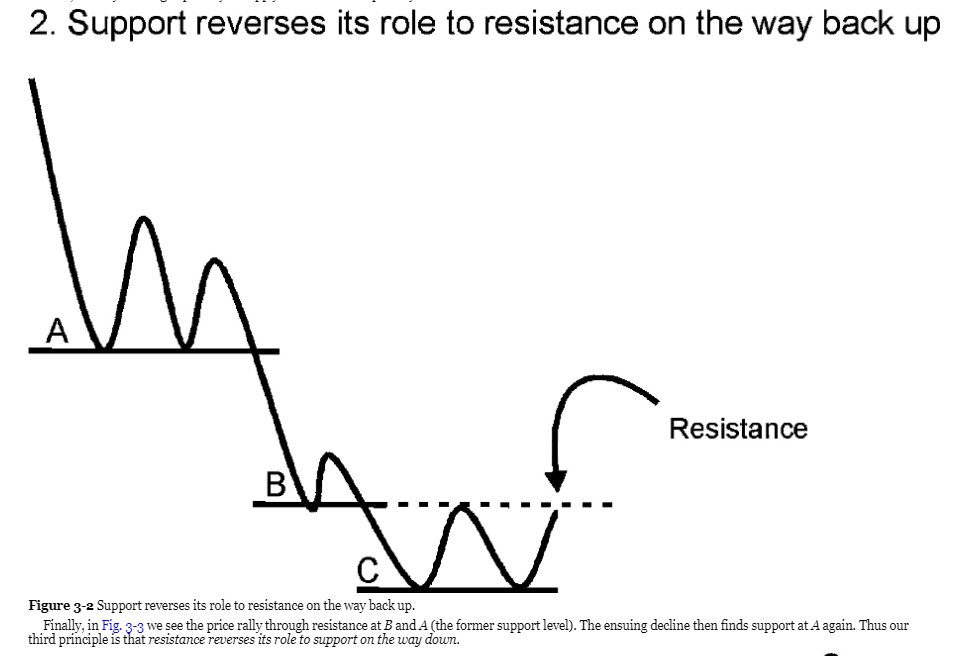

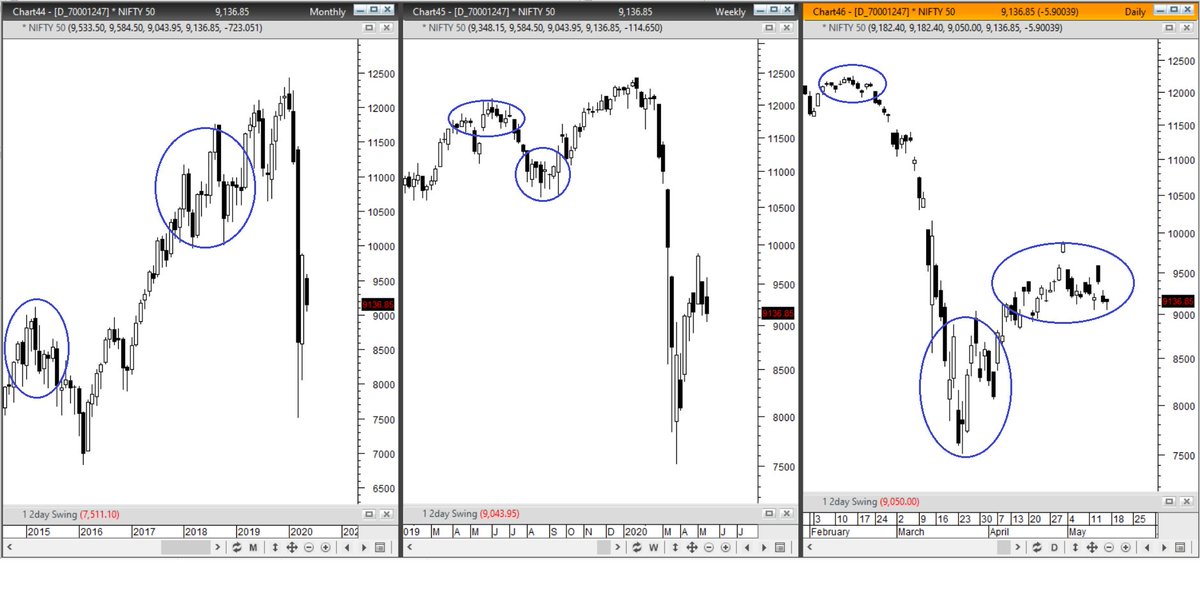

Earlier I explained how to make charts cleaner by using Two day Swing Lines & today I explained how to identify Relative Highs & Relative Lows in an objective manner

Link1:

Link2:

1/n

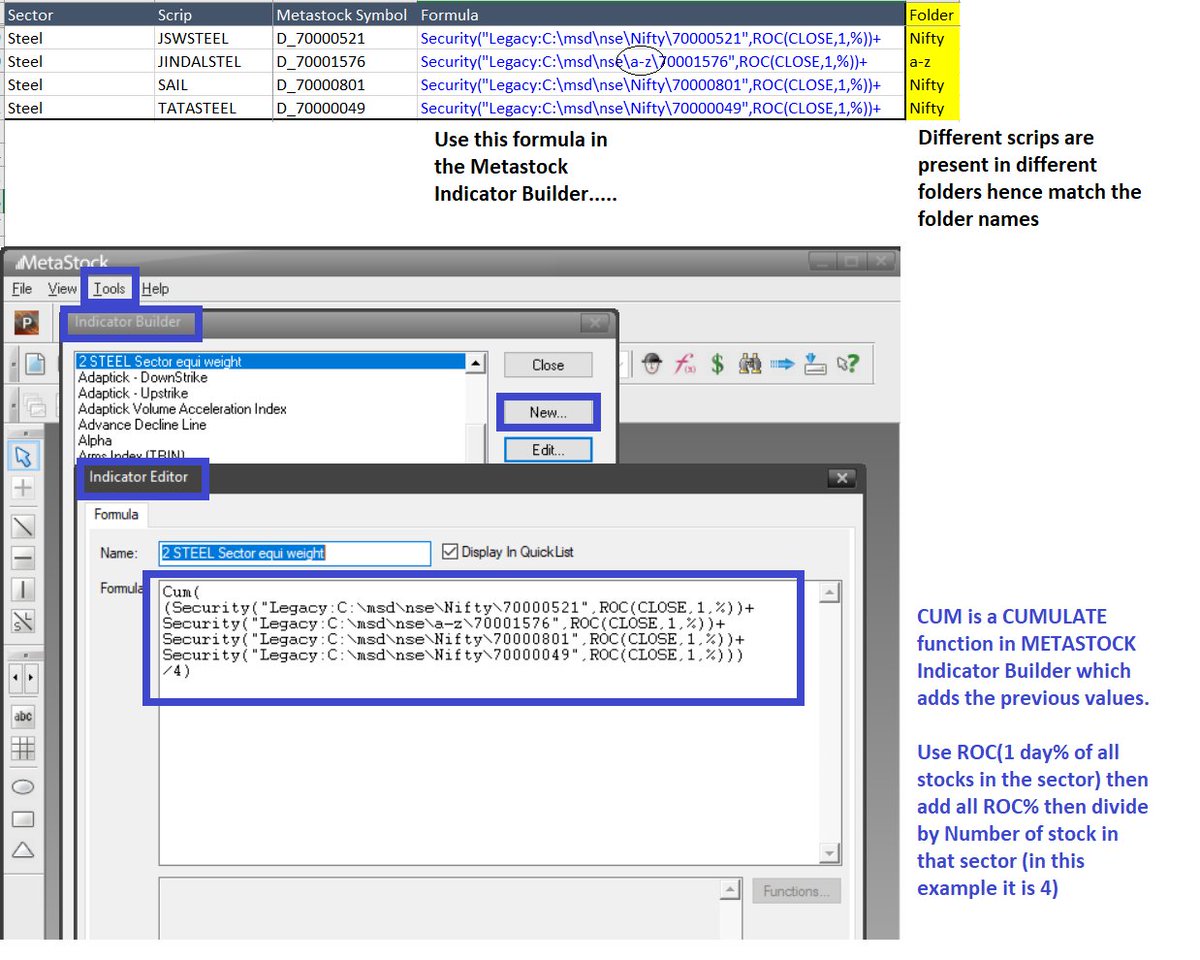

Now I will try to show how to make a TRADING system out of the two....

Tools used:

Relative High AND Low identifier (N=10) and

Two day Swing Lines

.....2/n

Further to the above thread to find trade setups using the above mentioned tools.

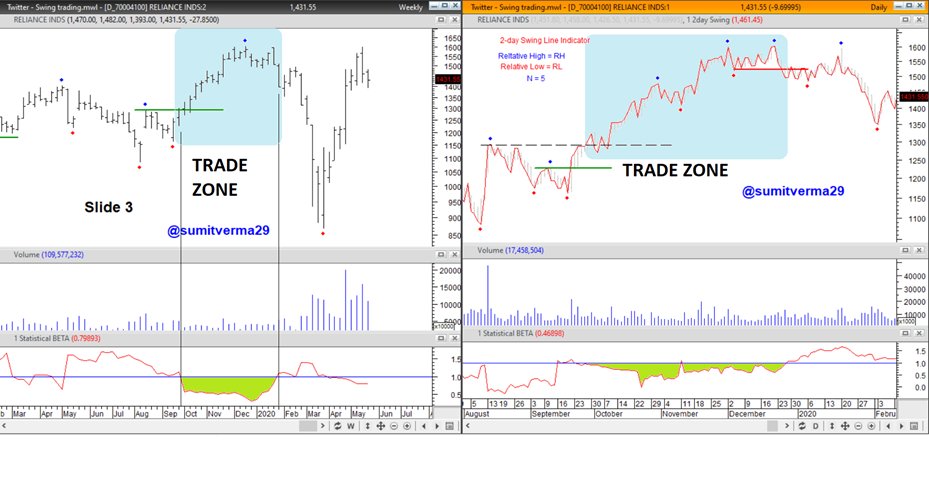

Topic: Identifying "TREND FOLLOWING trade setups" using Top-Down approach

- Weekly and Daily charts are taken with Relative Highs and Relative Lows marked (parameter N=5)

..contd..

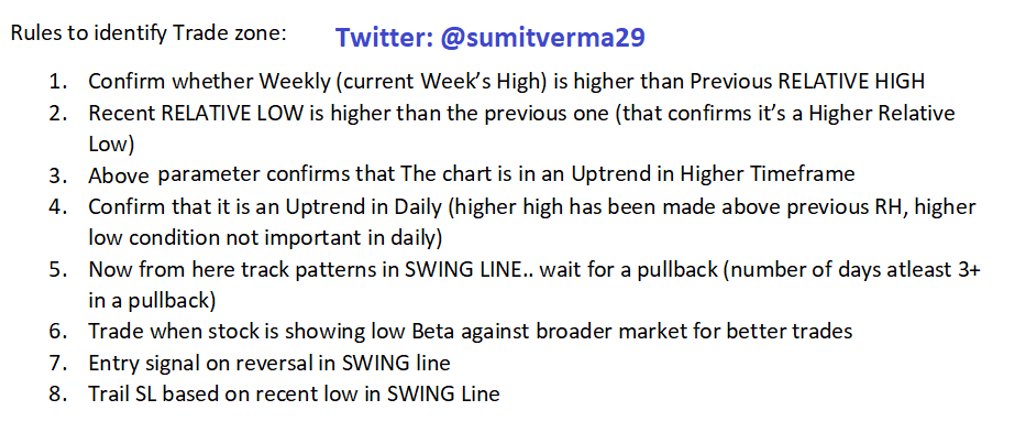

- Below are the rules followed to find the trade setup

- Charts for same attached in order of sequence

Contd....

Final Picture

*Most imp is the ZONE to select for trading. Better trade setups appear in lower beta zone in largecap when N=5 is used. For Midcaps, N=10 works better due to beta factor.*

Many more concepts on pipeline to be explained under #LetsLearn...

Stay tuned..