Of this, over $50T is USD debt by American households, nonfinancial corporations, and the govt.

Much of the rest is debts for other countries in other currencies.

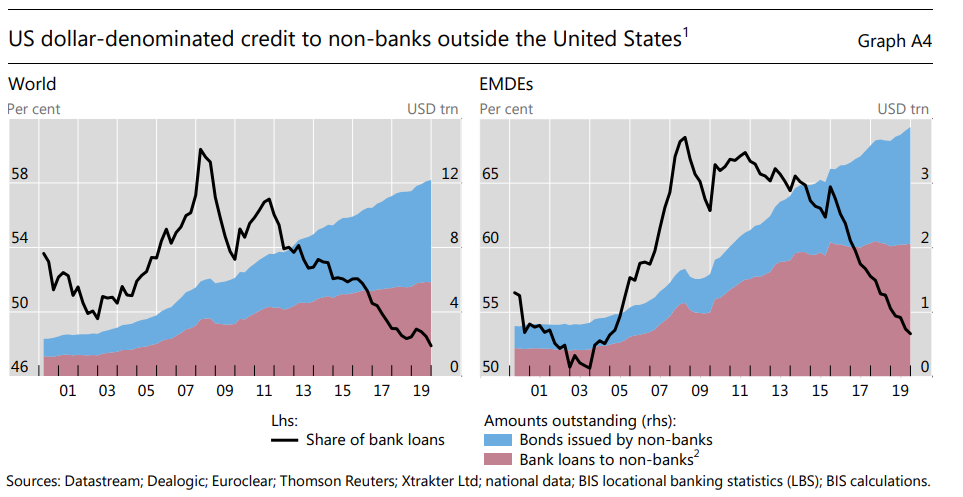

About $8T of that $12T is in advanced nations, and $4T is in EM.

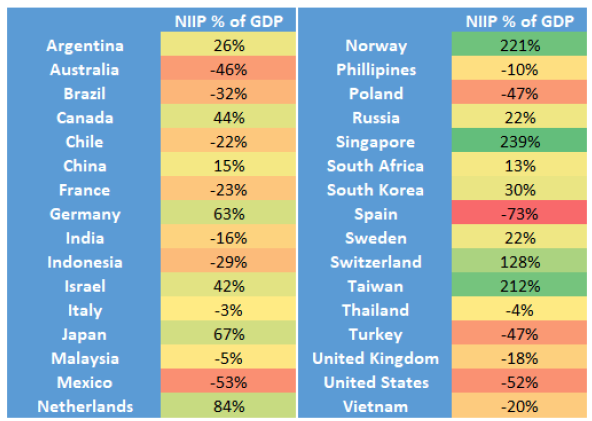

Many of them are still in danger. Most of them don't have swap lines anyway. Localized problems.