The meme achieved superior performance in nocoiner conversion…

…and flooded your timeline with 🔢math, 💎minerals and 🔥heated opinions you may not understand.

Time to slash FUD and review some of the #stats:

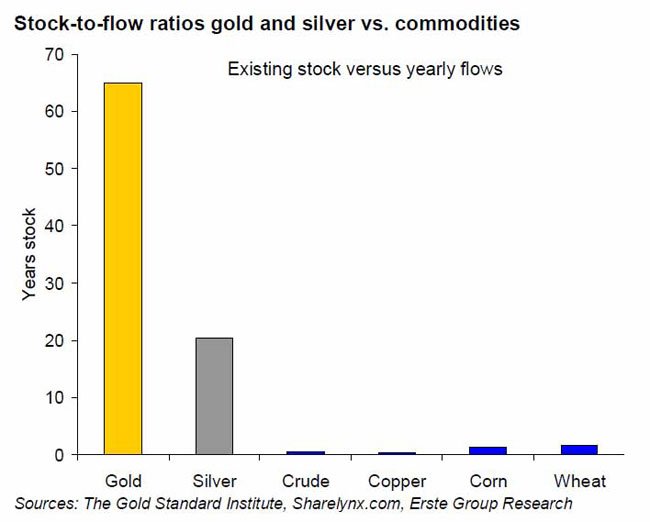

“in how many yrs, at current production levels (flow), will the market add *new assets* equivalent to all current outstanding assets (stock)?”

@TraceMayer, @Saifedean flirted w/ applying it to BTC...

goldstandardinstitute.net/2011/07/16/sto…

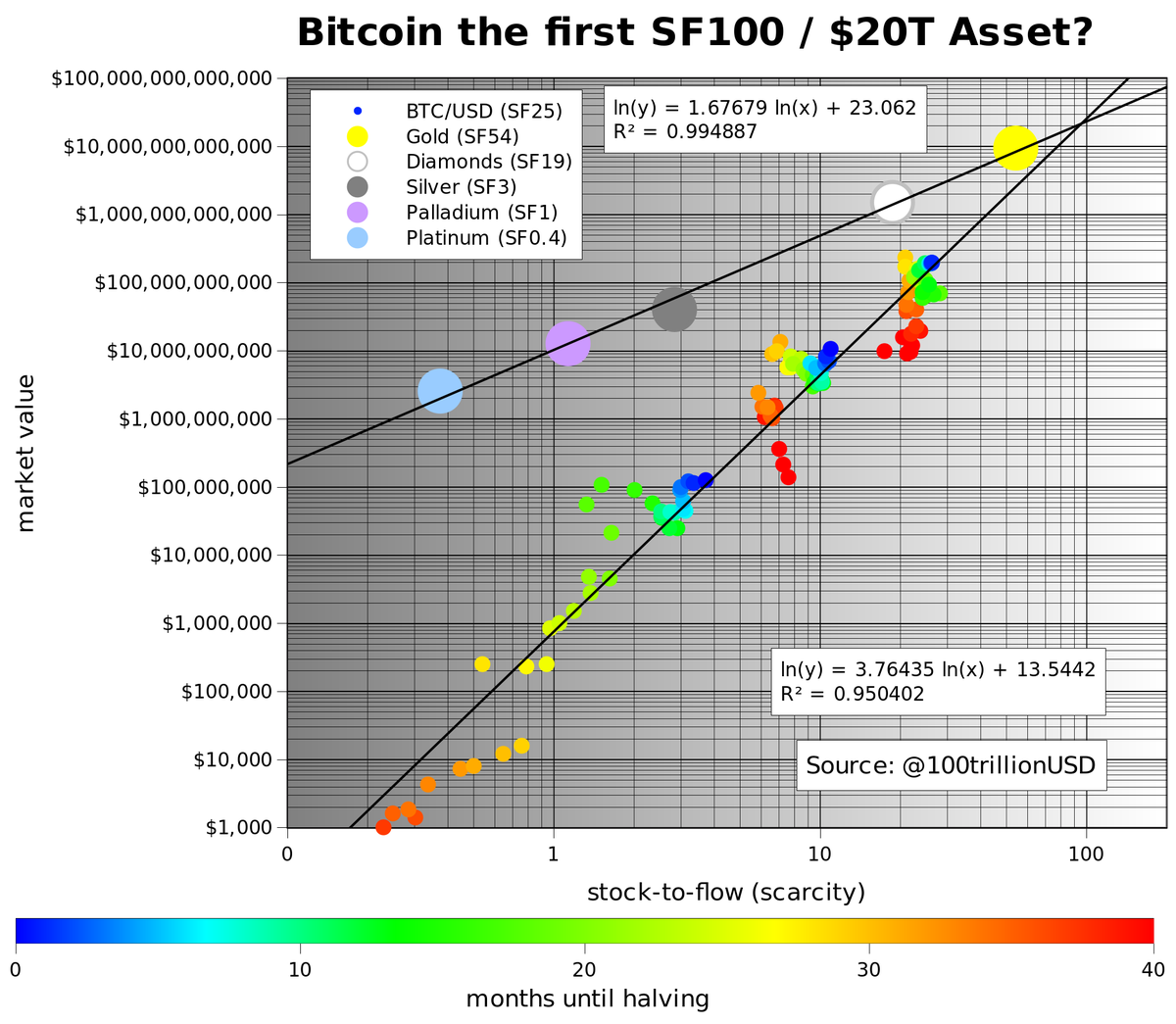

Visualising BTC’s S2F X other assets also helped.

In the instantly-turned-classic chart, what pops to the eye is Bitcoin’s fierce path to the #moon.

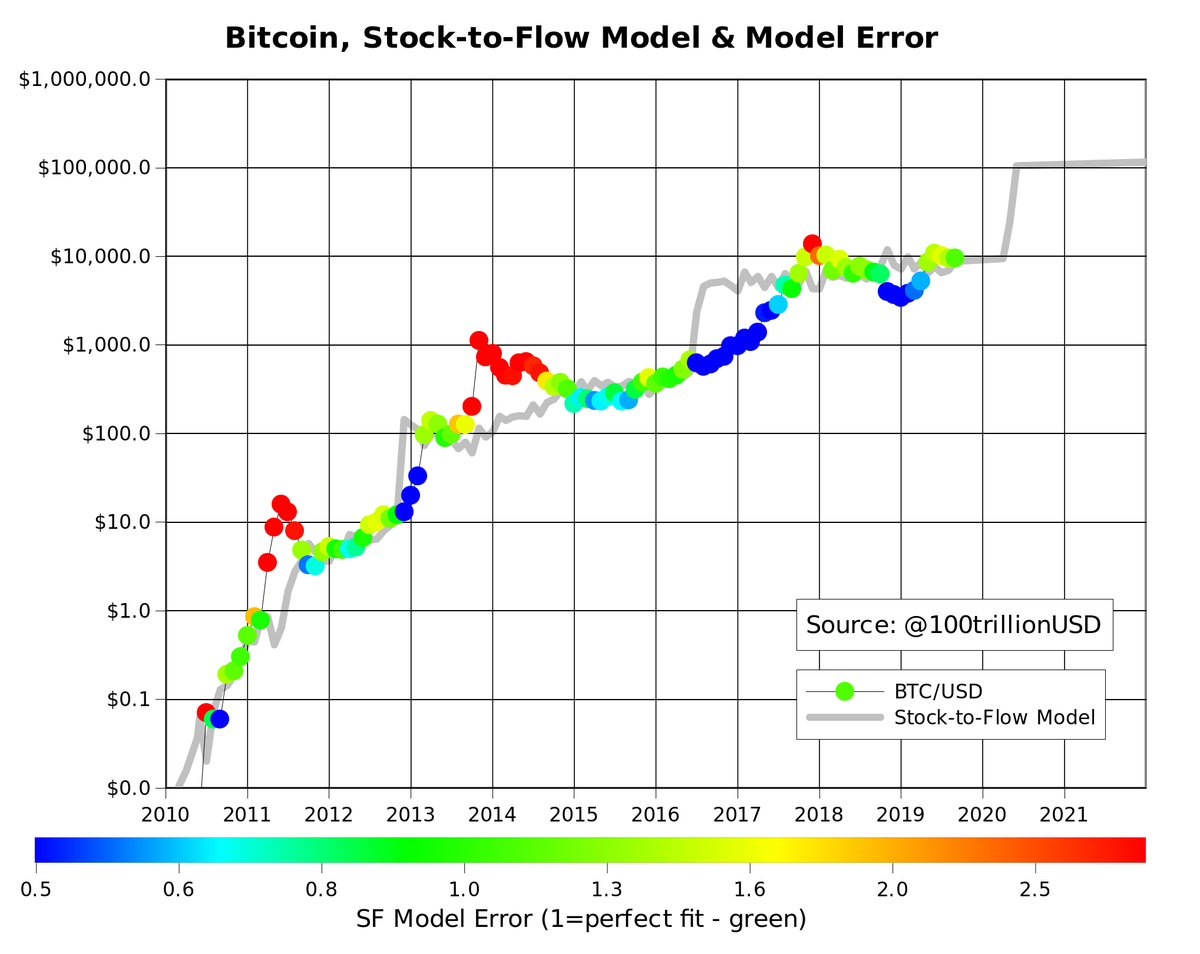

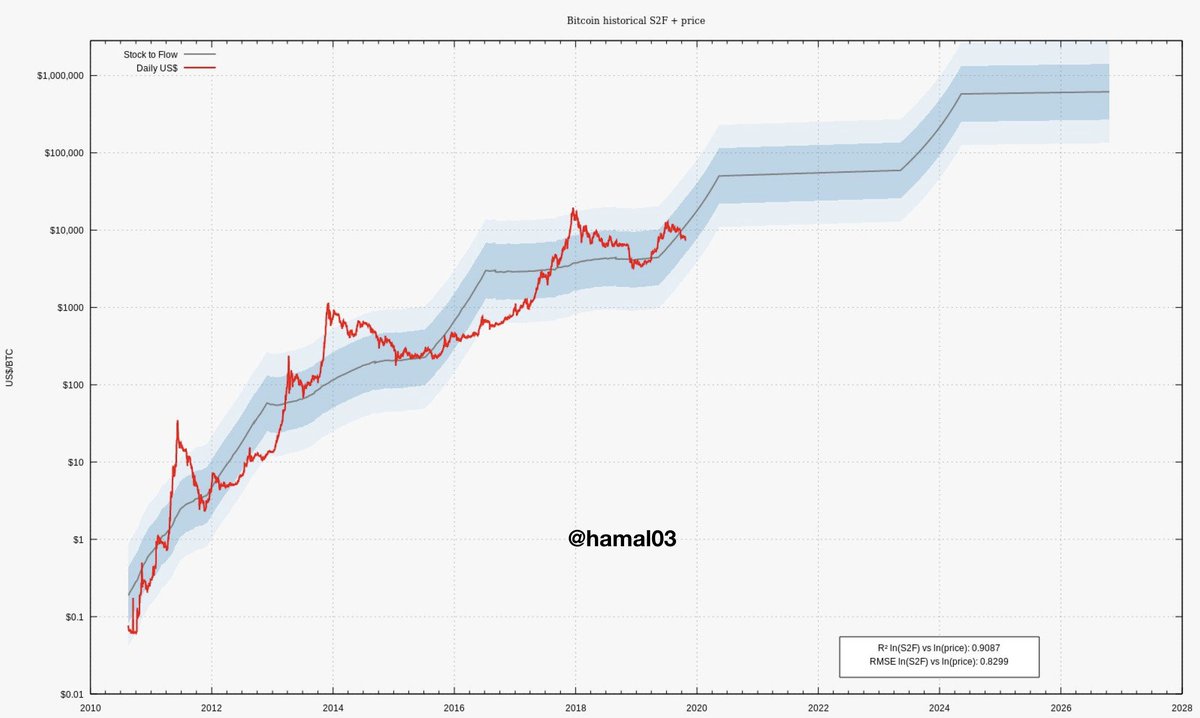

The S2F *model* is planB’s ingenious touch.

Regressing the S2F of BTC against Mcap, he found a (well fitting) linear correlation.

It makes forecasts when extrapolated. Today, ~ $11.6k

digitalik.net/btc/

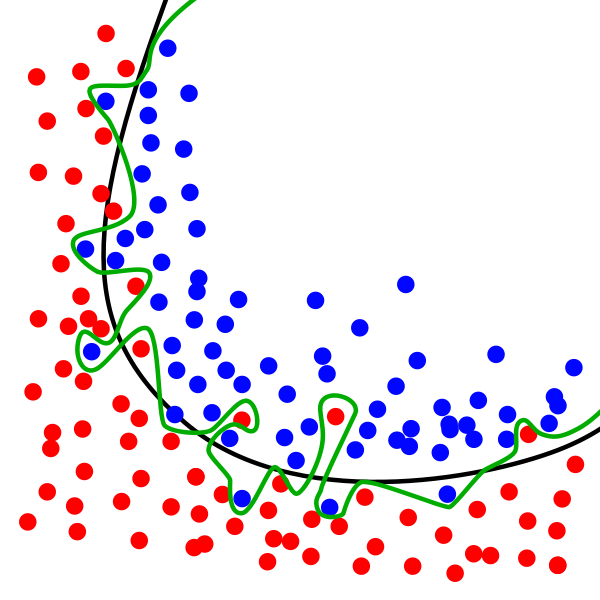

He pointed to the possibility of “overfitting”: we’ve only been through 2 halvings, and the sample of data for Bitcoin price history is still quite limited.

Illustrating: a model with *only* data from 2009-2012 would’ve produced good enough predictions till today.

Green=overfitted, black=generalized 👇

Overfitting is rarely a problem in a linear regression (w/ enough datapoints):

en.wikipedia.org/wiki/Overfitti…

That’s valid: the *indicator is not new* in physical commodities, but *the model is*.

We’re yet to see the correlation (SF2 <> Mcap) tested for more assets (PlanB did it for 5).

〰️ 2 series being cointegrated (BTC’s S2F and mcap here) = “they move together” (their difference is a stationary series).

If they’re not, one can falsify a regression (deem it spurious).

medium.com/burgercrypto-c…

In statistics, you don’t prove stuff. You try - and fail - to disprove it, over & over.

No cointegration might have invalidated the model. But the opposite isn't true.

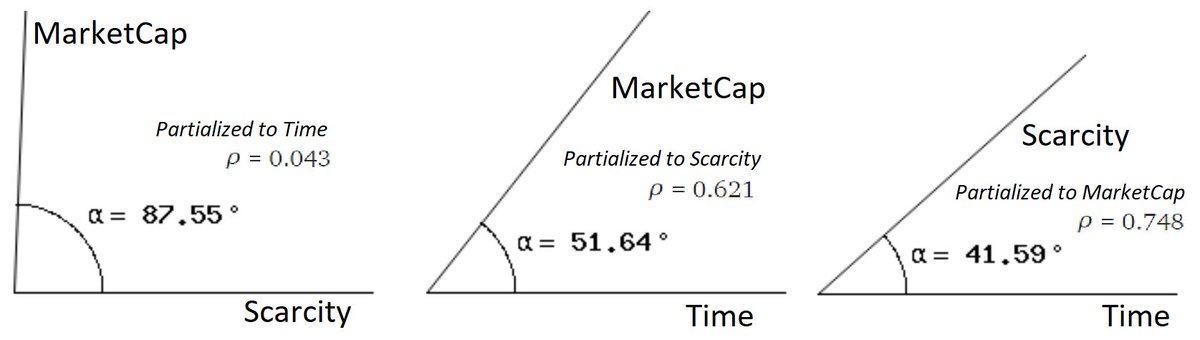

How confidently can we really say Scarcity drives MarketCap?

medium.com/coinmonks/a-mo…

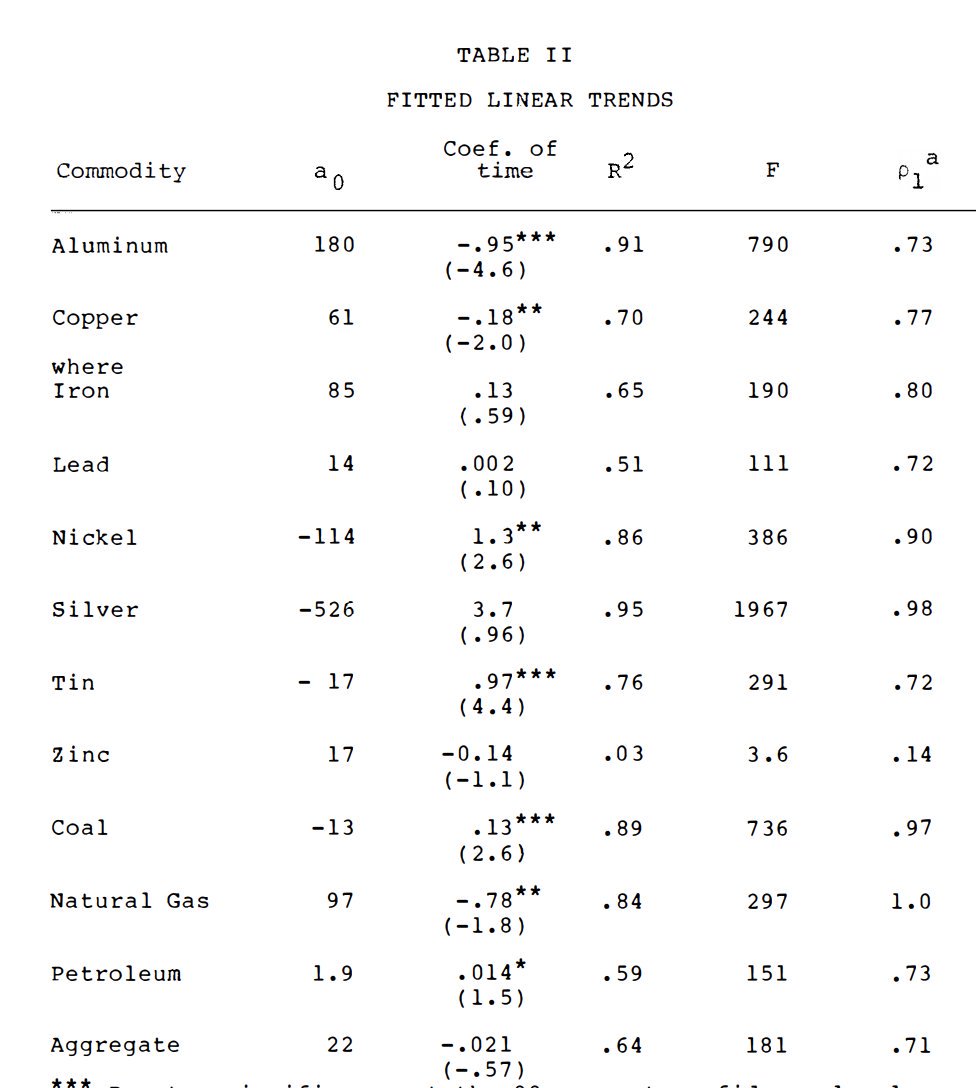

It gauges the lin. relationship b/ween 2 variables *after* removing the influence of a 3rd (and 4th, etc).

S2F contributes little in a classic multivariate regression.

@hcburger1 makes a similar point (see his purely time-based Power Law).

AIC for

ln(market price) ~ ln(Stock to Flow)

is lower (better) than for

ln(market price) ~ time

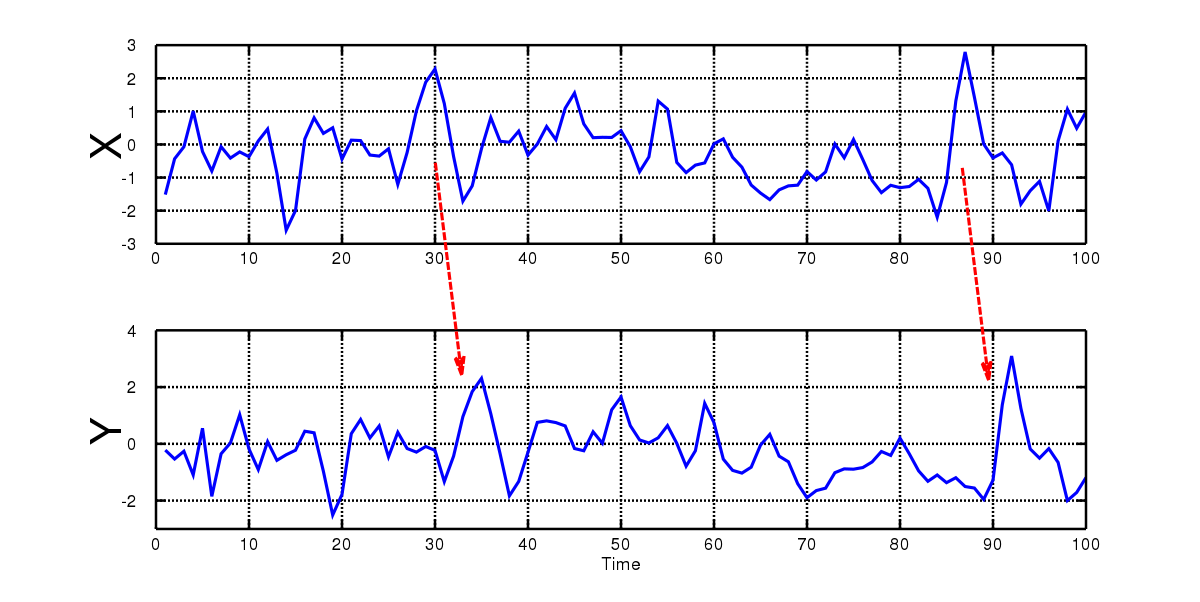

@phraudsta knocked the joke down with a G-causality test.

🧠 So now you’re familiar with the basic concepts around the S2F model.

❌🏃 And also, with how far people’ve come in trying to falsify it.

🗝️ What are the ELI5 TAKEAWAYS?

Metcalfe Law, MV = PQ, you name it...

👶 S2FM is embryonic, but may welcome many skeptic money managers into Bitcoin.

These can now at least envision an answer to:

what drives BTC value? How to quantify it?

All models are wrong. Some are more useful than others.

🎯 Don't expect any S2F price forecast to be exact in a particular date.

💪 Expect the model to be wrong with certain frequency. Also, to improve with new data (this is still out for jury).

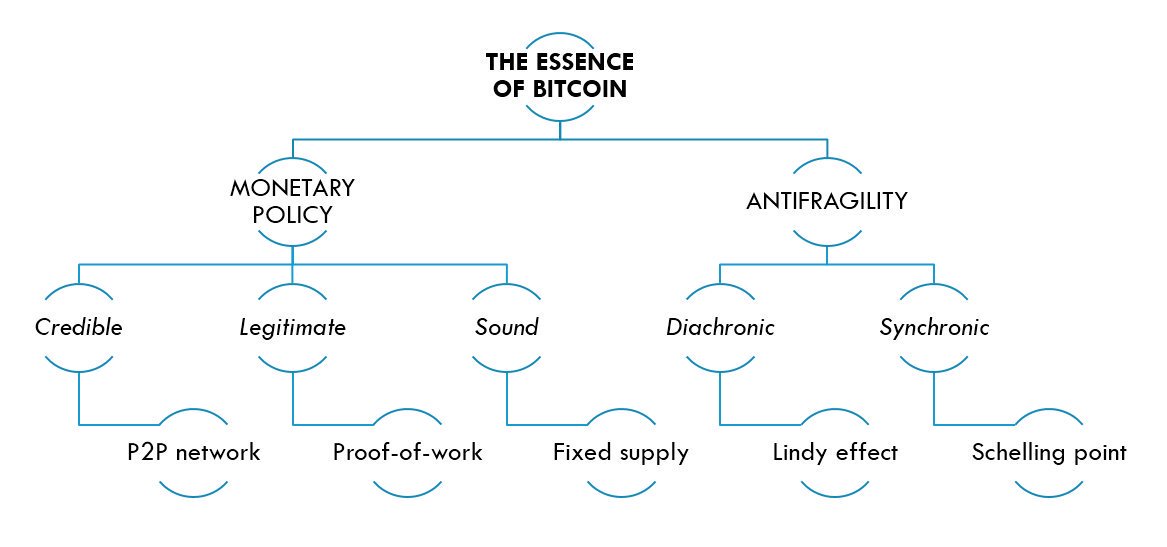

The premise that “BTC is a SoV, hence the model should work”, may be backwards.

Given that we only model things that are a SoV with S2F, BTC may be demonstrating to be a SoV partly *because* S2F model works for it.

LTC may not have the quality of *unforgeable scarcity* (h/t @NickSzabo4), and has not been established as a SoV.

(this hypothesis needs + tests)

medium.com/@phraudsta/lit…

Some get uncomfortable w/ a model that predicts $50K+ already <1y from now (& much +, further).

To get around that, you can blame the fate of the U$ dollar (hyperinflation)...

...use kWh for measuring purchasing power of BTC (h/t @SGBarbour)...

In fact, some of the most sensible critics so far have to do with the flow denominator.

Devour the texts above.

Think independently.

Follow @100trillionUSD, @phraudsta, @hcburger, @IntoTheLoop & @BurgerCryptoAM to keep up with their latest findings. Correct me where I'm wrong!

& thanks to them for putting all out for public scrutiny 🙏