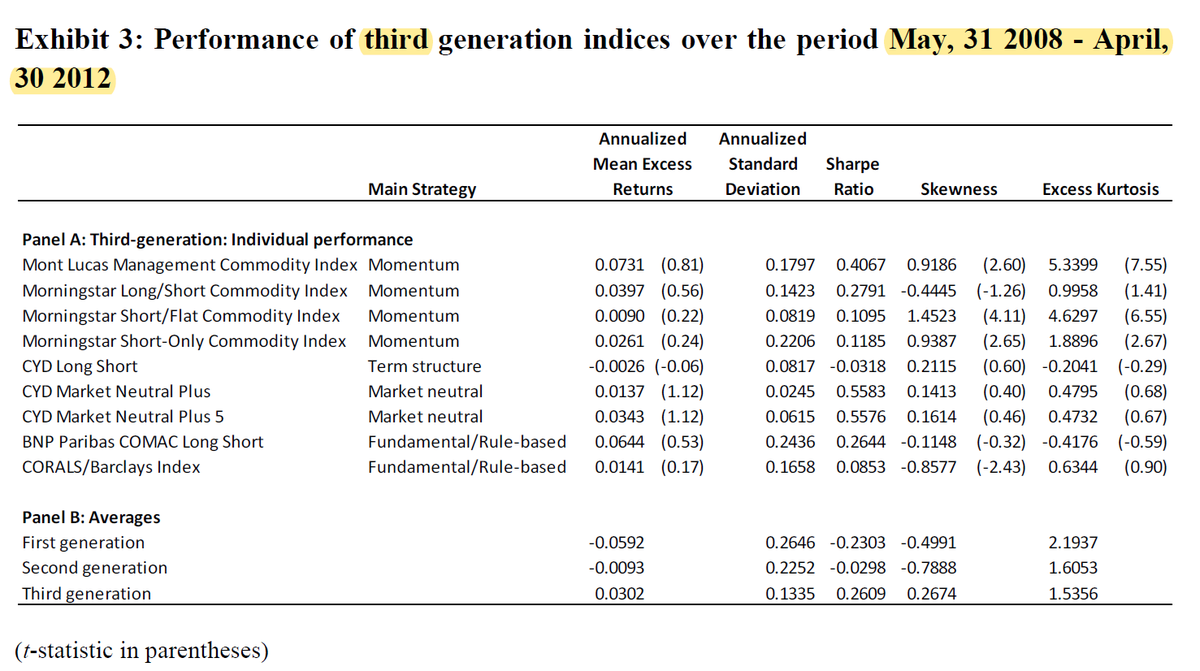

For a short common sample period, long/short third-generation commodity indices outperform long-only second-generation versions, which outperform first-generation passive indices.

papers.ssrn.com/sol3/papers.cf…

Exploiting Commodity Momentum Along the Futures Curves

Commodity Futures Risk Premium: 1871–2018

Strategic Allocation to Commodity Factor Premiums