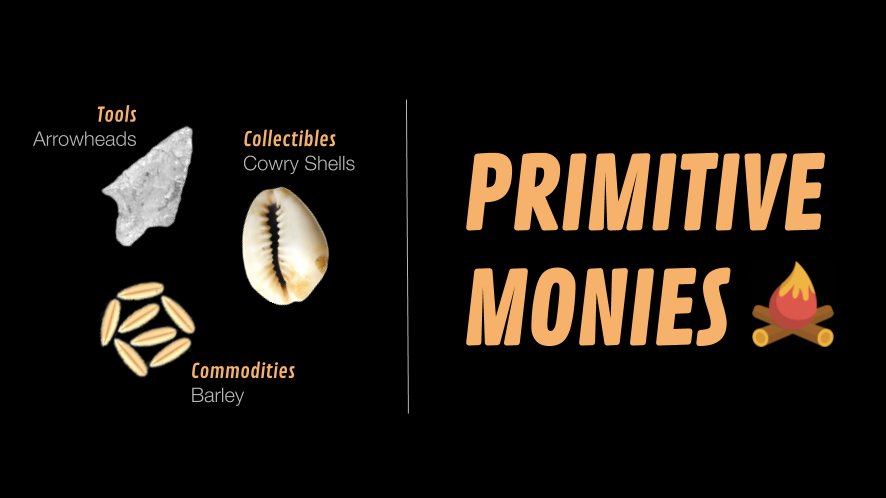

The things we've used as money has evolved over time.

Technology has always been the agent of change, directly or indirectly, altering the incentives of hodling one form over another.

Technology has always been the agent of change, directly or indirectly, altering the incentives of hodling one form over another.

'Monetary status is a spontaneously emergent product of human action.. it is not something that is conferred through academic debate, rational planning, or government mandate.'

-@saifedean

-@saifedean

"Primitive money existed long before large scale trade networks. Money had an even earlier and more important use. Money greatly improved the workings of even small barter networks by greatly reducing the need for credit."

- Nick Szabo (2002)

- Nick Szabo (2002)

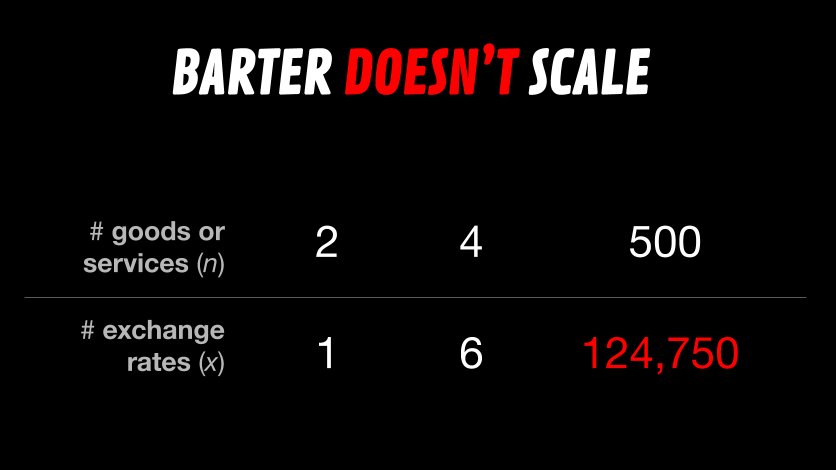

"An economy of favours and obligations doesn’t work when large numbers of strangers try to cooperate.. Barter is only effective when exchanging a limited range of products. It cannot form the basis for a complex economy."

-Yuval Noah Harari, Sapiens (2014)

-Yuval Noah Harari, Sapiens (2014)

With the advent of metallurgy, metals soon proved superior.

Metals could be made into uniform weights, were more durable and allowed for larger values to be transported more easily. Different metals had different value based on their scarcity and difficulty to extract.

Metals could be made into uniform weights, were more durable and allowed for larger values to be transported more easily. Different metals had different value based on their scarcity and difficulty to extract.

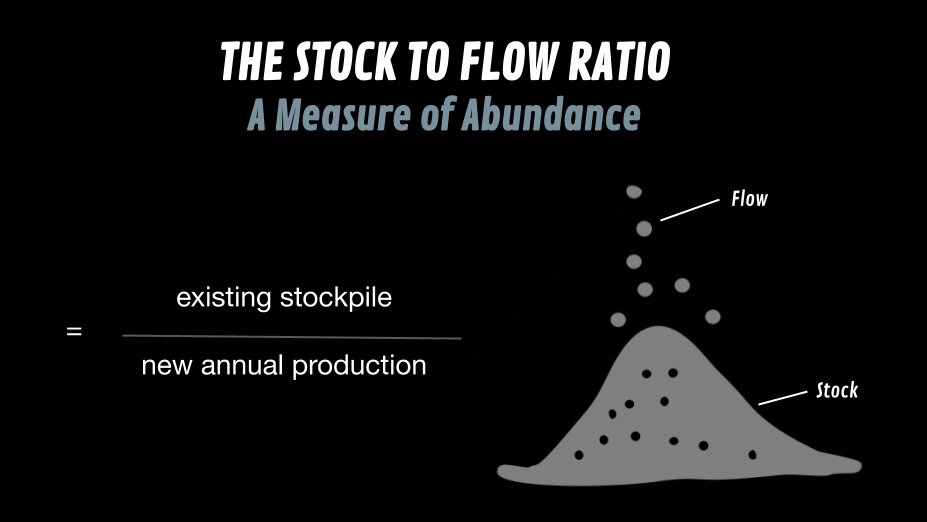

"For anything to function as a good store of value.. it has to appreciate when people demand it as a store of value, but its producers have to be constrained from inflating the supply significantly enough to bring down the price."

-Saifedean Ammous, The Bitcoin Standard (2018)

-Saifedean Ammous, The Bitcoin Standard (2018)

"The clear winner throughout human history has been gold..due to two unique physical characteristics.. it is virtually impossible to destroy and..impossible to synthesize from other materials."

-Saifedean Ammous, The Bitcoin Standard (2018)

-Saifedean Ammous, The Bitcoin Standard (2018)

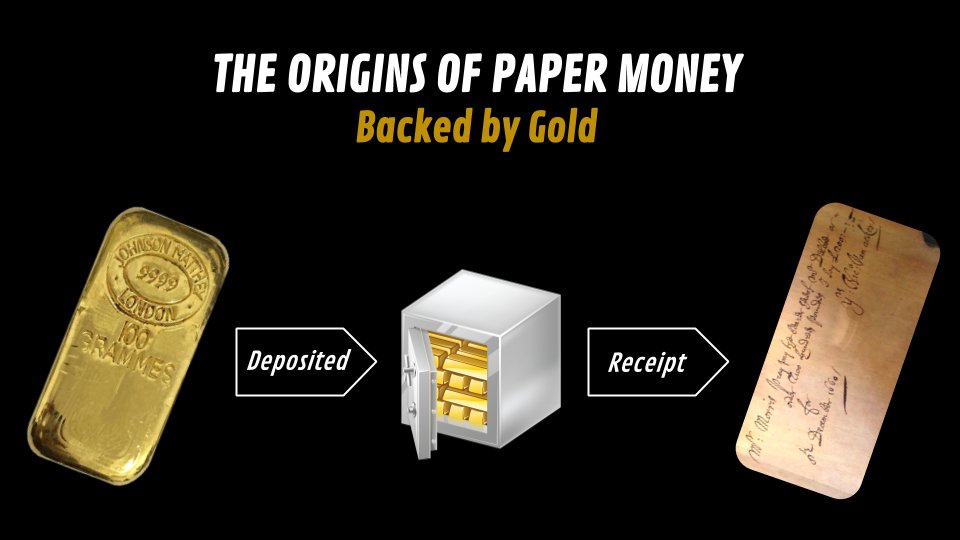

As trade and trade routes expanded, larger transactions took place. This meant transporting sizable quantities of gold in the face of pirates, bandits & shipwreck.

Paper notes (redeemable for gold by the bearer) offered a subtle solution where trusted storage existed.

Paper notes (redeemable for gold by the bearer) offered a subtle solution where trusted storage existed.

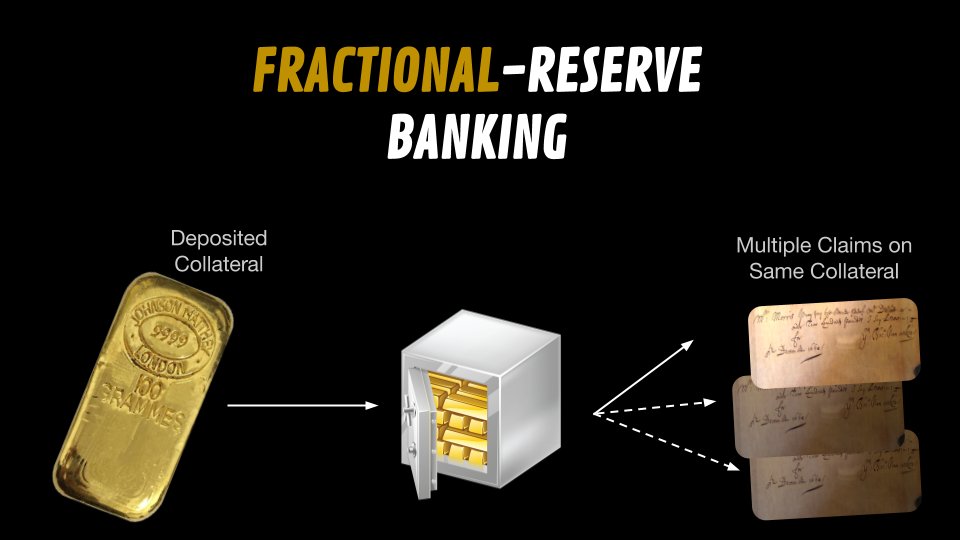

Gold storage came with a fee. But, if you allowed a vault/bank to lend out your gold, they would pay YOU for the privilege.

If deposits > redemptions, banks may be tempted to issue multiple notes (as 'loans') against the same piece of collateral in order to grow profits.

If deposits > redemptions, banks may be tempted to issue multiple notes (as 'loans') against the same piece of collateral in order to grow profits.

Governments would eventually end the private issuance of currency by establishing their own national ‘central bank’. Such institutions were granted exclusive rights to issue banknotes, often backed by a set ratio of gold, and thus establishing a unified national currency.

The gold peg was a hindrance to govt's who wished to run deficits in order to fund their vision (e.g. projects/wars too unpopular to fund via ⬆️taxes).

Central banks, although supposedly independent, would eventually all lose their gold backing as we moved into the 'FIAT' era.

Central banks, although supposedly independent, would eventually all lose their gold backing as we moved into the 'FIAT' era.

A digital representation of 💵🪙, digital fiat was enabled by the proliferation of digital comms. networks, growth of consumer devices & standardisation of payments protocols.

Digital fiat is replacing physical fiat at a rapid pace thanks to ⬇️costs, ⬆️speeds & ⬆️surveillance

Digital fiat is replacing physical fiat at a rapid pace thanks to ⬇️costs, ⬆️speeds & ⬆️surveillance

The main thing preventing non-gov’t issued digital currencies from taking hold was the coordination of trust required among strangers.

“..no mechanism exists to make payments over a communications channel without a trusted party” -Satoshi Nakamoto

“..no mechanism exists to make payments over a communications channel without a trusted party” -Satoshi Nakamoto

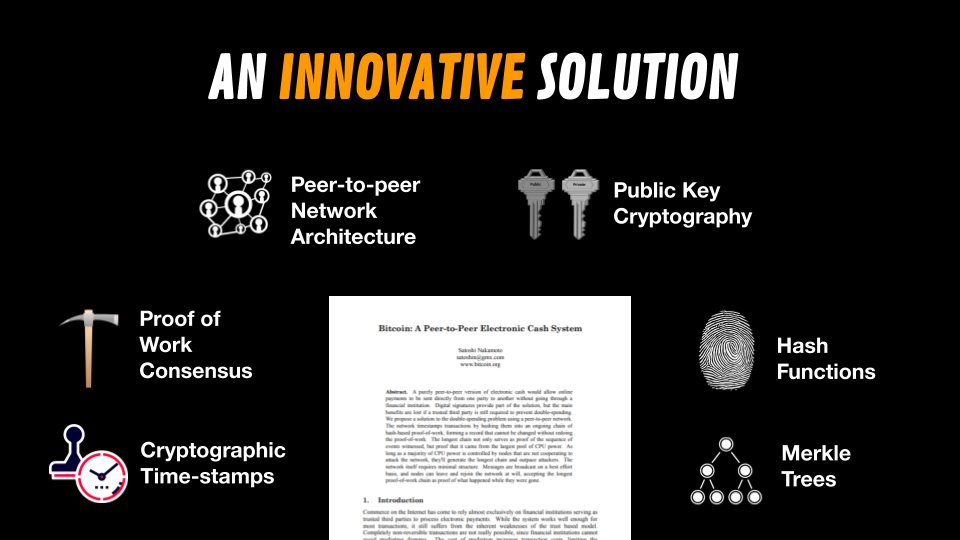

“..we propose a solution to the double-spending problem using a peer-to-peer distributed timestamp server to generate computational proof of the chronological order of transactions.” -Satoshi Nakamoto (Oct 31, 2008)

Bitcoin Whitepaper:

bit.ly/3mDS7Pl

Bitcoin Whitepaper:

bit.ly/3mDS7Pl

From digital abundance to verifiable scarcity.

“the invention of Bitcoin represents the discovery of absolute scarcity, or absolute irreproducibility, which occurred due to a particular sequence of idiosyncratic events that cannot be reproduced.” -@Breedlove22

“the invention of Bitcoin represents the discovery of absolute scarcity, or absolute irreproducibility, which occurred due to a particular sequence of idiosyncratic events that cannot be reproduced.” -@Breedlove22

• • •

Missing some Tweet in this thread? You can try to

force a refresh