#EQUITAS #STOCKSTUDY #FNO #DERIVATIVE

*** Big shorts covered their position..........Bullish

(18 % decrease in COI from last one week)

*** Price in consolidation near lower edge of BB with little increase in delivery% .

*** Big shorts covered their position..........Bullish

(18 % decrease in COI from last one week)

*** Price in consolidation near lower edge of BB with little increase in delivery% .

*** My understanding says.... No retailers have guts to short ITM PE at the start of the expiry. Therefore, my view is Bullish....

*** Addition in far OTM CE.... Bullish.

*** Average Day to day increase in PCR.... More PE added ... Bullish.

3 >5 >8 >13 Days.

*** Addition in far OTM CE.... Bullish.

*** Average Day to day increase in PCR.... More PE added ... Bullish.

3 >5 >8 >13 Days.

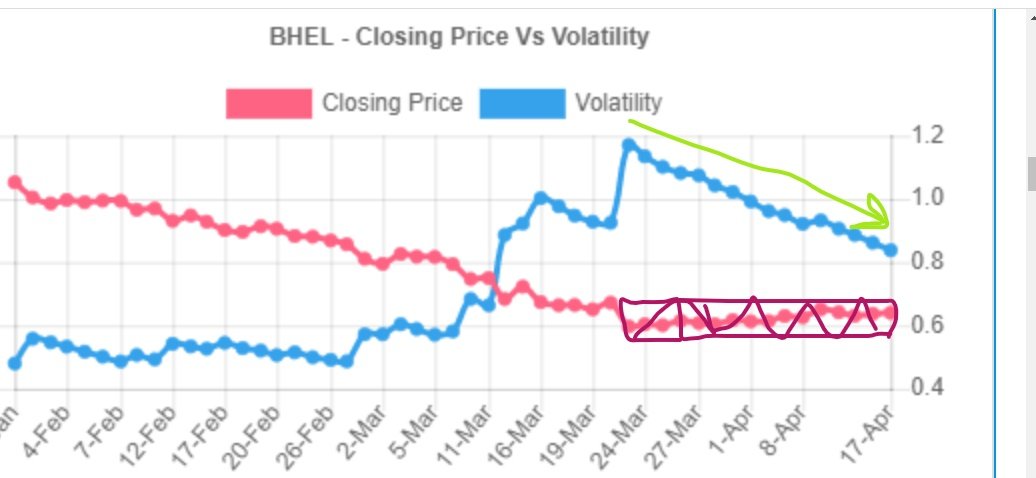

Daily volatility at its lowest level from last three months. My understanding says now time to go up.

***Shared for learning and analysis purpose.

May not match with basic theoretical leanings.

***Shared for learning and analysis purpose.

May not match with basic theoretical leanings.

• • •

Missing some Tweet in this thread? You can try to

force a refresh