1/ I am pretty sure these eye-popping charges from Max Hospitals for Covid management appeared on your timeline too.

Let's understand:

a) how Health Insurance is likely to treat these charges?

b) how you can plan and prepare for the future?

*thread*

#covid #maxhospital

Let's understand:

a) how Health Insurance is likely to treat these charges?

b) how you can plan and prepare for the future?

*thread*

#covid #maxhospital

https://twitter.com/gautamkapoor54/status/1271589606215921664

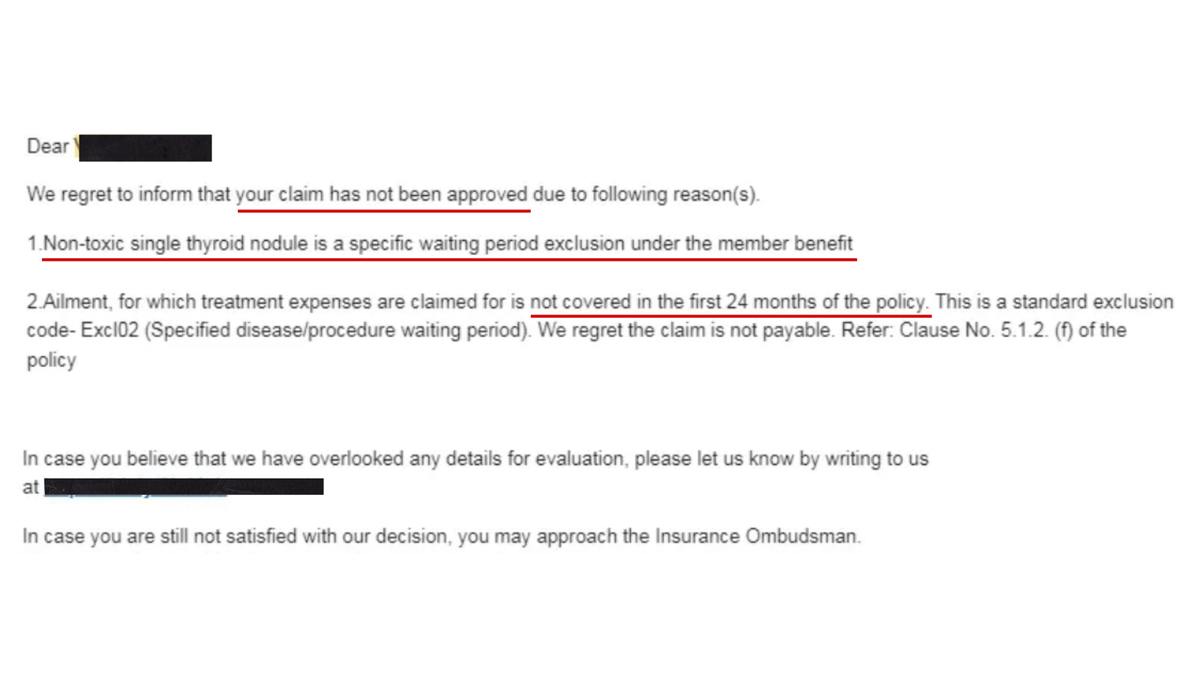

2/ Health Insurance cos won't pay based on fixed package charges, unless they are part of a pre-agreed contract.

Insurers will demand a detailed breakup of the package charges and then evaluate the claim against the insurance policy.

Insurers will demand a detailed breakup of the package charges and then evaluate the claim against the insurance policy.

3/ Here's how Insurers will look at the breakup from Max

#1 Room Rent, #2 RMO Visits, #3 Nursing, are considered part of Room Chg. If these are billed separately, only Room Rent will be paid.

Consumables under # 7a & # 7b are not covered

Rest of the items are payable separately

#1 Room Rent, #2 RMO Visits, #3 Nursing, are considered part of Room Chg. If these are billed separately, only Room Rent will be paid.

Consumables under # 7a & # 7b are not covered

Rest of the items are payable separately

4/

- Any ad hoc miscellaneous charge in the breakup are not payable.

- Any charge that is not reasonable (disproportionately high) will be paid only at reasonable rates.

Unfortunately, you pay what is not payable.

- Any ad hoc miscellaneous charge in the breakup are not payable.

- Any charge that is not reasonable (disproportionately high) will be paid only at reasonable rates.

Unfortunately, you pay what is not payable.

5/ Of course, if you have a health insurance policy with a room rent limit, you are up for proportionate deductions.

Which means that if your ICU room limit is 10K per day & you are charged say 20K per day - your entire bill may have a proportionate deduction of around 40-50%

Which means that if your ICU room limit is 10K per day & you are charged say 20K per day - your entire bill may have a proportionate deduction of around 40-50%

6/ How can you prepare for long term, instead of panic?

a) Have a policy that covers each family member for 10-15L. Ideally 20L.

b) Ensure your policy has no room rent cap.

c) Get a fixed cash benefit policy for the deductions. Read about it here:

a) Have a policy that covers each family member for 10-15L. Ideally 20L.

b) Ensure your policy has no room rent cap.

c) Get a fixed cash benefit policy for the deductions. Read about it here:

https://twitter.com/themahavir/status/1261289457623367680?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh