Peter Lynch is a legend in the mutual fund industry. His fund, Fidelity Magellan, generated returns of approximately 29% annually, creating fortunes for investors along the way.

Here are some of Lynch's most valuable investment tips

This is perhaps the most famous of all of Lynch's quotes, but it's often misunderstood. Lynch is not advising you to buy stock in a company simply because it makes your favorite product or service. This can be an excellent starting point, but...

Stocks are not just pieces of paper or blips on a computer screen. They represent partial ownership of real businesses.

For a long-term investor, volatility and risk are two very different things. A stock's day-to-day movements are irrelevant.

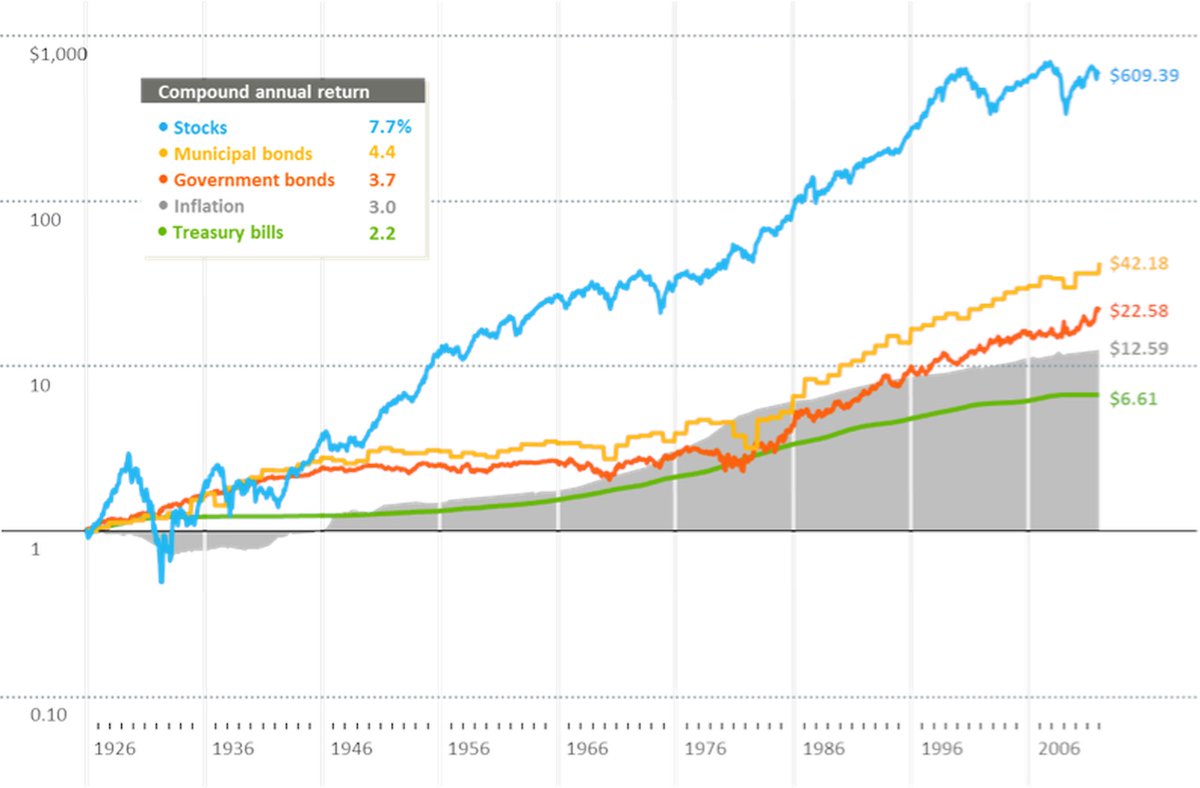

Truly life-changing wealth is made over years and decades. Thus, investors should be prepared to hold their stocks for long periods of time in order to maximize their gains.

The biggest challenge to holding on to your stocks is fear. Frightening headlines and fear-mongering pundits can cause even ardent bulls to question their views.

Investing in great businesses can give you a valuable edge. Companies with powerful competitive advantages often grow stronger over time as their weaker rivals fade away.

When you own stock in great companies, there's no reason to try and time the market cycles.

You don't have to be perfect to do well as an investor.