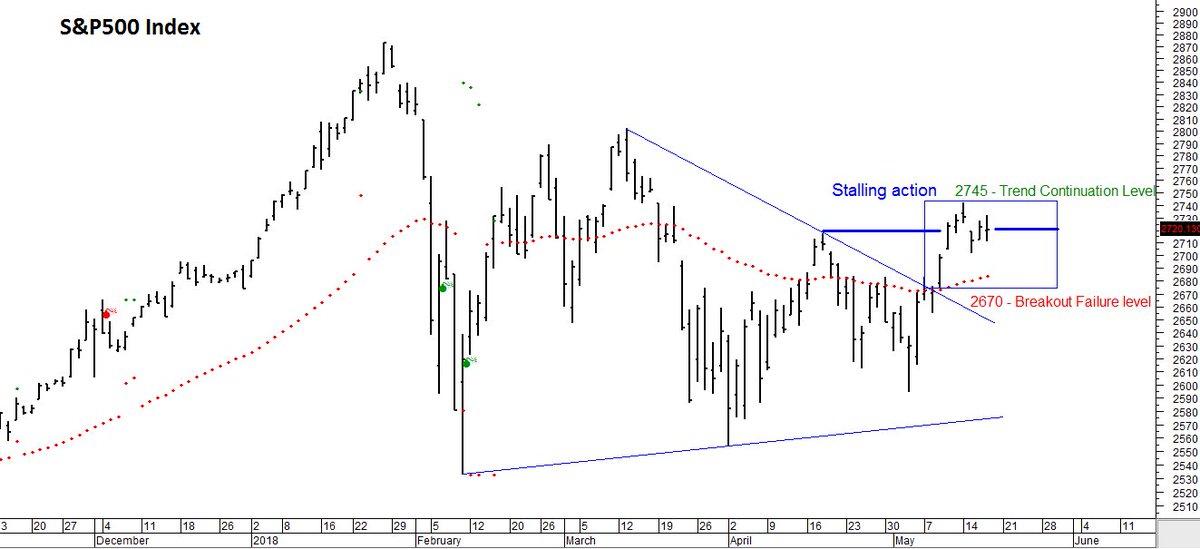

#S&P500 chart update.

#S&P500 chart update.