* Enhanced long-only commodity indices based on contract maturity, momentum, and carry

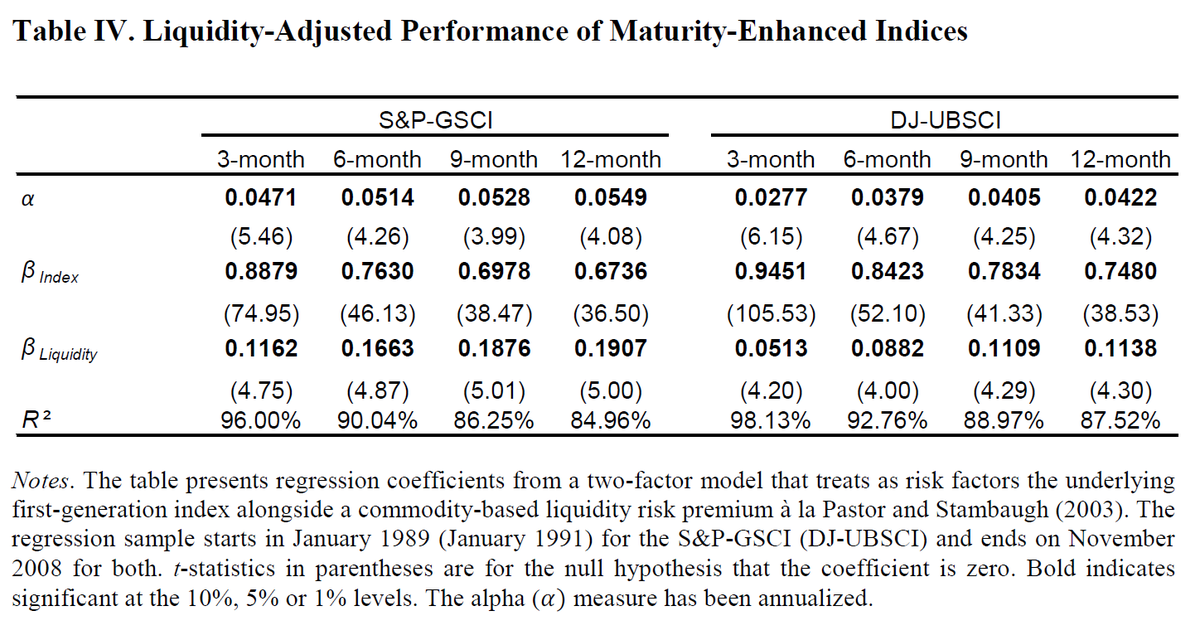

* Longer-maturity contracts have higher returns with less volatility

papers.ssrn.com/sol3/papers.cf…

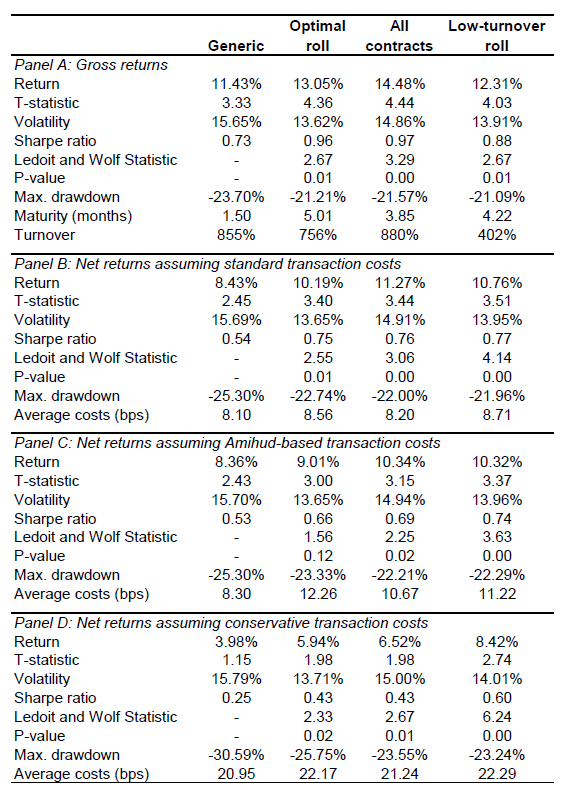

GSCI index: 0.173 Sharpe → 0.08 Skill Metric

3-month: 0.4531 → 0.29

6-month: 0.5172 → 0.31

9-month: 0.5508 → 0.32

12-month: 0.5753 → 0.34

They control for cross-sectional momentum and carry and also include transaction costs: