●Debts related to #Covid_19india will be excluded from default under IBC

●No fresh insolvency proceedings for 6 months (1yr)

●Special insolvency framework for MSMEs u/a 240A

●Minimum threshold for MSME insolvency raised to Rs 1Cr via Oridnance

●Amendments via Ordinance to drop 7 compoundable offenses + 5 others.

#atmanirbhar

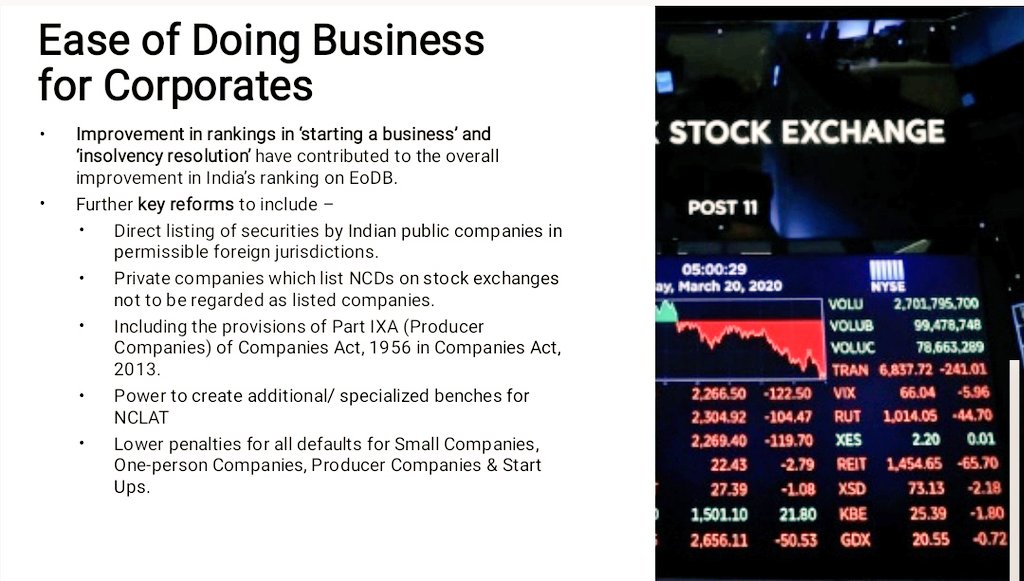

●Direct listing of securities by Indian companies in foreign jurisdictions

●Pvt cos that list BCD on stock exchanges not to be considered as listed cos

#atmanirbhar

●India's Public sector undertakings to be privatized

One of the biggest signals given by govt about unshacking the economy and reducing govt controls.

Well done @PMOIndia @FinMinIndia @nsitharaman @ianuragthakur

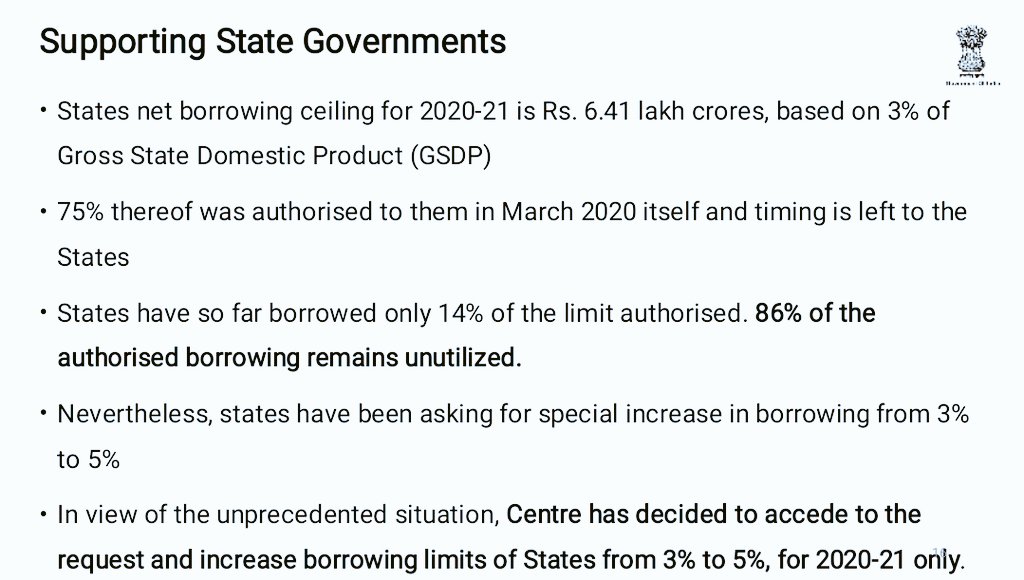

●Centre agrees to States request for increased borrowing.

●States borrowing limits hiked to 5% from 3% for current financial year ending Mar 31, 2021 ONLY.

●Rs 4.28 LkCr extra borrowing.

States net borrowing for FY21 projected Rs 6.41 LkCr at 3% of GSDP

#atmanirbhar

Govt Sources:

Public sector privatization policy should not be misconstrued especially in the context of state-owned Banks.

The formulation will specify strategic sectors.

For banks, consolidation via mergers remains the core strategy.

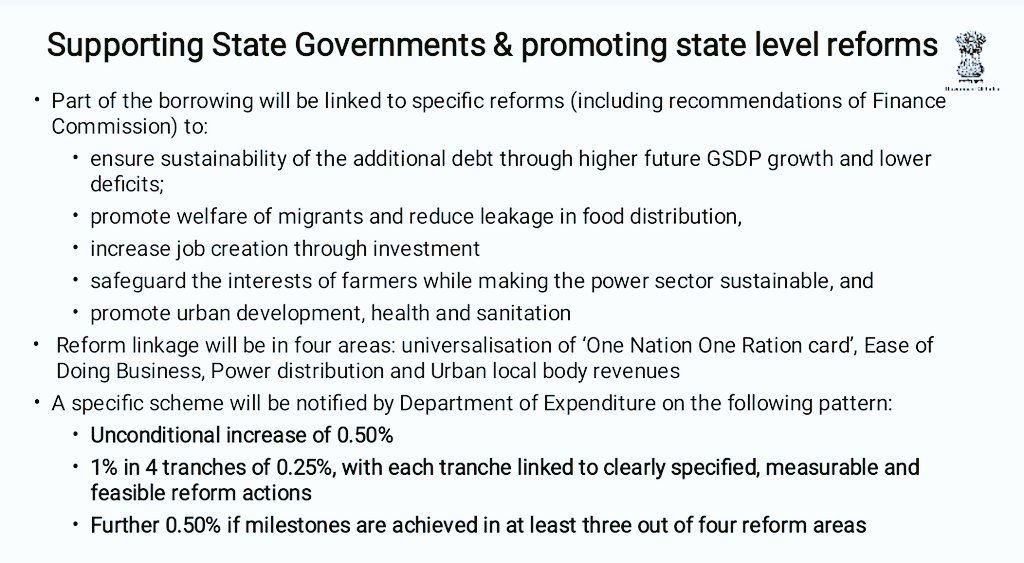

●First 0.5% is unconditional (from 3% to3.5%).

●Next 1% in 25 bps each linked to specified actions.

#atmanirbhar