That's a fancy way of saying you can inject BTC into a time machine and withdrawal it 6 months later with a ~20% surplus.

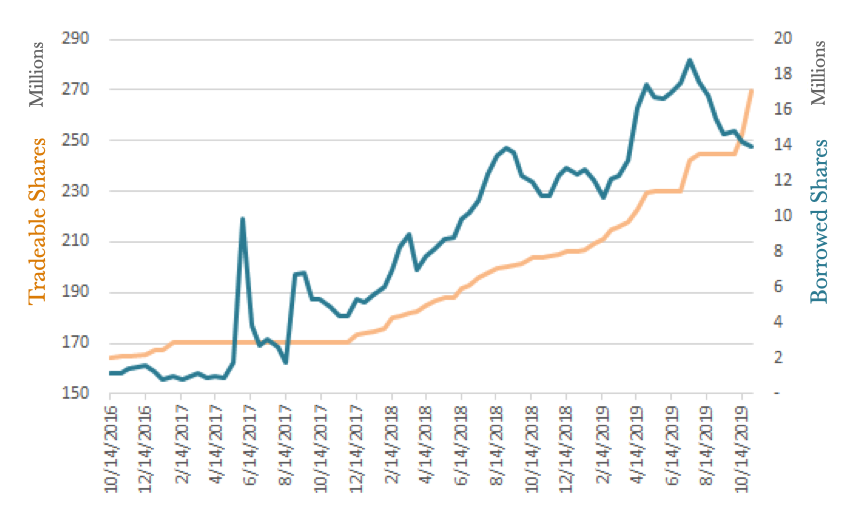

For comparison, BTC has 0.5-1% of short interest (futures) relative to market cap, at any given time.

BTW, fun fact: there's NO REDEMPTION mechanism in gBTC.

🪄 The billions it holds are ultimately black-holed to Grayscale.

Can anyone confirm or counter this? I'm not sure 🤔

Whether you use it to buy coffee on Starbucks, transfer to cold storage, or pick up some altcoins: any harsh move triggers a taxable event.

One may...

In fact, Coinbase Custody keeps Grayscale BTC's (and DCG has big stakes in both).

You're not missing much by feeding Barry over Brian.

Coinshares;

Van Eck/SolidX;

Edgy European/Singaporian ETPs;

Even CME futures for a subset of customers.

None has the blatantly recognisable "BTC" in its ticker stamped across the biggest brokers in America.

Seems to me the SEC is waiting for something we do not know of (or know won't happen), to green light one.

What most fail to realise is that "everything else" besides an ETF has been built.

One can trade hash futures. Hold BTC on an IRA. Short on CME.

The question always comes back.

Think of this: BitMex alone trades in a day more than the AUM of **all** the Grayscale funds combined.

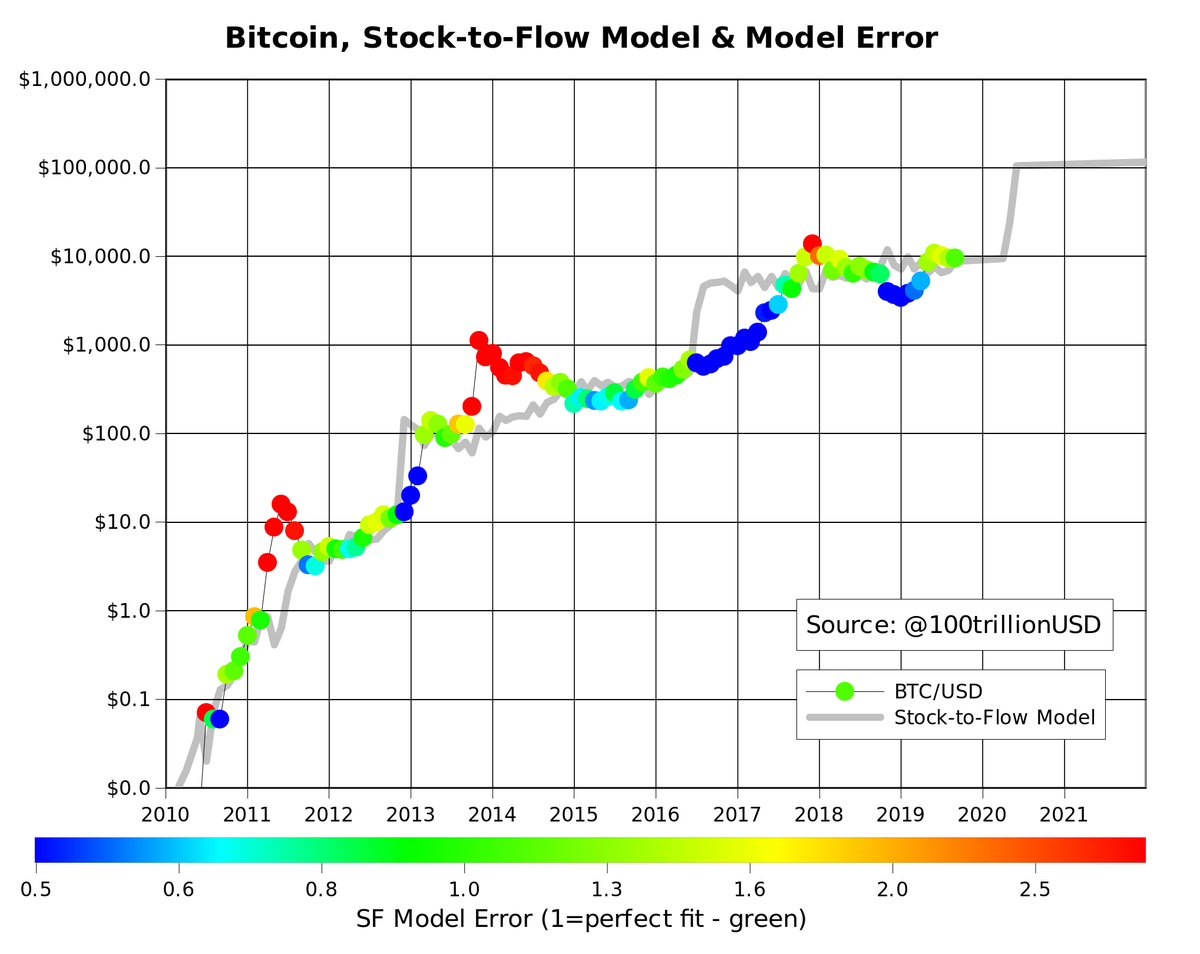

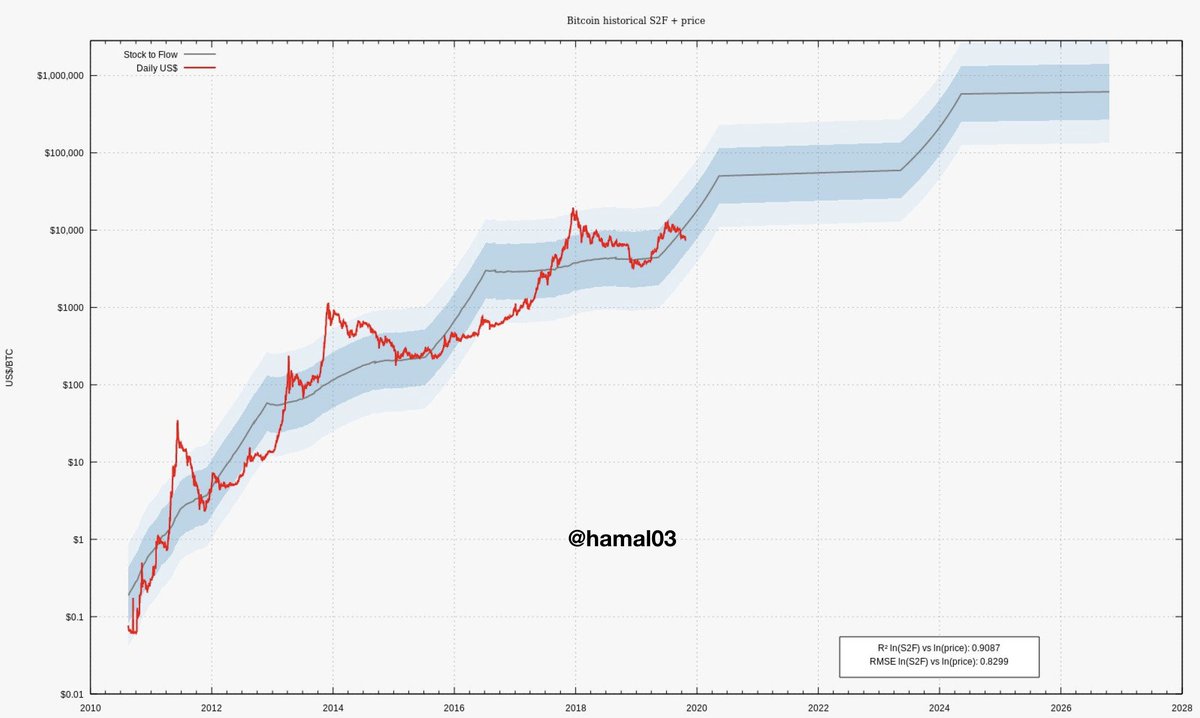

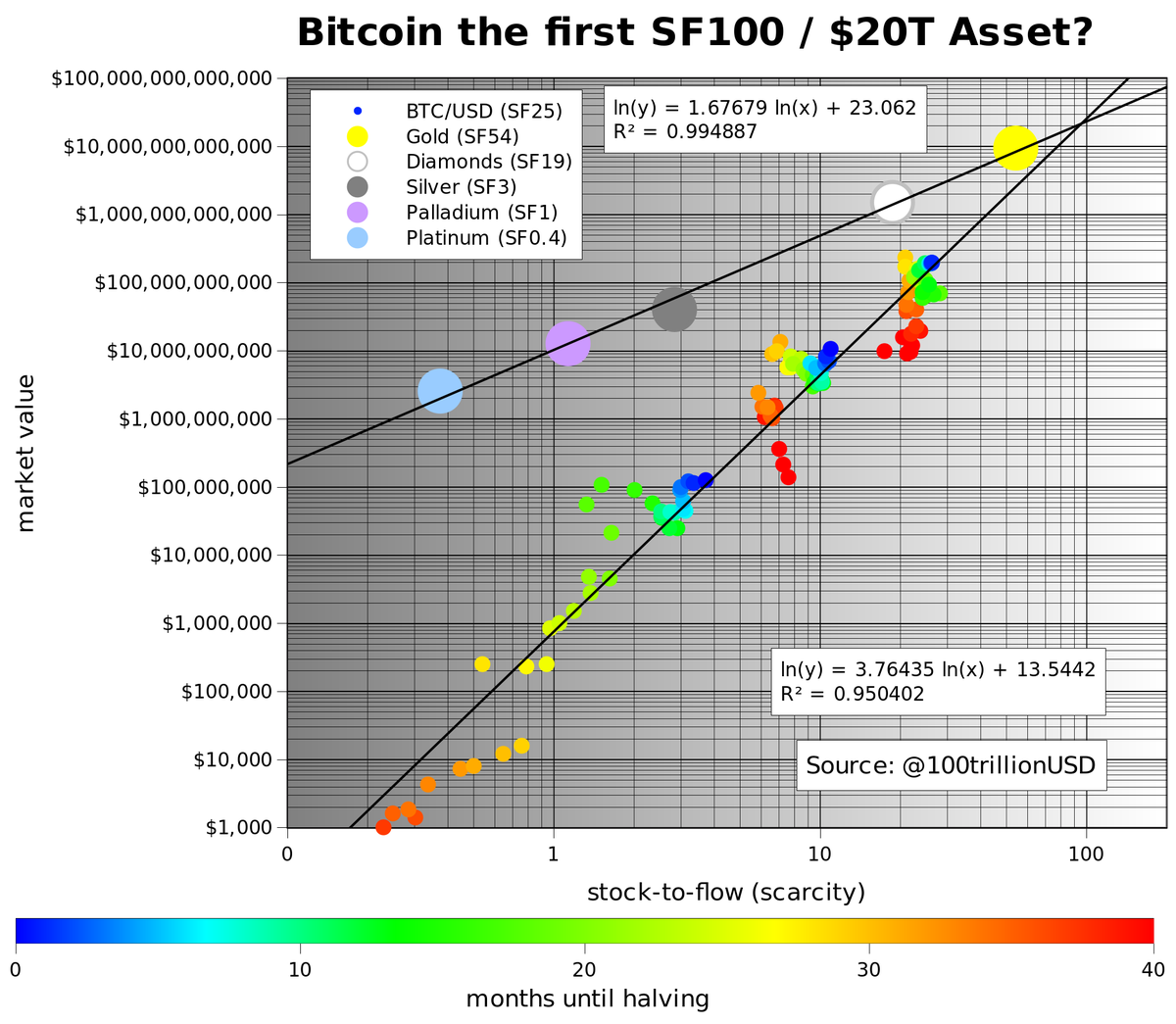

Halvings, stock-to-flow, Grayscale's black hole.

Some forget this is the part of the equation that's *less* exposed to change.

The weighty variable is on the other side. Bitcoin pumps with demand.

Dunno. I think it reflects a mix of institutional interest, retail interest and short-term expectations.

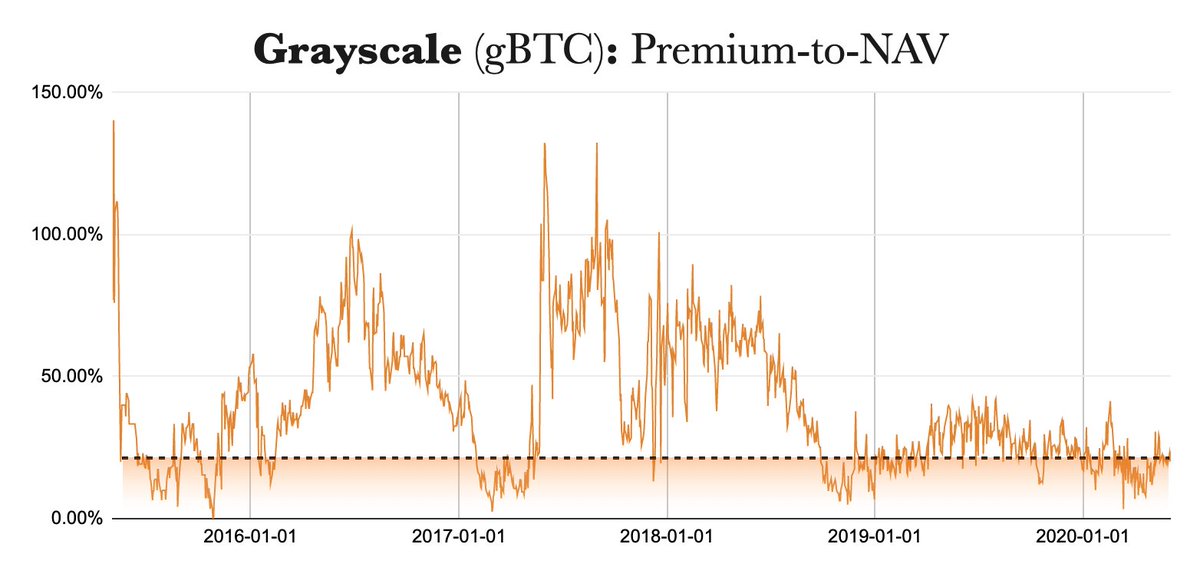

Returns on the premium (which is obv. not stationary itself) are positively correlated with BTC price returns (1d).

One must remember there's exogenous factors in play. If the fund halts the creation of new shares for a while, the premium reacts, tangentially to what happens to BTC's price.

🔚