Asset classes are defined by the preferences of a generation. So how will the world's first digitally-native cohort behave?

Millennials get a lot of the attention, but the future of Bitcoin will one day be driven by Generation Z to see the asset through to its maturity.

🧵👇

Millennials get a lot of the attention, but the future of Bitcoin will one day be driven by Generation Z to see the asset through to its maturity.

🧵👇

Firstly, who is Gen Z? What are the generational boundaries?

There’s still much debate about the exact cut-off for millennials, but let’s take the @pewresearch definition of people born between 1997-2012. Making this cohort currently between 8 and 23 years of age.

There’s still much debate about the exact cut-off for millennials, but let’s take the @pewresearch definition of people born between 1997-2012. Making this cohort currently between 8 and 23 years of age.

While population growth in the West has slowed to a crawl, the number of young people in Western Africa and parts of Asia exploded in recent years and will continue on a steep incline.

"Africa will define the future (especially the bitcoin one!)."

-@jack (Nov, 2019)

"Africa will define the future (especially the bitcoin one!)."

-@jack (Nov, 2019)

What major event have shaped their experience so fat?

“The defining things in life are the things that happen in early formative years, your early teens and mid-teens. For Gen Z, that event was the financial crisis.”

-Bill Handel, @TheRaddonReport

“The defining things in life are the things that happen in early formative years, your early teens and mid-teens. For Gen Z, that event was the financial crisis.”

-Bill Handel, @TheRaddonReport

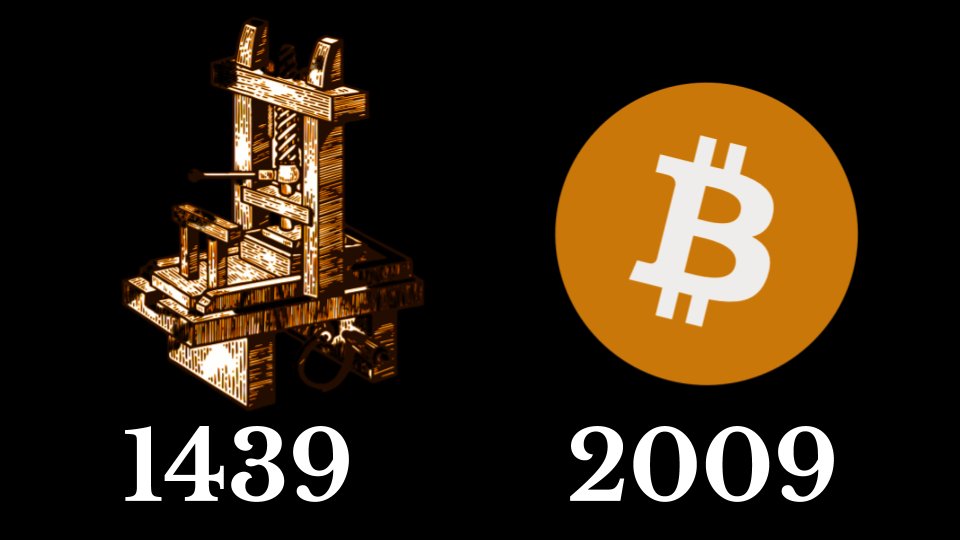

The youngest Gen Z’s do not know a world without Bitcoin in it.

It’s as much of a mainstay in the financial world as any other viable investment. Though this time they get to be part of the asset's birth story and ride it to maturity.

It’s as much of a mainstay in the financial world as any other viable investment. Though this time they get to be part of the asset's birth story and ride it to maturity.

A few key attributes about this generation.

1. They’re well-educated and have grown up with access to the all the recorded knowledge in human history.

Source: Pew Research

pewrsr.ch/35FCe5v

1. They’re well-educated and have grown up with access to the all the recorded knowledge in human history.

Source: Pew Research

pewrsr.ch/35FCe5v

2. They are never not connected. There will be no bullshitting a generation with the ability to instantly self-verify any claim.

Source: Global Trends Among Gen Z

bit.ly/3lE0vi0

Source: Global Trends Among Gen Z

bit.ly/3lE0vi0

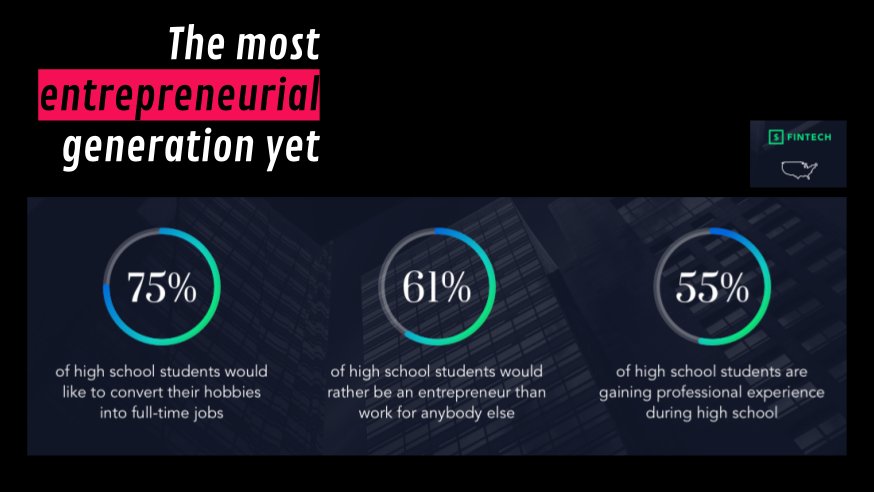

3. Hammered by the post-COVID job market, coupled with greater access to freelancing platforms and tools for building online businesses, Gen Z is unlikely to risk placing all their eggs in one basket. The true ascent of online small business is coming.

4. Gen Z have learnt from our mistakes. Trusting third parties with your personal data is a risk to be avoided where possible. They also demand a service that is operational 24/7.

Generation Z: Fuelling Disruption in Financial Services via Target Group

bit.ly/3lrxKF6

Generation Z: Fuelling Disruption in Financial Services via Target Group

bit.ly/3lrxKF6

4. continued

Global Trends Among Gen Z via Snap Inc & @globalwebindex

bit.ly/35pZNiz

Gen Z: Approaching Money Differently via @visualcapitalist

bit.ly/32BFQ6M

Global Trends Among Gen Z via Snap Inc & @globalwebindex

bit.ly/35pZNiz

Gen Z: Approaching Money Differently via @visualcapitalist

bit.ly/32BFQ6M

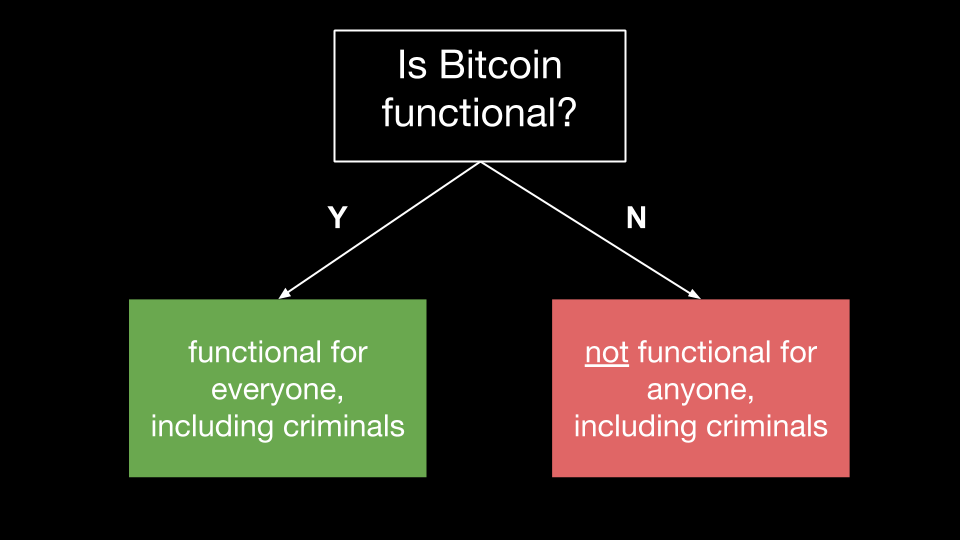

What about the attributes of bitcoin and the digital world in general that they intuitively understand?

1. The value proposition of pseudonymous identities when communicating online

1. The value proposition of pseudonymous identities when communicating online

2. The digital world as a more dynamic and convenient alternative to the physical.

“Fortnite operates as much like a social network as a game..

that’s what Fortnite is: a community, a virtual 'third place', the Starbucks of its day."

-Peter Suderman (NYT, 25 May 2019)

“Fortnite operates as much like a social network as a game..

that’s what Fortnite is: a community, a virtual 'third place', the Starbucks of its day."

-Peter Suderman (NYT, 25 May 2019)

3. Gen Z are intimately familiar with non-gov’t issued digital monies and transacting instantly, without friction, in their chosen realms.

4. “Gen Z is more interested in digital payments products & services than any other generation.

Over half use digital wallets monthly, and over three-quarters use other digital payment apps or P2P apps..” -@businessinsider

Banking & Payments for Gen Z: bit.ly/3neruRA

Over half use digital wallets monthly, and over three-quarters use other digital payment apps or P2P apps..” -@businessinsider

Banking & Payments for Gen Z: bit.ly/3neruRA

Bringing it all together.

“The most important driver of anything tied to money is the stories people tell themselves and the preferences they have for goods & services. Those things don’t tend to sit still. They change with culture and generation.” -@morganhousel

“The most important driver of anything tied to money is the stories people tell themselves and the preferences they have for goods & services. Those things don’t tend to sit still. They change with culture and generation.” -@morganhousel

What about how Gen Z is approaching money & investing?

“trust is actually eroding in institutions and legacy providers of financial services. And trust in software and technology startups is really increasing.”

-@illscience (GP @ a16z)

chart: @EdelmanPR

“trust is actually eroding in institutions and legacy providers of financial services. And trust in software and technology startups is really increasing.”

-@illscience (GP @ a16z)

chart: @EdelmanPR

Older Gen Z’s are actively seeking alternatives as the incentives of holding cash savings has evaporated in their lifetime.

“In a world where benchmark interest rates globally are near, at, or below zero, the opportunity cost of not allocating to bitcoin is higher.“ -Fidelity

“In a world where benchmark interest rates globally are near, at, or below zero, the opportunity cost of not allocating to bitcoin is higher.“ -Fidelity

Although buying power is relatively limited at the moment, Gen Z’s current habits (investing > saving in fiat) will shape what they do when they see their wealth increase.

Manole Capital 2020 Gen-Z Financial Services Survey:

bit.ly/3f0MVCE

Manole Capital 2020 Gen-Z Financial Services Survey:

bit.ly/3f0MVCE

“Why would I go to someone for financial advice when I can find what I need online? It’s DIY, it’s tech, it’s an alternative to an older model.”

-Jonah Stillman, co-author of 'Gen Z @ Work'

-Jonah Stillman, co-author of 'Gen Z @ Work'

The accessibility of Bitcoin, as permissionless, makes it an attractive option for a generation with high rates of smartphone ownership and internet connectivity.

Fidelity Digital Assets: Bitcoin Investment Thesis by @riabhutoria

bit.ly/3lNzYyV

Fidelity Digital Assets: Bitcoin Investment Thesis by @riabhutoria

bit.ly/3lNzYyV

Low interest rates on cash savings + declining trust in institutions + access to investment products/assets via technology = independent approach to personal finance

Source: @MerrillEdge 2018 Report

Source: @MerrillEdge 2018 Report

What sort of power does this generation have in the decisions they make with their money? Turns out, not much...yet.

Data source: The Power of Gen Z Influence via Barkey

bit.ly/3koCCcz

Data source: The Power of Gen Z Influence via Barkey

bit.ly/3koCCcz

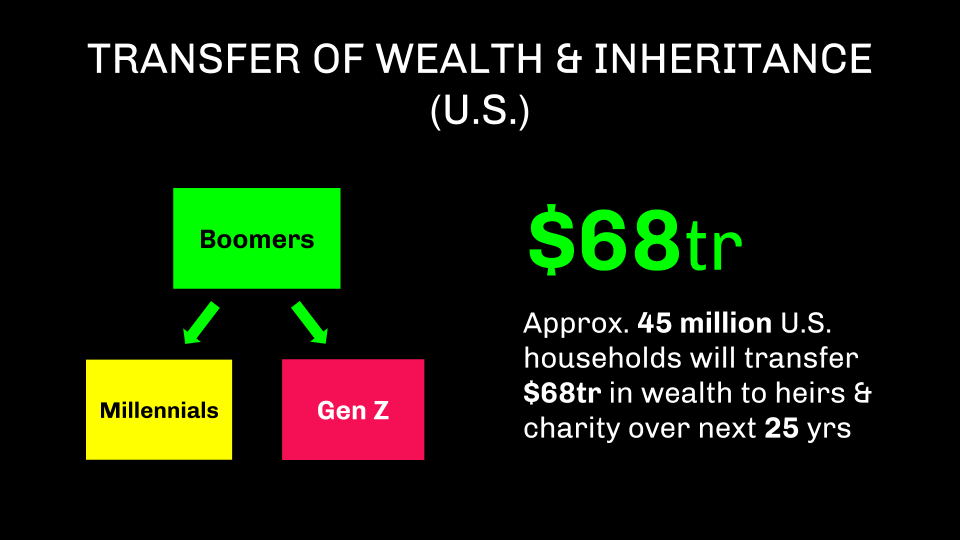

In the coming decades the largest generational wealth transfer we’ve ever seen is set to take place. This wealth will need a home to protect its purchasing power against the ever-increasing money supply.

The Great Wealth Transfer by @cerulli_assoc

bit.ly/3ls65E1

The Great Wealth Transfer by @cerulli_assoc

bit.ly/3ls65E1

Chief Strategy Officer at CoinShares, @Melt_Dem explains the significance of the shift that is currently taking place.

Fidelity Digital Assets: Bitcoin Investment Thesis

bit.ly/3lNzYyV

Fidelity Digital Assets: Bitcoin Investment Thesis

bit.ly/3lNzYyV

Via a @Paxful commissioned survey of U.S. Millennials (aged 22 to 42) and Gen Zers (18 to 21) in August 2019.

From “Crypto Markets Are Maturing, but Gen Z Is Rewriting How Markets Work” by @NoelleInMadrid

bit.ly/3kEZ3dR

bit.ly/3kEZ3dR

• • •

Missing some Tweet in this thread? You can try to

force a refresh